Dairy markets are in a very different situation than almost any experienced since 2014.

The dominant features of the basic U.S. dairy situation continue to be tighter milk production, record export volumes, increased prices, sluggish domestic consumption and decreasing inventories. Total dairy cows and total milk production in the United States were both less than a year earlier during the September-November rolling quarter. December prices for nonfat dry milk and dry whey were the biggest monthly prices since 2014. They, as well as December butter and cheese prices, were among the most observed during all months since the beginning of the year 2000. The long period of difficult market conditions – from 2014 until recently – constitutes a major reason for the production contraction that’s driving the current situation.

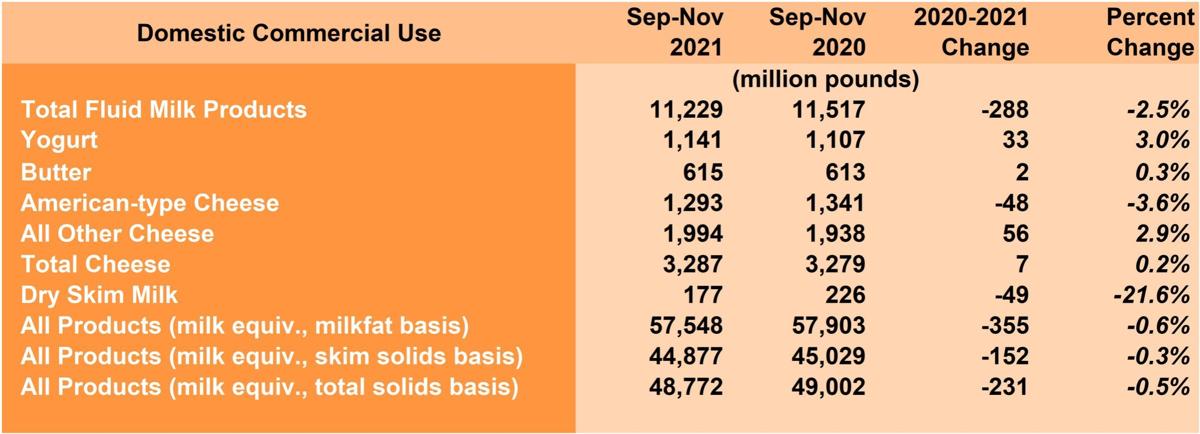

Commercial Use of Dairy Products

Growth in total commercial use of milk in all dairy products in all markets, domestic and export, was positive for both milkfat and skim solids; it averaged about 1 percent during September-November. But that growth was due entirely to exports; domestic commercial use during that period decreased by about .5 percent from a year earlier. Fluid milk and American-type cheese were two key categories that showed reduced consumption in the United States.

U.S. Dairy Trade

The United States exported the equivalent of 17.6 percent of domestic milk-solids production during calendar year 2021 to date through November – a record by that measure for the first 11 months of any calendar year, the next most being 16.2 percent in 2020. Strong growth in exports of fats and cheese coupled with generally reduced exports of dried milk and whey products during September-November raises the question of how much those changes indicate a rebalancing of the preponderance of skim-milk products in the typical U.S. dairy-export mix. The answer is noticeably but minor.

During first-half 2021 exports of mostly skim-ingredient products, defined as those consisting of 70 percent or more skim-milk solids, accounted for an average of 85 percent of total milk solids exported. During July through November, that percentage decreased to 83 percent. The corresponding percentages of greater-fat products, defined as those with fat content of 20 percent or more, were 14 percent and 16 percent.

Exportable supplies of dairy products are becoming tighter among the world’s major export suppliers in Europe and Oceania, and world prices are increasing in response. But U.S. imports of the traditional key product categories of cheese and concentrated-protein products have increased significantly as U.S. domestic supplies tighten, prices increase and importers prioritize supplying the coveted U.S. market.

