Flourishing cheese market size and consumer consumption in China

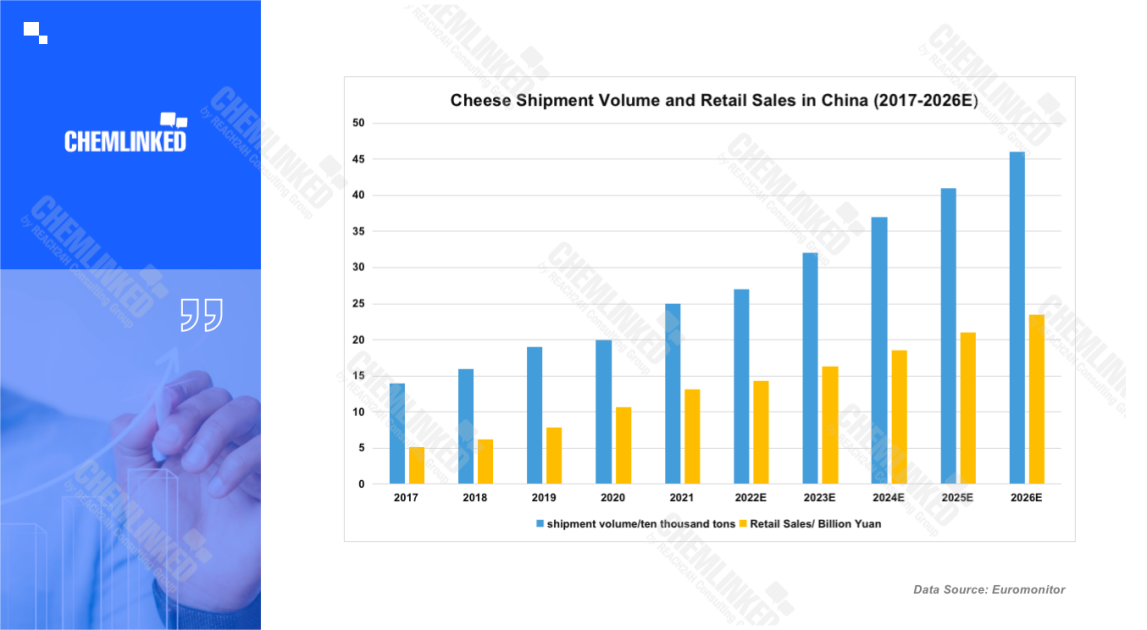

According to Euromonitor, the cheese shipment volume in China has surged from 140,000 tons to 250,000 tons during 2017-2021. The cheese retail sales have risen noticeably from RMB 5.2 billion to RMB 13.1 billion in the same period. In the next five years (from 2021), the compound growth rate of both the cheese shipment volume and the retail sales will maintain double-digit growth, far above the world average. The shipment volume was estimated to reach 270,000 tons in 2022 and 320,000 tons in 2023, and the retail sales were expected to come up at RMB 14.3 billion in 2022 and RMB 16.3 billion in 2023.1

Although the average cheese consumption in China is far below many western countries as well as Japan and Korea, it has significantly increased from 80g/person/year in 2017 to 130g/person/year in 2021.2 According to the statistics from United States Department of Agriculture, the total cheese consumption in China also grew from 155,000 metric tons in 2019 to 194,000 metric tons in 2021. A decline occurred in 2022 (175,000 metric tons) due to the negative impact from COVID-19 recurrence in China.3 At the 2022 China Cheese Development Summit Forum, the Dairy Association of China released an action plan, proposing that the national cheese production would reach 500,000 tons, and the national cheese retail market size would exceed RMB 30 billion by 2025. Interested in the potential cheese market and cheese demand, more dairy firms have made strategic layout on Chinese cheese market.

Dairy enterprises’ striving for the Chinese cheese market

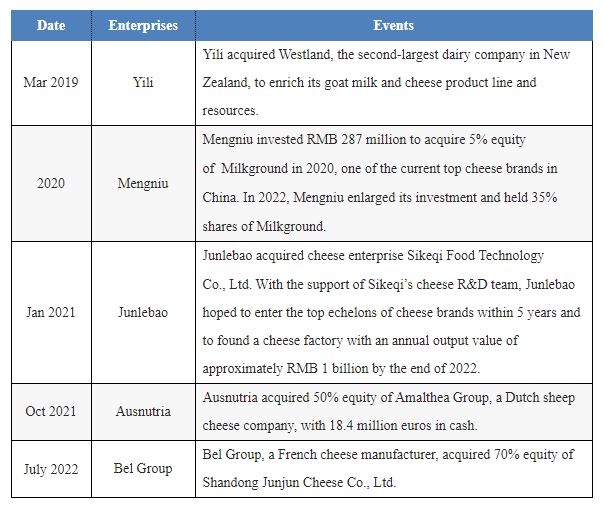

Dairy firms have made substantial actions to scramble for the Chinese cheese market in recent years. The two dairy giants, Mengniu and Yili, have made earlier trials in cheese market. With the potential of the market having been noticed by more dairy companies, more investment has been flowed into the market. The following is the list of some representative financial events in the cheese market:

High market concentration of cheese brands and diversified cheese stick products

The current cheese market in China is dominated by leading enterprises, among which Milkground and Milkana respectively accounted for 28% and 24% market share.2 The current products on the cheese market can be categorised as original cheese and processed cheese. Original cheese is generally served in restaurants. Processed cheese is usually served as snack. With market size reaching RMB 10 billion in 2022, nowadays processed cheese is better welcomed in China due to the higher suitability of its taste to Chinese consumers and the promotion of leading brands. 1

Processed cheese products include cheese stick, cheese slice, cheese strip, etc. Cheese stick is the most popular one, which was first launched by Milkana, but was popularised by Milkground. Presently, promoted by the increasingly intensive market competition, dairy enterprises have rolled out a wide range of cheese sticks with distinctive features.

Miaofei released the zero-sucrose cheese stick.

Milkana launched a cheese stick product with strawberry fillings.

Milkground unveiled a cheese stick product which can be stored in room temperature. Since most of the previous cheese stick products should be preserved at low temperature, the cheese stick launched by Milkground created more opportunities for the cheese market.

Mengniu rolled out a type of cheese stick with 6 times calcium content of ordinary milk and decrease in sugar and salt. Cheese stick with high-content calcium is a common type of cheese stick products that dairy companies are eager to release. Milkground, Dr.Cheese, Yili, etc. have also launched similar products. The monthly sales of Milkground, Dr.Cheese and Yili’s high-content cheese sticks have reached 20,000 plus, 10,000 plus and 10,000 plus, respectively.

Future innovation in flavours and functions

In terms of innovation, two trends are obvious in cheese products. As most cheese products are served as snacks, creating new flavours would be one of the main trends in the future. At present, there are flavours like combined fruits, vanilla, chocolate, etc. Dairy enterprises are supposed to develop more unique flavours to attract various consumers. In addition, the firms can launch limited editions in different seasons, for instance, cherry flavour in spring, honey peach flavour in summer and creamy flavour in autumn.

Cheese is well-known for its high nutrition, especially calcium and protein. Adding additional new nutrients in cheese products is another popular trend of innovation, which will probably attract more consumers. Probiotics, taurine and dietary fiber are currently popular nutrients that can be added to products. In the future, the market is expected to see more cheese products with distinctive functions.