By Jesse Newman / Photographs by Maggie Shannon for The Wall Street Journal

Dairy farmers in California, the nation’s top milk producer, face pressure from rising costs, increasingly complex environmental regulations and a quest for water—challenges all magnified by a historic drought. For some, the challenges are existential.

In the north coast, home to the state’s small, organic dairy farms, shrunken reservoirs and shriveled pastures pushed some farmers to the brink earlier this year. In the San Joaquin Valley—a vast agricultural region in the center of the state where 90% of California’s milk is produced—farmers are paying more for cow feed and water, driving up the cost of producing a gallon of milk.

California’s milk production, combined with dairy processing, brings more than $20 billion annually to the state economy. Dairy is the top farm industry by revenue in California, the nation’s biggest agricultural state.

Growing challenges have spurred a shift in the past decade, prompting some California dairy farmers to move, shut down, or turn to growing crops. Recurring droughts are now intensifying their struggles, boosting milk sheds further east and threatening the state’s dairy-capital status, according to farmers, agricultural economists and industry groups.

California is expecting a dry winter, which would further strain existing shortages. The state said Wednesday that for the first time, it might not have enough reserves to distribute water to local districts, which handle flows to homes, businesses and farms.

Mike Monteiro, 58, a third-generation dairy farmer, spent the spring waiting for rain. Little came, signaling a second season of drought and dashing hopes that water would flow like it usually does, from reservoirs to his fields and barns in central California.

He turned to water below ground, switching on the pumps in his wells. Within months, they were delivering just half their normal volume. One well began pumping sand.

By summer, Mr. Monteiro called it quits on two of his three dairies, located in Tulare County, America’s largest dairy county. “If we stay dry, these older facilities will have to get shut down in the next three years,” he said.

Similar decisions are playing out across California as back-to-back droughts in the state force farmers to make choices about where—or whether—they will be able to continue raising the crops or livestock that make up a pillar of the region’s economy.

Dairy farms are huge consumers of water. A lactating cow drinks as much as 50 gallons of water a day, and much more is used to grow crops to feed herds.

In the San Joaquin Valley, dairy farmers short on water this year have fallowed land devoted to feed crops such as corn and alfalfa, or pulled back on irrigation, hurting yields.

To fill the gap, they and others have had to purchase feed from surrounding counties and states, in a year when costs have soared. Prices for corn and soybeans from the Midwest are sharply higher due to tight supplies. Western drought compounded the problem, denting harvests and pushing up prices for feed products from alfalfa to almond hulls.

Rising feed bills and other costs prompted Frank Mendonsa, a second-generation dairy farmer in Tulare County, to borrow against a parcel of farmland he owns. To reduce expenses, he is sending more young animals to slaughter that would become dairy cows when bred. That limits the amount of feed he needs by restricting his herd’s ability to grow, he said.

“We’re getting weekly fliers of sellouts,” said Mr. Mendonsa, referring to estate and livestock sales held by farmers leaving the business. “I need the price of feed to turn around or I’ll be another person with his name on a flier.”

Mr. Mendonsa said rising costs for feed, water and labor have accelerated plans to consolidate his family’s multiple dairies and ultimately milk fewer cows. This year is shaping up to be his second-leanest ever, and he worries next year could be worse if coming months don’t bring more snow and rain.

“We’re scared to death we’ll have one more dry year,” Mr. Mendonsa said.

California’s dairy industry expanded rapidly from the 1980s through most of the 2000s, a period dubbed “the white wave.” Dairy farmers moved to central California, building operations that were larger and more efficient than those in most other states.

Milk production surged, crowning California as the nation’s top milk producer in the early 1990s, around the time a San Francisco-based agency created the ubiquitous “Got Milk?” advertising campaign for the California Milk Processor Board.

Growth in California’s milk output slowed after 2008, however, as supply restrictions, rising costs for feed and labor and tighter environmental regulations made dairy farming in the state more challenging, according to farmers and industry groups.

