BNZ economists are estimating that Fonterra’s cut to its milk price forecast will chop nearly $2 billion from dairy industry revenues this year.

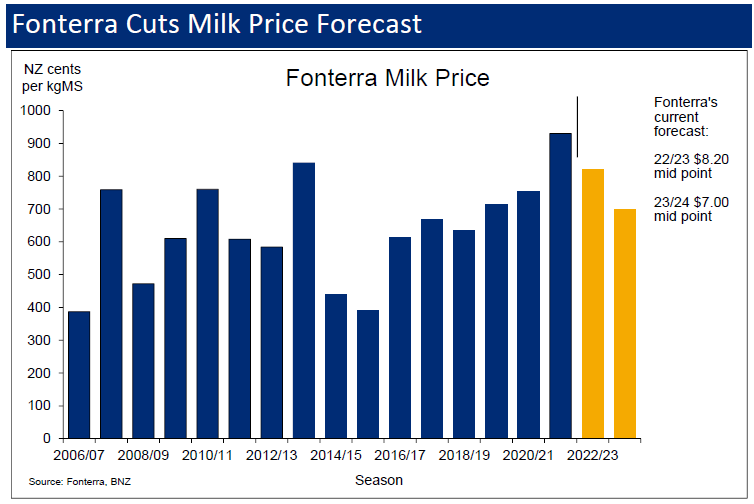

The giant dairy co-operative (Fonterra) last week lopped, in effect, $1 per kilogram of milk solids off its forecast milk price for farmers this season – reducing the ‘midpoint’ price of its forecast to just $7kgMS.

The move by Fonterra followed a series of weak results at the GlobalDairyTrade auctions. Overall dairy prices are down 13.4% (in US dollar terms) since the start of 2023, and down a whopping 42.4% since peaking in March 2022.

In BNZ’s weekly Markets Outlook publication, senior economist Doug Steel said if Fonterra’s milk price forecast cut to farmers is broadly indicative of conditions across the wider industry, “and there is no reason to think otherwise”, then it represents a reduction in industry revenue in the order of $1.9 billion.

“And compared to last season’s milk price, which is likely to be finalised around $8.20, it represents a revenue reduction of around $2.25 billion,” he said.

“For Fonterra farmers’ cashflow, there are some offsets such as a higher percentage of the forecast milk price being paid earlier this season, funds from recent asset sales to be returned this month (equating to around 50c / KgMS), and the prospect of a higher dividend return.

“But milk is the main source of revenue, and the price cut hefty.”

Steel pointed out that dairy is NZ’s largest export earner, “so material changes are of macroeconomic importance”.

Lower dairy sector returns will have flow-on consequences through regional areas and the wider national economy. Real economic activity will take “a noticeable hit” especially when “second round multiplier effects are taken into consideration”.

“The forecast milk price reduction from the previous season equates to around 0.6% of GDP. Including second round multiplier effects, it is not difficult to see this as a headwind of as much as 1% of GDP or more.”

Steel said the BNZ economists had “long been cautious” on the near-term milk price outlook and primary product prices more generally.

“It is one reason we anticipate relatively weak domestic consumption and investment, [the] forecast for which we may well have lowered further recently had it not been for some offsetting strength in population growth via net migration.”

Steel noted that it is not just dairy export prices that have softened but prices for NZ’s other major primary exports as well, including recent “material weakness” in lamb prices (against a usual seasonal increase) and logs.

“AgriHQ figures show lamb prices are around a quarter down on a year earlier. Beef prices are relatively better, but still around 10% lower than a year ago.

“These are not only some strong headwinds to growth, with flow on economic effects including to the fiscal accounts, but also disinflationary forces in and of themselves.”