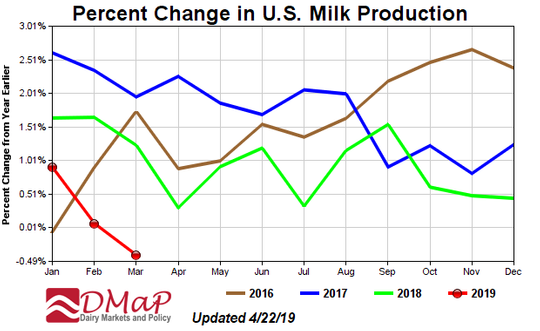

In their April “Dairy Situation and Outlook” podcast, UW-Madison’s Mark Stephenson and Bob Cropp believe that current trends in milk production, based on the most recent report released by the U.S. Department of Agriculture, could lead to a higher milk price forecast.

“The news that milk production has really slowed ought to help straighten things out and keep milk prices moving in the right direction,” said Cropp, adding that cows numbers had dropped significantly. “Nationally, we’re down 10,000 cows from February to March 2019.”

According to the USDA report, U.S. milk production fell 0.4% in all 50 states and down 0.1% for the top 23 dairy states. During March, Wisconsin cows produced 2.62 billion pounds of milk, up less than 1 percent from last year.

“There’s been quite a few exiting farming and production per cow was forecast to be up just 0.5%, but in February they revised that projection to just 0.1%, so we’ve really slowed milk production in the state,” Cropp said.

The average number of milk cows in Wisconsin last month was 1.27 million, the same as February but down 4,000 head since this time last year.

Cropp said that among the top 23 dairy states, 10 reported decreased production while over half noted falling herd numbers.

“In Pennsylvania they were down 29,000 head from a year ago,” he said. “This is good news as far as those production levels, in that we should see some movement up in the price.”

Along with the Milk Production report, the USDA also released the cold storage report. Cropp says that the March cold storage report said butter stocks were building seasonally, up 11% from February, but down 1% in March.

“This is normal because cream supplies are tightening,” Cropp said, adding that American cheese stocks were softening a bit. “They’re only up 2.3% so that’s an improvement.”

Cropp says that cheese exports were up and down, with Mexico buying 20% less cheese in January and then purchasing 9% more the following month.

“South Korea bought the most cheese in four years, like 71% more,” he said. “The cheese stocks are improving and that’s reflected in the prices on the CME.”

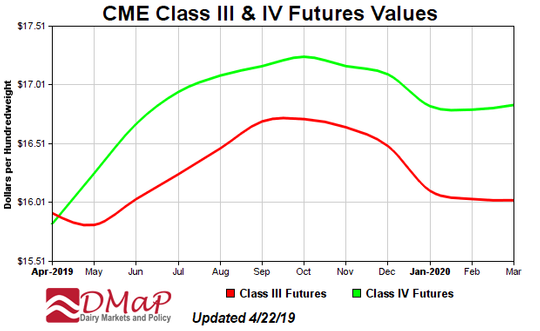

Cheddar barrels gained $0.06 on Monday, helping to bump up the Class III price to just under $16.00/cwt.

Stephenson says the market is beginning to improve.

“In my opinion, when we get to the fourth quarter there’s going to be an opportunity for prices to really break,” he said. “When buyers begin to feel that stocks are tightening and they’re concerned that they might not be able to secure their supply, then they’re going to go into panic buying, and then our prices will jump.”

Cropp said sales in the dry whey market have fallen off, impacting Class III milk prices.

“We had dry whey prices of 0.55/lb and not it’s 0.33/lb, which knocked a dollar off of Class III milk,” he said. “It might be down due to China struggling with African Swine Fever which has taken a toll on their swine herd for which they buy a lot of whey products for.”

Stephenson says most countries that are export competitors around the world are also experiencing tightening markets too.

“It’s a year for maybe a significant recovery, the first time we’d see that in almost five years,” Stephenson said.

A wet spring has a lot of farmers on edge as well, Cropp said.

“We’re getting this wet weather and farmers are anxious to be out on the land,” he said. “I think how this crop season turns out is going to be significant. There’s a bit of tightness in the hay supply as well as corn and soybeans which may result in an increase in feed cost margins. But hopefully milk prices will go up to accommodate that.”

As the months go by and more outlook information is provided, Stephenson says he’s getting a better feel for futures markets.

“We’ve had markets that are a little up and a little down, month after month after month,” he said. “I think maybe we’re at the point where we’re getting substantiating information about these markets (heading upward). I think this is the years that we’re looking for a recovery.”