Production costs for California dairies vary annually, largely in line with swings in feed prices, the top expense for farmers. Animal feed represents more than 60% of total costs this year, compared to 48% in 2010, according to Mary Ledman, a global dairy strategist at Dutch lender Rabobank. Costs for hired labor, the second-largest expense, have swelled 20% over the same period.

Following surplus production in 2008, California dairy cooperatives implemented supply restrictions that limited growth in milk production. Compliance with local air and water quality regulations, plus state labor and greenhouse gas rules have boosted both costs and complexity for dairy farms over time, according to Daniel Sumner, an agricultural economist at University of California, Davis. He said environmental regulations have also raised costs for local processors, limiting the prices they offer dairies for raw milk.

Dairy farmers throughout the state have sold herds or relocated, or morphed into almond or pistachio growers as prices boomed.

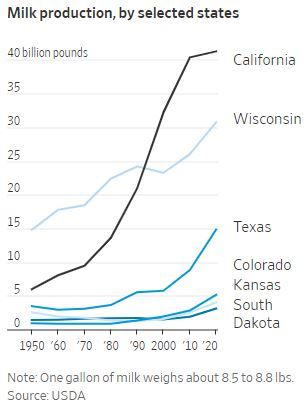

Milk production increases in 25 other states outpaced that of California over the past decade, according to U.S. Department of Agriculture data. From 2010 to 2020, California’s output grew by 2% while Colorado’s rose 83% and Texas’ grew 68%.

In the first 10 months of this year, California’s milk production grew 1% compared with the same period in 2020, according to USDA. Texas saw a 5% increase, while South Dakota’s output jumped 15%. Overall, U.S. milk production grew 2%.

Large dairy processors are investing further east. U.S. milk production has gradually shifted from the nation’s coasts to its midsection as consumers eat more dairy in the form of cheese, which doesn’t require processing near major cities because it is less perishable and more easily shipped than fluid milk, according to Ben Laine, a Rabobank dairy analyst.

This year alone, at least four processors unveiled plans for new dairy plants or expansions in the Midwest and Plains. California-based Hilmar Cheese Co., one of the biggest U.S. cheese producers, is building a new cheese and whey-processing plant in Kansas. Two other plants are planned for Texas.

Nationwide, the U.S. dairy herd is contracting after farmers expanded last year, buoyed by new milk-processing capacity, strong demand during the pandemic and federal relief payments. As of Jan. 1, the U.S. herd had grown to 9.4 million milk cows, its largest in 26 years, though that number has fallen in recent months.

California’s dairy industry remains significant. Milk production in the state still outstrips that in Wisconsin, the next-largest state, by a long shot. Economists say California’s industry benefits from advantages, such as proximity to U.S. ports, which give farmers a leg up in export markets that are a growing source of demand for dairy products.

Droughts are part of a natural cycle of water. But the drought currently gripping the Western U.S. has climate scientists concerned that the cycle may be shifting. This has major implications for farmers and the communities they surround. Photo illustration: Carter McCall/WSJ

“California has led the nation in dairy production for decades, and even as they adapt to climate and other challenges, dairy farmers are well-positioned to maintain their industry leadership,” said a spokesman for California’s department of food and agriculture.

He said the state’s dairy producers meet the highest environmental and labor standards in the country and have taken measures to reduce water usage per unit of milk and cut greenhouse-gas emissions using technology such as dairy digesters, which turn cow manure into electricity or vehicle fuel.

California Dairies Inc., a major cooperative, recently announced plans to build a new plant for processing ultrahigh temperature and extended shelf-life milk, some of which don’t require refrigeration. The premium products, popular in Europe and elsewhere, will offer farmer members a higher return for their milk, said Rob Vandenheuvel, a senior vice president at the co-op.

PHOTO: MAGGIE SHANNON FOR THE WALL STREET JOURNAL

“California dairy farmers are resilient,” he said. He added that impacts of the drought vary by region and many more dairies will struggle if dry weather continues next year.

Farmers’ investments in technology tied to milking barns, animal genetics, nutrition and comforts, such as fans and misters to keep animals cool, mean California’s cows are growing more productive over time, said Rabobank’s Ms. Ledman, suggesting milk output may hold steady even if cow numbers decline.

