|

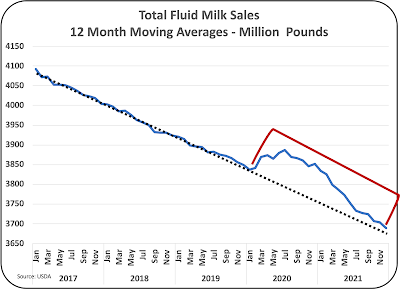

| Chart I – Fluid Milk Sales |

CHEESE – Chart II

Cheese followed a different route from fluid milk. When COVID hit and people were discouraged from eating in restaurants and encouraged to “stay at home,” they bought food from grocery stores, not restaurants. Cheese for grocery stores is packaged very differently from cheese packaged for food service sales. The type of cheese also varies. This caused a major and immediate impact on cheese processing and distribution.

Cheese production had very nice increases in 2017 and 2018 growing by about three percent annually. The slowdown in cheese production started in early 2019 and lasted through 2020. For these two years, the increase in cheese production was only about a half percent annually. In 2021, production of cheese has again started growing at the same rate as in 2017 and 2018, increasing by about three percent annually.

|

| Chart II – Cheese Production |

|

| Chart III – Ice Cream and Sherbet Production |

|

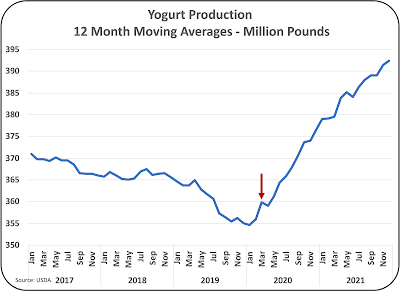

| Chart IV – Yogurt Production |

COVID and “stay at home” had a significant impact on the dairy industry by every metric explored in this post. COVID did not end in March of 2021, one year after the start, but dairy statistics indicate that eating habits and dairy consumption headed back to near normal. The only statistic that seems to have retained the COVID impact is yogurt, and that category is very small compared to overall dairy statistics.

Legal notice about Intellectual Property in digital contents. All information contained in these pages that is NOT owned by eDairy News and is NOT considered “public domain” by legal regulations, are registered trademarks of their respective owners and recognized by our company as such. The publication on the eDairy News website is made for the purpose of gathering information, respecting the rules contained in the Berne Convention for the Protection of Literary and Artistic Works; in Law 11.723 and other applicable rules. Any claim arising from the information contained in the eDairy News website shall be subject to the jurisdiction of the Ordinary Courts of the First Judicial District of the Province of Córdoba, Argentina, with seat in the City of Córdoba, excluding any other jurisdiction, including the Federal.

1.

2.

3.

4.

5.

eDairy News Spanish

eDairy News PORTUGUESE