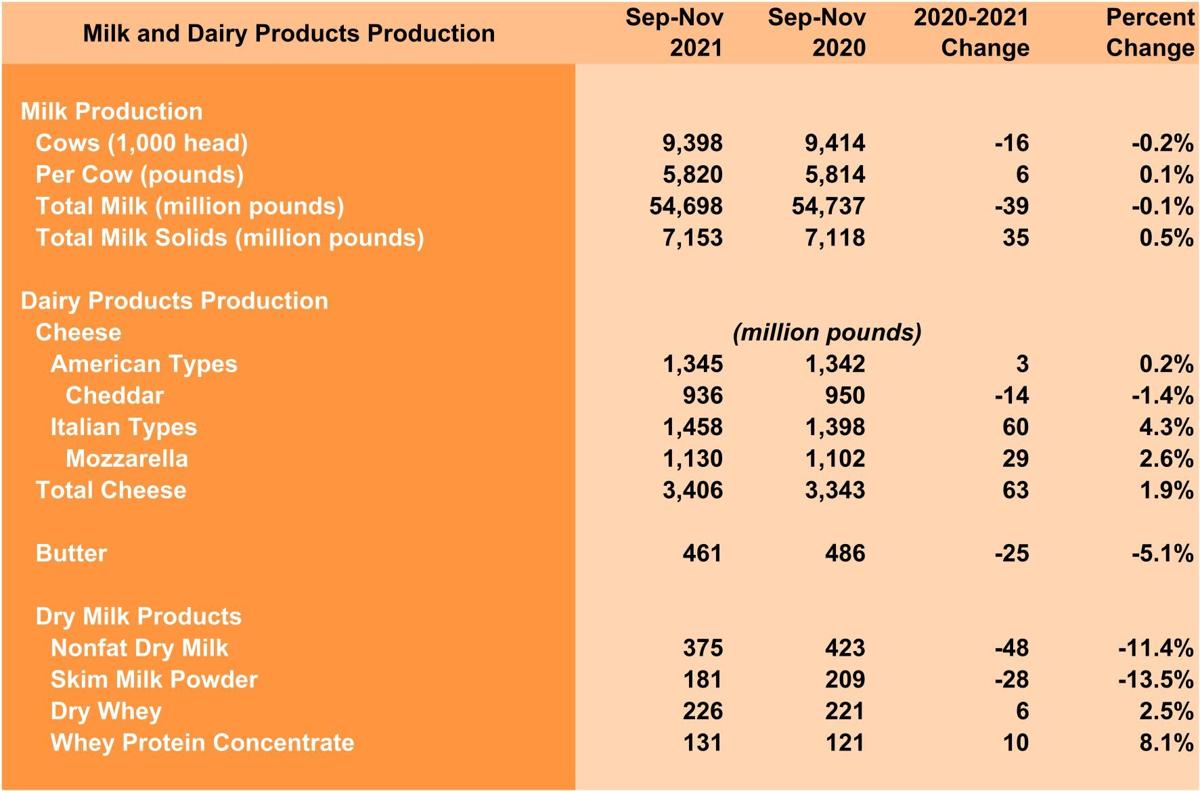

Milk Production

Milk production was marginally less, by .07 percent, from a year earlier, during the three-month period September through November. U.S. milk production has been steadily growing for decades. But production growth has actually been negative, on average, during one out of every six rolling three-month periods during the past two and a half decades. Reduced cow numbers were the driver for the latest decline; average cow productivity still showed a small increase. Milk-solids-production growth was unchanged from a month earlier in November, as reported by the U.S. Department of Agriculture’s Economic Research Service. The USDA’s National Agricultural Statistics Services reported year-over-year milk-production growth decreased well into negative territory that month.

Dairy Products

Although Cheddar-cheese production was less than a year earlier during September through November, growth during the period for most cheese and whey products contrasted sharply with marked declines in butter and dry-skim-milk products. Despite recent significant price increases for butter and skim-milk products, compared with more-modestly increased prices for cheese, available milk is still being preferentially routed to cheese and whey production.

