According to Euromonitor International’s Voice of the Consumer: Health and Nutrition Survey (2022), 63% of global consumers responded that having a strong immune system defines what being healthy means for them.

However, label claims such as high protein, organic, and no added sugar are also growing as consumers increasingly view food as medicine. Generally, health claims have become increasingly important to global consumers, with 43% of respondents from Euromonitor International’s Lifestyles Survey (2022), paying close attention to nutritional information and labelling, highlighting the significance of clear labels and messaging.

At home and hybrid lifestyles change eating patterns and habits – including for dairy products

Many consumers globally are staying at home more often and adopting a hybrid lifestyle, with a strong shift towards a flexible pattern of eating at times that are convenient, bringing about a wave of changes in pack sizes and product formats. In Canada, Snack’rs cubes and Squeak’rs cheese curds formats were launched to reinvent cheese as a convenient option for school lunches, or to add to local culinary delights such as poutine.

As consumers around the world try to reduce their expenses due to the rising cost of living, dairy products are increasingly positioned for elevated consumption and cooking occasions at home, as consumers try to cut costs by recreating meal experiences at home instead of frequenting foodservice outlets.

Health and wellness trend to be a key growth driver for dairy

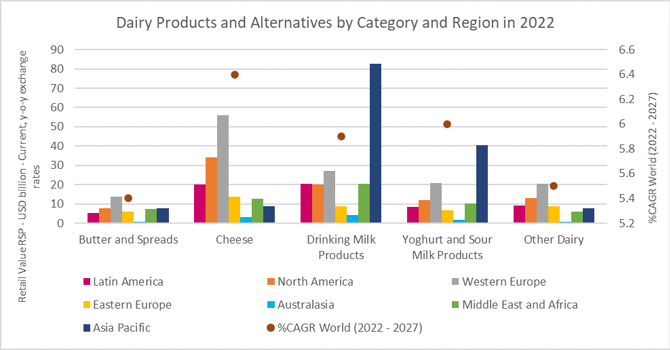

Immunity and gut health continue to be hot topics in the industry, and the pandemic has further supported demand for immune-boosting yoghurt variants, which is likely to remain a relevant trend in the category as consumers lean towards products that highlight wellness. Sour milk products, including kefir, are set to be the fastest growing performers globally, with an expected forecast CAGR of 4% in retail value sales. In addition, emerging markets are delivering the fastest growth for cheese, and in particular Asia Pacific is expected to witness a 7% CAGR over the forecast period, largely set to be driven by strong growth in China. Cheese is increasingly recognised in China as containing high-quality nutrition, particularly for children, due to its calcium and protein content, without a high level of salt or other added ingredients.

Furthermore, COVID-19 has accelerated the health and wellness trend, as global consumers have become more conscious about wellbeing and building good eating habits, which are key drivers of growth for dairy. As self-care has become more pronounced post-pandemic, “better for you” products have been an overriding trend across packaged food, as consumers seek to enjoy food and feel good about themselves without the guilt. As health and wellness takes precedence, industry leaders are trying to evolve and meet changing consumer preferences without compromising on taste despite cost pressures. Consumers are increasingly looking for snack choices to be nutrient-dense, serving additional health benefits, rather than just being a filler option between meals. This has led to the stronger popularity of dairy products such as yoghurt and sour milk products as a healthy addition to consumers’ diets.

What’s next for dairy products?

NZMP(New Zealand Milk Products) is the ingredients and solutions brand of the dairy co-operative Fonterra. Perspective is its monthly publication providing commentary, trends and data from leading industry experts. For further insight on trends and innovations in dairy, please read the article, Market Overview and Key Trends in Dairy Products.