Ag Economy Barometer reports over a third of farmer respondents cite high input prices as their top concern for the coming year.

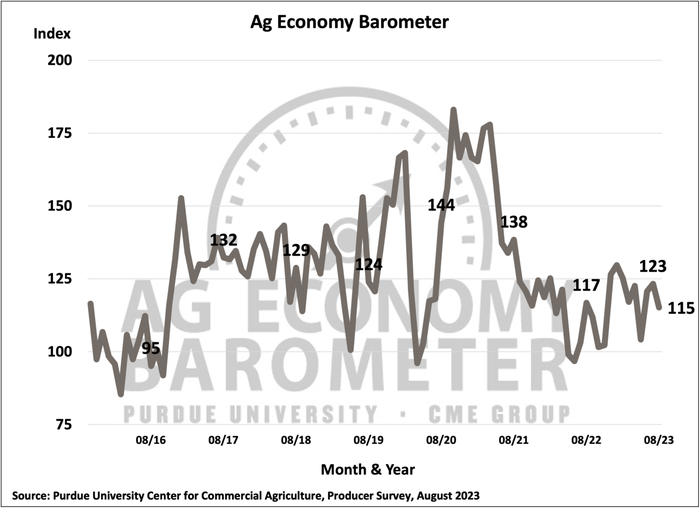

U.S. farmers’ sentiment weakened in August as the Purdue University-CME Group Ag Economy Barometer dipped 8 points to a reading of 115. This month’s decline was fueled by producers’ weaker perception of current conditions both on their farms and in U.S. agriculture.

“Rising interest rates and concerns about high input prices continue to put downward pressure on producer sentiment,” says James Mintert, the barometer’s principal investigator and director of Purdue University’s Center for Commercial Agriculture. “This month over half of the producers we surveyed said they expect interest rates to rise in the upcoming year.”

When asked about their top concerns for their farming operations in the next 12 months, producers continue to point to higher input prices (34% of respondents) and rising interest rates (24% of respondents). Even though crop prices weakened significantly this summer, only one in five producers (20% of respondents) chose declining commodity prices as one of their top concerns.

Financial outlook

Although producer sentiment weakened in August, producers’ rating of farm financial conditions changed little this month. The Farm Financial Performance Index declined just one point to a reading of 86.

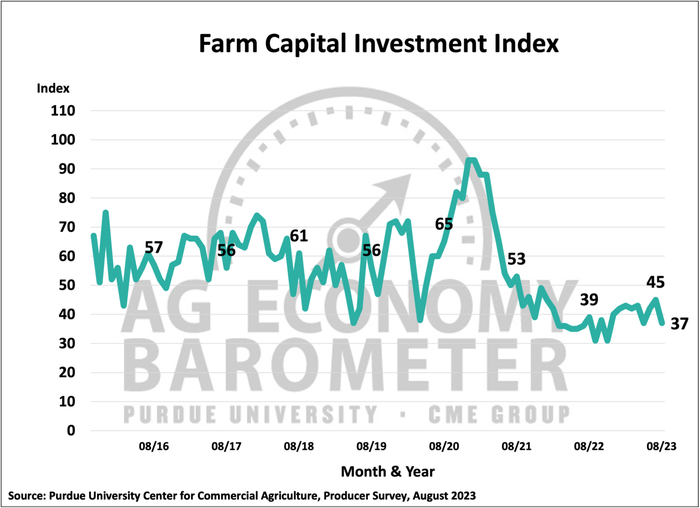

However, producers’ perspectives on farm financial conditions were noticeably weaker than a year ago when the index stood at 99. Weaker producer sentiment this month did translate into a decline in the Farm Capital Investment Index. The investment index fell to 37, eight points lower than in July and two points lower than this time last year.

Among producers with a negative view of the investment climate, the increase in prices for farm machinery and new construction along with rising interest rates were the two most commonly cited reasons for their negative view. In a related question, 60% of producers in said they expect interest rates to rise in the upcoming year.

Farmland values

Despite increasing concerns about rising interest rates, producers remain cautiously optimistic about farmland values. The Short-Term Farmland Value Expectations Index rose one point to 126, while the long-term index was unchanged at a reading of 151.

About 4 out of 10 (39%) respondents said they expect farmland values to rise over the next year, while 13% said they look for values to decline in the next year. When asked about their longer-term view of farmland values, more than 6 out of 10 (63%) respondents said they expect values to rise over the next five years, while 12% said they expect values to fall.

Carbon contracts

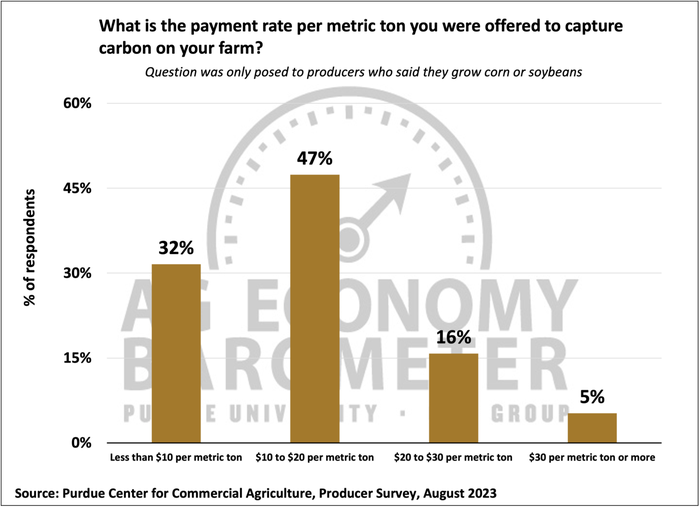

This month’s survey posed questions about carbon contracts to corn and soybean growers. In the August survey, 6% of corn and soybean growers said they have engaged in discussions with companies about receiving payments to capture carbon on their farms, while just 2% said they had signed a carbon contract.

Nearly half (47%) of the farms who discussed contract terms with a company said they were offered a payment rate of $10 to $20 per metric ton of carbon captured. Among the farms who engaged in discussions but chose not to sign a carbon contract, half of them said it was because the payment level was too low.

This month’s Ag Economy Barometer survey was conducted from August 14-18, 2023. Learn more about the survey results.