On the other hand, global milk production is still declining for the fourth consecutive quarter.

Milk production in the ‘big seven’ dairy export regions (the European Union, United States, New Zealand, Australia, Brazil, Argentina and Uruguay) has been contracting year-on-year for the past three quarters.

Rabobank forecasts this downward trend will continue for the Q2 2022 period — creating a four-quarter-long, back-to-back run of constricting milk supply — something that hasn’t been seen since 2012-13.

“The current slowdown in global milk output is directly related to higher costs of production and weather events,” the report said.

“In the past, production has recovered and surpassed previous peaks, but now there are structural issues that could limit a significant rebound in production from some key exporters.”

Australia

At home there is widespread milk decline across all regions, but the record opening milk prices and revisions are providing cash flow and confidence to farmers.

Rabobank senior dairy analyst Michael Harvey said these milk prices were important as dairy farmers face cost headwinds.

“The cost of home-grown feed and supplementary feed will be more expensive, among other inflationary pressures,” Mr Harvey said.

“Against this backdrop, labour availability remains a handbrake on expansion. There is a likelihood that farm margins will be lower in the new season not higher, despite a circa 15 per cent lift in milk prices to record levels.”

Mr Harvey said there were bright spots on the horizon.

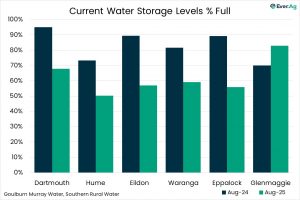

“Seasonal conditions remain supportive for spring pasture growth, and water market conditions are good for irrigation farmers,’’ he said.

“Non-milk incomes remain elevated, supported by a very firm beef market.”

New Zealand

Kiwi farmers are anticipating another profitable season, but higher input costs will chew into margins.

South America

Herd reduction continues as drought and high costs push farmers. Any rebound from the South America trio (Brazil, Argentina and Uruguay) will be slow as production costs remain high.

United States

Limited growth in the milk pool has pushed domestic milk prices high, but demand at these levels is showing signs of hesitation, adding volatility to the market.

Inflation is another issue to be watched.

European Union

Rabobank doesn’t expect the EU milk pool to grow until the second half of the 2022 year due to low year-on-year comparables.

China

China’s carryover stocks and strong milk production growth overhands weak demand due to COVID-19 lockdowns, ill-boding for 2022’s import outlook