Dairy Outlook: The Class III milk-feed ratio is at a 14-month high.

Buckle up! Milk prices, along with nearly all commodities, are expected to be volatile through the rest of 2023 and into 2024, according to Ben Buckner, dairy and crops analyst for AgResource Co. Buckner spoke during a recent Professional Dairy Producers Dairy Signal webinar.

“We have milk production declining in the U.S. and elsewhere, we’ve got fragility in the world economic landscape, and no energy supplies,” Buckner said. As a result, “we’re going to see very choppy, very volatile markets into 2024.”

Buckner does think the recovery in milk prices that occurred in July is sustainable, at least through January, but prices for milk, cheese, butter and other dairy products will be up and down.

“The cash cheddar price has been quite strong since July based on tightening supplies of milk,” he said. “We may lose 5 to 10 cents in price in September, but we’ll see newer annual high prices in October, November or December.”

While milk supplies are starting to grow ever so slightly year over year in the U.S., global milk production is not growing at all.

Drought, heat take toll

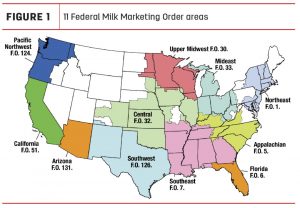

“Milk production in the U.S. suffered the most in Texas, New Mexico and Arizona, where it has been hot all summer, and in the Northwest, where drought has been building,” Buckner said.

He noted that there have been soil moisture and pasture challenges nationwide throughout the summer.

“As a result, milk supply issues probably get worse before they get better, which supports higher dairy market prices,” he said.

Buckner acknowledged that bullish prices in the beef market this year are contributing to lower dairy cow numbers. Due to high beef prices, more dairy cows are being culled.

“We’re not growing our dairy cow numbers, and per-cow milk production is down year over year, which is giving us higher dairy market prices,” he explained.

Buckner believes the Class III milk price will rise 30 to 50 cents per cwt between now and the holidays, which would lift the Class III price above $19 by December.

“Things do look better for the dairy industry into the early part of 2024,” he said. “The Class III milk-feed ratio — comparing cash milk prices to cash corn prices — is at a 14-month high today.

“There are a lot of questions about corn yield given we have had very little rain in places like Wisconsin, Illinois and most of the Plains states during the month of August and early September. So maybe we lose some corn yield and some bean yield, but I do think these harvests will move along very quickly. I think they will be done 10 to 12 days ahead of normal.”

Tighter butter, cheese supplies

Buckner said the market is prepared for tight butter and cheese inventories in November and December.

“I don’t think we will see $3 butter this year, but butter is priced at $2.50 to $2.60 per pound, and we’ve seen butter sales rise,” he said.

Buckner said USDA raised the all-milk price for 2023 to $19.95 per cwt, “and we think that is correct.”