Dairy-Product Inventories

American-type cheese is the only major dairy-product category to show larger stocks than a year ago in November. Butter, dry skim milk and dry whey stocks were all less that month than a year earlier by mostly double-digit percentages, while stocks of other than American-type cheese were unchanged for the year. Compared to their year-over-year changes, November stocks were less by even larger percentages for almost all product categories when compared with their respective maximum levels during the intervening 12 months.

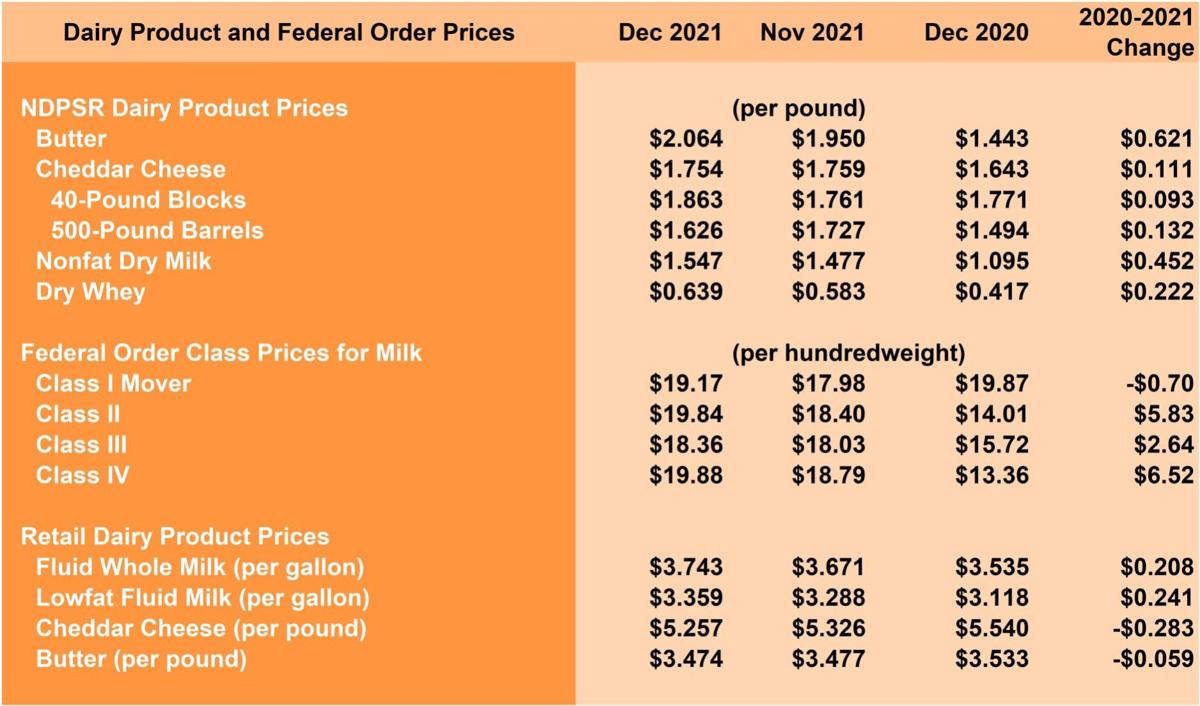

Dairy Product, Federal Order Class Prices

The monthly average National Dairy Products Sales Report survey price for block cheese increased by about a dime a pound from November to December, while the barrel-cheese price decreased by about the same amount. That left the overall cheese price essentially unchanged for the month. By contrast butter, nonfat-dry-milk and dry-whey prices increased significantly in December. Federal-order-class prices increased accordingly, with Class III increasing by only 33 cents per hundredweight; others increased by more than $1.

The December retail price data for dairy products reported by the Bureau of Labor Statistics shows both whole- and lowfat-milk prices have increased by about 7 cents a gallon from a month earlier. Average Cheddar-cheese retail prices decreased by the same amount per pound at the same time. The Consumer Price Index for dairy and related products increased again by 1.6 percent from a year ago in December, as reported by the Bureau of Labor Statistics. It had increased scarcely more than that during any month after February 2021. By contrast, the overall rate of inflation has increased steadily all this past year, to reach 7.1 percent in December. Inflation in all food and beverages has done the same since April, hitting 6 percent in December.

