After record high milk prices in 2022, milk prices continue to fall reaching prices not seen since 2020 and 2021. Class III prices for July could dip to $13.800/cwt, $5.63 below January and a whopping $11.99 below a healthy $25.79 just a year ago.

Prices dipped into the $13 rante from October of 2020 to February of 2021. Milk prices are now well below profitable levels for dairy producers.

What’s to blame?

Much lower cheese and dry whey prices have contributed to lowering the Class III price. The price of 40-pound cheddar cheese was in the $1.30’s to $1.40’s per pound in June with some improvement in July to the high $1.40’s. A year ago in July, 40-pound blocks were ranging from $1.94 to $2.11 per pound. In June, Cheddar barrel cheese reached as high as the mid $1.50’s per pound but declined to as low as $1.34 in June. In July barrels were in the low $1.40’s per pound. A year ago, in July barrels ranged from $1.55 to $1.83 per pound.

However, both blocks and barrels may be starting to trend higher. Today on the CME, 40-pound blocks increased $0.135 per pound to $1.72 and barrels increased $0.12 per pound to $1.58. Dry whey started the year at $0.415 per pound, got as high as $0.4675 per pound in March but has been as low as $0.225 to as high as $0.2775 per pound in June and July and is now $0.25. A year ago, in July dry whey ranged from $0.445 to $0.50 per pound.

What about the milk supply?

These prices show that milk prices are subject to rather small changes in milk supply, milk demand or a combination of changes in supply and demand. Last year milk production was just 0.1% higher than the year before. This year milk production from January to June has been 0.7% higher than a year ago but the increase is slowing. June milk production was unchanged from a year earlier.

Increased domestic demand and/or dairy exports are required to take up this increased production to prevent falling milk prices. Record high milk prices last year resulted in higher retail prices of dairy products which may have dampened domestic demand some. With lower milk prices, retail dairy product prices are starting to decline some but not nearly to the extent of lower milk prices.

Dairy exports enjoyed healthy sales last year with record cheese exports. But on a volume milk solids equivalent basis, May exports were 13% lower than a year ago with cheese exports down 18% lower and dry whey product exports down 29%. May was the third consecutive month dairy exports were lower than the previous year.

Weaker demand from key export markets such as China and increased competition from New Zealand have dampened exports. Lower dairy exports mean more milk is needed to clear the domestic market without lowering milk prices.

Have we hit bottom?

The July Class III price should be the bottom for the year with the price trending upward for the remainder of 2023. Milk cow numbers fell by 16,000 from May to June. June cow numbers decreased by 5,000 animals from this time last year were finally below a year ago, down 5,000. There was no increase in milk per cow. As a result, June milk production was unchanged from a year ago.

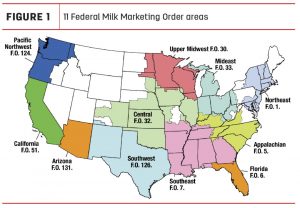

June milk production compared to a year earlier for the five leading dairy states and their cow numbers were: California -1.2%, 4,000 fewer cows; Wisconsin +1.0%, 2,000 fewer cows; Idaho +1.9%, 14,000 more cows; Texas -5.0%; 13,000 fewer cows; and New York +3.4%, 7,000 more cows. All of last year Texas was just behind South Dakota with the highest increase in milk production. But the loss of 8,000 cows from an explosion and fire along with hot weather have reduced milk production.

Other states having relatively strong increase in June milk production over a year ago were: SD +6.9%, Ohio +3.3%, Mich. + 3.2%, GA +3.0%, Ind. +2.7%, Iowa +2.5% and Minn. +1.6%. June milk production was below a year ago by 7.1% in New Mexico, 3.1% in Oregon and 1.2% in Florida.

Milk production likely to stay down

Milk production is likely to run below year ago levels for the remainder of the year. With the existing widespread drought this year’s final crop production is uncertain. The drought has already reduced alfalfa hay production. Feed prices will remain at relatively levels. Higher feed prices and lower milk prices will make margins tight for dairy producers. Dairy producers are likely to reduce cow numbers in response.

Domestic demand may improve as retail prices soften some. Dairy exports could improve some by the third quarter of the year. Except for butter the price of cheese, dry why and nonfat dry milk/skim milk power are very competitive on the world market. Some export markets may take advantage of these lower prices and start to increase purchases.

Milk prices to trend upward

Milk prices will trend higher for the remainder of the year. Milk production will be in its seasonal low August through September. Schools will begin to open at the end of August and early September which will help beverage milk sales. By October butter and cheese stocks will start to build to meet the higher season sales of cheese and butter Thanksgiving through Christmas.

Class III futures show a continued improvement in the Class III price with it rising into the $15/cwt range by August, the $16’s by September and the $17’s for the remainder of the year. However, the latest USDA forecast is not as optimistic. USDA has Class III averaging just $14.30 for the third quarter and $15.05 for the fourth quarter with the average for the year $16.05 compared to $21.96 last year.

With the sensitivity to small changes in milk supply and/or demand I think the probability is high for third quarter and fourth quarter prices to be higher than USDA’s forecast. But time will tell.

Cropp is Professor Emeritus at the University of Wisconsin Cooperative Extension, University of Wisconsin-Madison