Agriculture contributes an estimated one-quarter of global greenhouse gas emissions. The economy in New Zealand, a tiny country at the bottom of the world, relies on its vast natural resources such as fishing, forestry and mining, and most critically agriculture. More than 80% of money coming into the country is from these primary sector exports. So why is it initiating the world’s first agricultural farming carbon tax, which some say will damage its critical farming sector?

New Zealand has announced it will become the first country globally to put a price on agricultural greenhouse gas emissions. Although the actual price has yet to be determined, effective January 1, 2025 it will begin levying (farmers see it as a tax) the producers of food – farmers.

Is it good policy? Will it set a standard for the rest of the world to emulate? Are farmers being unfairly targeted? What are potential benefits?

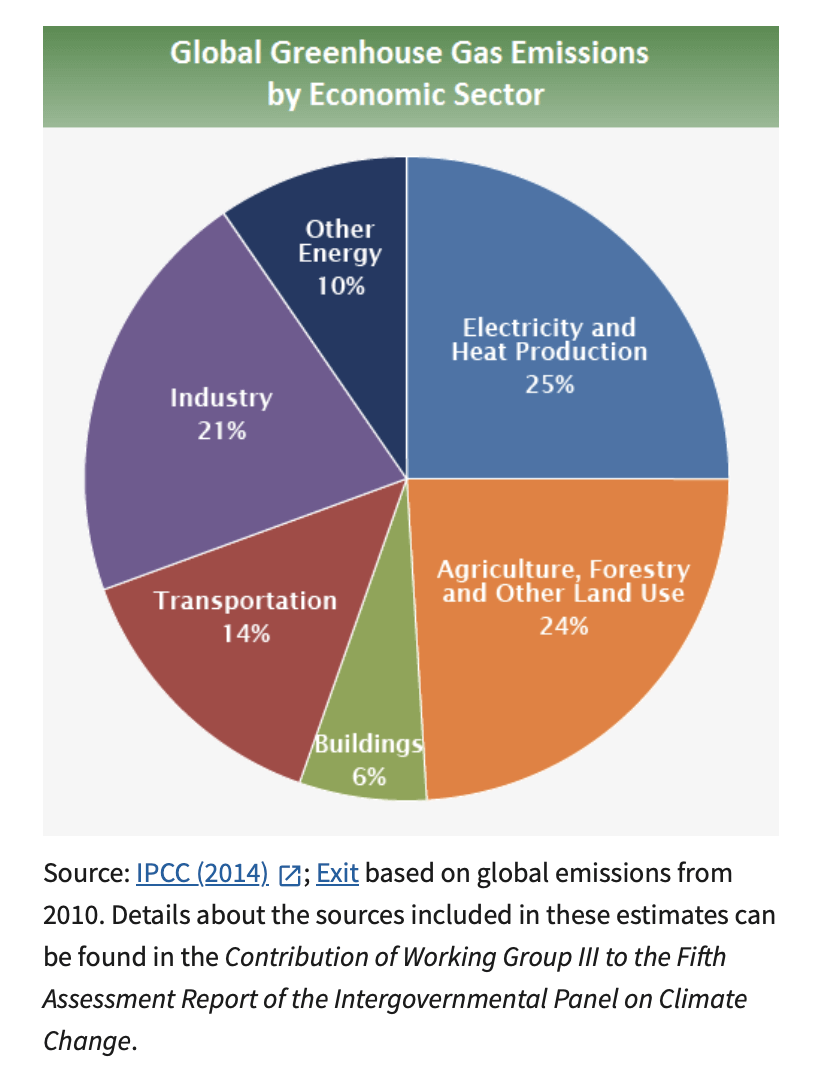

Human activities are responsible for almost all of the increase in greenhouse gases in the atmosphere over the last 150 years. Agriculture is estimated to be among the biggest contributors, at 24%, just behind energy used for electricity and heat.

New Zealand’s GHG profile is unusual in that half of its emissions come from agriculture. Over 80% of energy generation is already from renewable sources, and the country is heavily reliant on road transport (and hence fossil fuels) for freight. A decrease in agricultural emissions is considered vital for meeting international agreements. Tax proponents maintain that GHG emission reductions spurred by the tax could help make the country carbon neutral by 2050.

But the tax will have considerable implications for farmers and potentially for the public. Farming is the country’s biggest industry, generating 12% of the gross domestic product. Many economists believe that taxing food emissions will reduce farm income, and impose restrictions around innovation and choice. Taxation might also reduce food production, with implications for the economy and possibly for food security.

Challenging that belief, the government maintains the tax will help the farm economy. Prime Minister Jacinda Ardern said the farm levy would be invested back into the industry to fund new technology, research and incentive payments for farmers, giving them a “competitive advantage … in a world increasingly discerning about the provenance of their food.”