Economists are upgrading their milk price forecasts again after a further recovery in global dairy prices at the latest auction.

Economists are now starting to raise their milk price forecasts again at the same kind of speed they were slashing them only weeks ago, as global dairy prices continue to rally.

More gains in prices at the GlobalDairyTrade auction early on Wednesday, New Zealand time, mean that overall prices have now recovered nearly 17% from the big plunge in August, while the key whole milk power (WMP) prices have risen nearly 18%. Overall prices are now actually at levels last seen in June of this year, while WMP prices are just slightly below where they were before the August drop.

Overall prices have now risen in each of the last four GDT auctions.

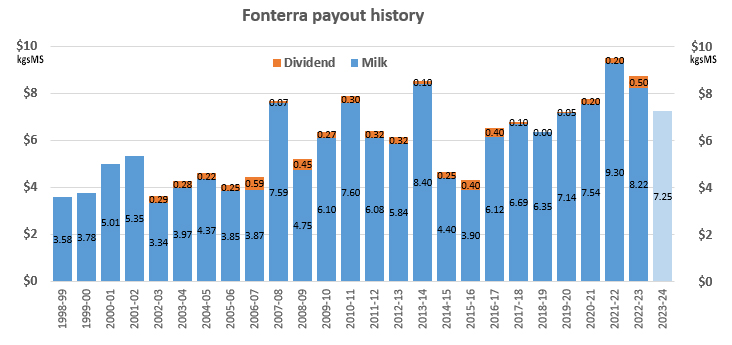

Last week, and ahead of the latest global price gains, dairy giant Fonterra raised its forecast milk price for farmer suppliers by 50 cents to an effective $7.25 per kilogram of milk solids. (Fonterra forecasts a price range and the new forecast for the 2023-24 season is for a range of $6.50 – $8.00 per kgMS, with a new midpoint of $7.25 per kgMS, up 50 cents.)

Just before the latest season started in June Fonterra gave an initial forecast of, in effect $8 per kgMS, but then ended up cutting that all the way back to $6.75 in the face of flagging global dairy prices.

And economists were cutting their forecasts at the time as well – but now they are pushing them back up again.

“The worst of this price cycle may be behind us,” Westpac senior agri economist Nathan Penny said, in raising his forecast for the milk price to $7.25 from $6.75, which is in line with Fonterra’s own forecast.

ASB economist Nat Keall has gone a bit further, raising his forecast to $7.35 from $6.60 previously.

But nobody’s getting carried away with the recent price rally at this stage, with Keall saying the ASB economists “still see downside risk to the outlook”.

And likewise Westpac’s Penny remains “relatively cautious”. Demand in our largest market (China) remains weak and recovery some time away, he said.

“We also note that at this milk price level, many farmers will still be in the red. In that sense, we are not out of the woods.”

But he said market sentiment has changed, and three things “have helped turned the price tide”.

“Firstly, prices hit very low levels, and this has led to increased buying interest, notably from the Middle Eastern and European buyers – after all, everyone loves a bargain. Secondly, the declaration of an El Niño weather pattern has increased the risk of a drought and a contraction of supply later in the season. Lastly, oil prices have lifted over recent months, and this may have given further impetus to demand from Middle Eastern buyers.”

But in contrast, we haven’t yet seen a material improvement in Chinese demand. Indeed, Chinese buyers haven’t changed their buyer patterns materially. Similarly, Chinese economic data “is also inconclusive at this juncture”.

“At this juncture and given that 2022 spring production was weak, we anticipate some lift in annual terms. However, that is likely to be tempered by the fact that cashflow pressures are likely to mean that farmers’ purchase less feed and other inputs. Later in the season, El Niño could lead to drought and put downward pressure on New Zealand production. While global dairy markets are acutely aware of this risk (and have factored this risk in to prices), we are more sanguine. Indeed, feed is currently ample and water tables are very high, so we expect that impact, if any, is likely to be somewhat muted.”

ASB’s Keall, despite remaining cautious said that, nonetheless, near-term risks to the dairy price outlook “are clearly looking more balanced”.

“Stronger demand from Southeast Asia and the Middle East has been doing a good job of supporting prices over recent auctions. A substantial proportion of product (circa 20% or so in our estimation) is priced over the September-October period, so the recent run of stronger auctions has mechanically pushed our 2023/24 milk price estimate higher.

“Global dairy production has started to decelerate over the past couple of months (including in China). The developments in the Middle East may boost oil and grain prices if sustained, in turn triggering further tightening in global dairy supply. Finally, with the NZD encountering resistance any time it reaches the 0.6050 mark of late, Fonterra is all but assured of a favourable effective exchange rate – we think around 61 or 62 US cents,” Keall said.