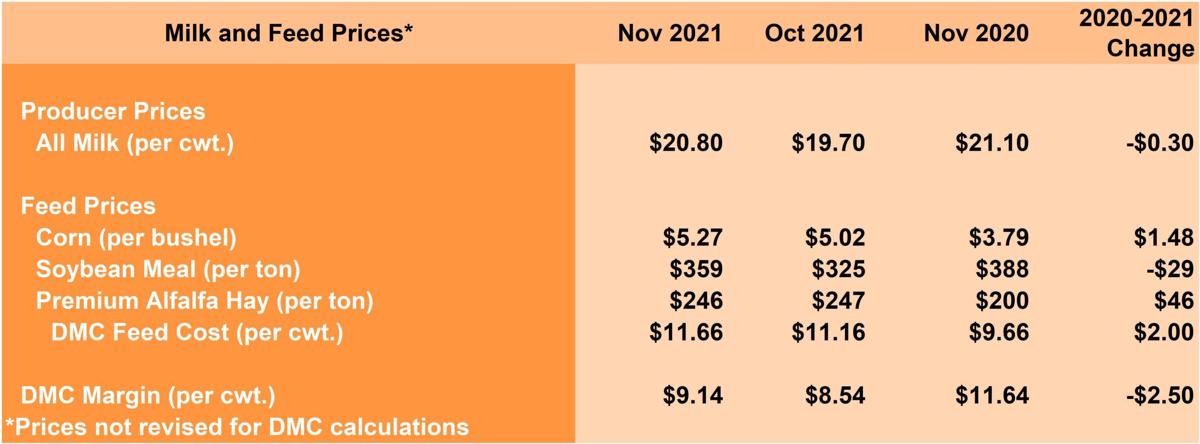

Milk, Feed Prices

The November margin under the Dairy Margin Coverage program was $9.14 per hundredweight, an increase of $0.60 per hundredweight. from October. The all-milk price component of the November margin was $20.80 per hundredweight, $1.10 per hundredweight more than a month earlier. The November Dairy Margin Coverage feed cost was also more for the month, by $0.50 per hundredweight, almost equally from increased corn and soybean-meal prices. But prior to the November increase, feed costs had been generally decreasing since spring 2021. The November premium-alfalfa-hay price decreased slightly from a month earlier after increasing steadily almost every month since September 2020. Monthly corn prices had also increased steadily since September 2020 but decreased this past year during the harvest months of September and October before increasing again in November. Monthly soybean-meal prices have increased and decreased in 2021 but have remained well less than their level during the first quarter of the year since then. The USDA reported that, as of Jan. 18, a total of almost $1.2 billion was expected to be paid to 18,823 operations enrolled in the 2021 Dairy Margin Coverage program, for an average of more than $63,000 per enrolled operation.

Looking Ahead

The effects of the current rather-dramatic pullback in cow numbers and production on dairy-product production, stocks and prices has been marked. To no surprise, it’s causing much speculation about how long it will last. Dairy-futures markets signal the trend will last well into 2022. Futures as of mid-January indicated that the 2022-calendar-year average U.S. all-milk price would be about the same as the record $24 per hundredweight average that the price attained during the 2014 calendar year. USDA’s mid-January monthly forecast update predicts U.S. milk production will increase by just 0.7 percent this year from 2021’s estimated total of 226.2 billion pounds. At the same time, USDA increased its forecast for the 2022 U.S. average all-milk price by $1.85 per hundredweight from just a month earlier – to $22.60 per hundredweight – which is still about $1.50 per hundredweight less than the futures were indicating at that time.

Another record that will almost assuredly be set soon is the percentage of U.S. milk solids exported during an entire calendar year. With data for just the final month of December to be reported, U.S. exports this past year are on track to reach 17.4 percent of solids production, 1.4 percentage points more than the previous record by that measure the year before.