Around 330 dairy farmers supplying milk to Saputo Dairy UK, formerly Dairy Crest, will see their January milk price rise by 2.35p/litre, taking the manufacturing standard litre price to 35ppl and liquid standard litre to 33.75ppl. Saputo buys more than 500 million litres of milk for its plant in Cornwall and makes award-winning cheddars Cathedral City and Davidstow.

We are acutely aware of the huge inflationary cost pressure that our farmer members face this winter.

Farmer-owned dairy cooperative, First Milk, has announced that its member milk price will increase by 2ppl, taking its standard litre price to 34ppl on a manufacturing price schedule. Robert Craig, vice chairman and farmer director, said: “We are acutely aware of the huge inflationary cost pressure that our farmer members face this winter.”

Milk price rise a positive step

“As always, our focus is on returning as much to our members as we can. Whilst this 2ppl price increase is undoubtedly a positive step, we will continue to work hard with our customers to recover increased costs from the marketplace, as well as focusing on any further mitigations we can take to reduce costs across our business.”

And Muller has said producers who meet the conditions of its Advantage scheme will get an additional 1ppl increase from January, on top of the 2ppl rise the processor had previously confirmed. The additional 1ppl is due to “rapidly raising on-farm production costs,” according to the company.

Lidl GB is also ensuring that Muller farmers who opted to benefit from a 3-year fixed-price contract for up to 50% of their milk supply will see this fixed price temporarily increase by 4ppl to 33ppl from the same date.

Rob Hutchinson, COO at Muller, said the rises were in light of the unprecedented increase in costs: “The commitment to the dairy industry from Lidl GB to increase the value of the fixed-price contract, an important and valuable hedge against milk price market volatility, also recognises the current pressures facing farmers.”

Pressure on milking herd

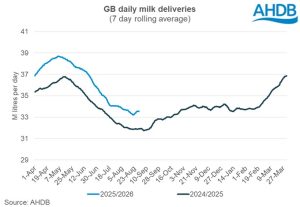

The pressure on the sector is one reason for the ongoing shrinking of the GB milking herd, which according to the Agriculture Horticulture Development Board, totalled 1.67 million as of 1 October. Katherine Jack, AHDB dairy analyst, said the milking herd had seen a 1.7% (29,000 head) decline in numbers compared to October 2020, marking an ongoing continuation of the long-term decline seen in the national herd.

While youngstock numbers have risen, she said there were many other factors that could maintain the status quo of long-term decline.

“Margins are particularly important at the moment, with higher prices having to compete with increasing costs. If the economics don’t favour expanding individual herds, farmers are likely to cull older animals to make space for the new ones instead.”