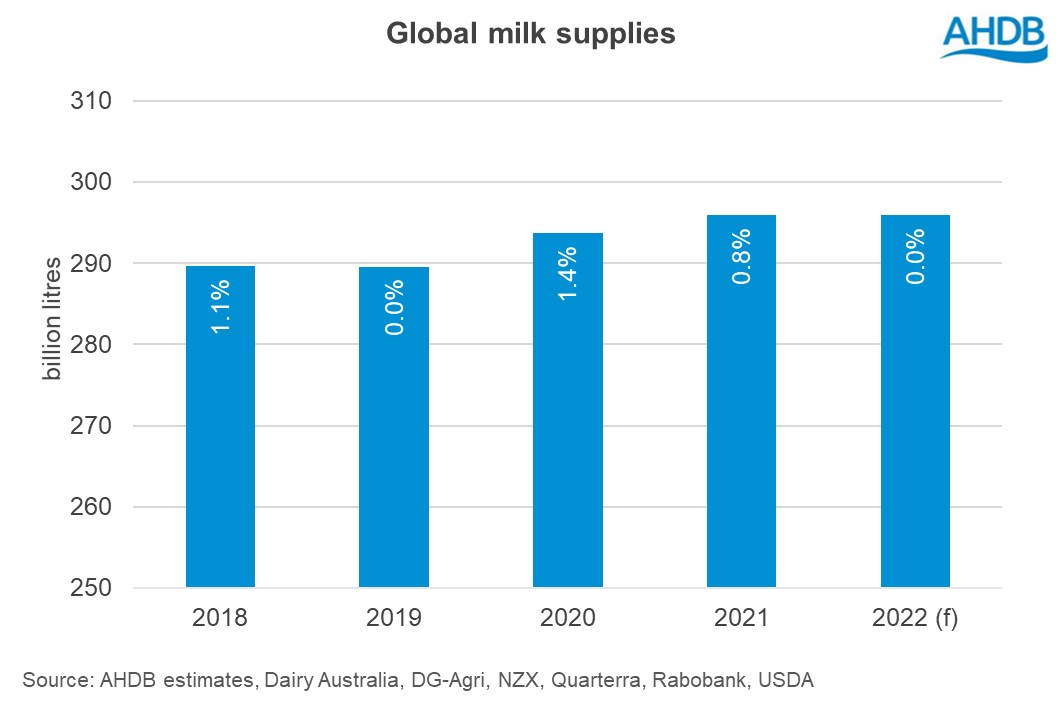

Following a low growth year in 2021, where global milk production [1] was up only 0.8%, 2022 is not looking to fare any better. Updated forecasts for the coming year now see global milk production remaining flat on the year. This is down from the 0.6% annual growth which was forecasted in January.

The latest data from each of the key exporting regions paints a less positive picture than in January. This is most notable in the UK where production is expected to decline by at least 0.9% on the year. EU milk production is set to remain in line with 2021, as are New Zealand and the US. Click here to view the latest global milk deliveries.

Already high input costs, now escalated by the current conflict in Ukraine, are offsetting strong milk prices and with no sign of relief in inflationary pressures, farmers do not feel encouraged to improve yields. The challenges of labour shortages, transport delays, increased greening requirements and unfavourable weather also need to be taken into consideration when looking at the feasability of increasing production.

With little growth in global milk supplies, prices will remain supported and have the potential to increase further if demand rises. However, there is some uncertainty around this, as when the large price jumps eventually flow through to consumers this is likely to dampen demand. We may also see reduced purchasing as buyers use up some of the security stocks held in response to delivery delays. These factors could slow down further increases in price.

[1] From the key dairy exporting regions – US, EU-27, UK, New Zealand, Australia, and Argentina