California dairy farmers have historically seen lower production costs than those in Midwestern states, though that advantage has narrowed in recent years, Ms. Ledman said.

Currently, milk prices are on the rise, helping offset farmers’ costs. Still, many in California are expected to break even or see a loss this year, according to dairy brokers and strategists.

Mr. Monteiro and his brother, who milk 7,000 cows across three facilities, started talking about closing their two older dairies during California’s last drought, which ended just four years before the latest one began. The dairies worked, but only while water was available and affordable.

He said that after learning from local officials this spring that he would get none of his allotted water from reservoirs due to the drought, he turned on the pumps in his wells, each of which can pull 1,200 gallons of water from the ground a minute. Farmers all around him did the same, he said, overwhelming the region’s underground aquifer, and slashing his water yields.

In June, his main well malfunctioned. Desperate for water, he drew up plans to punch five new 700-foot holes in the ground, each with a price tag of $300,000. But well drillers and repairmen were busy, and a monthslong wait left him without enough water to irrigate 400 acres of corn and alfalfa.

PHOTO: MAGGIE SHANNON FOR THE WALL STREET JOURNAL

He shelled out $1 million to buy feed from other farmers. His family operation can handle the expense, he said, because it is diversified. Still, with costs that high, his two older, less-efficient dairies don’t pencil out.

Closing those facilities will reduce his herd by more than 40%, Mr. Monteiro said, and roughly half the cows will likely be sold to farmers out of state.

“When you take an industry and you rob it of its profits there’s nothing else you can do,” Mr. Monteiro said, referring to dairy farmers’ escalating costs. “The only thing you can do is cease and desist.”

Prices California dairy farmers receive are set by a federal milk-pricing system and influenced by global markets and cooperatives that buy their milk.

Before the pandemic, a supply glut and trade conflicts had weighed on milk prices. Coronavirus threw dairy markets into a tailspin early last year, though a recovery in prices and profits ultimately drove U.S. farmers to bulk up their herds.

Like other California dairy farmers, Mr. Monteiro has begun shifting some of his acreage into almonds and pistachios. Those are thirsty crops, also threatened by drought, but he said they typically bring more profit per-acre than a gallon of milk.

New restrictions on groundwater pumping are helping fuel this shift, farmers say, and will further reduce feed supplies in California as calculations about returns per acre-foot of water—enough to cover an acre of land one foot deep—favor commodities such as fruit and nuts over cow feed, such as alfalfa.

Nate Donnay, a dairy economist with StoneX Group Inc., a financial services firm, said water in California will increasingly flow to the most profitable agricultural commodities, which likely won’t include dairy.

“We can make milk in a lot of other parts of the country, but we can’t make almonds in Wisconsin,” he said, referring to almonds’ need for a climate marked by mild winters.

Livestock auctioneers in the state say they are busier than in recent years, as more ranchers and dairy farmers sell herds and retire. Some dairy farmers with reliable access to surface water are cashing out, selling their farms for huge sums as growers of crops such as nuts scramble for land in more water-secure regions, said Nick Martella, owner of AM Livestock Auction. Some with poor water access have seen the value of their land sink in the past two years, farmers say.

David Lemstra said he realized a decade ago that dairy farming in California would be an uphill battle, due in part to water. He relocated last year to South Dakota, where he sells milk from his 4,000 cows to a newly-expanded cheese plant.

South Dakota isn’t immune to dry weather. As of late November, drought was afflicting 55% of the state, according to the U.S. Drought Monitor. But in California, Mr. Lemstra believes, water shortages are too often the result of decisions made by government officials. “South Dakota can be dry, but when it’s dry it’s between myself and God,” he said.

Mr. Lemstra said he is starting to see familiar faces as more herd advisers such as nutritionists commute from California to South Dakota to consult for dairies there. “In the 1970s, California had cheap land, cheap feed, cheap labor and cheap water,” he said. “It doesn’t have those anymore.”

Write to Jesse Newman at jesse.newman@wsj.com

Copyright ©2021 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8

Appeared in the December 6, 2021, print edition as ‘California Drought Threatens Dairy Farms.’