Some farmers are hoping for step-ups during the first half of the year, especially for spring flush milk.

Increasing production, especially of milk solids, seems to be a theme.

Meanwhile, milk processors are also considering their input costs and margins.

In the past two years, Inverloch dairy farmer Mick Hughes has fed high grain ratios because of the milk price offered by Saputo.

“Normally we feed 800 to 1.2 tonnes of grain, because of the comparable grain to milk price return,” he said.

“We increased the amount of grain we bought, and fed 1.8t/cow for this season.

“That milk:grain price ratio will probably change, because of what they’re offering this next season.

“I expect our milk price to go lower, and then we’ll need to feed grain strategically.”

Saputo Dairy Australia’s opening weighted average milk price for the 2024-25 season is $8 to 8.15/kg MS, with a growth payment on milk solids of $0.70/kg MS.

SDA’s opening offer is a significant step down from an average $9/kg MS at the start of the 2023-24 season.

“If we have a good season for grass growth and silage production, the milk:grain price will be irrelevant,” Mick said.

Kellie Gardiner, from Catani, milks alongside her parents and sister on a three-generation dairy farm.

The farm is still owned and managed by her grandfather, which limits her decisions about how to increase production.

They are also once-a-day milkers, supplying Bulla Dairy Foods.

“Bulla has offered us less than we’d like,” Kellie said.

The company’s opening price ranged from $7.85 to $8.65/kg MS, compared to last year’s opening of $8.80 to $9.60/kg MS.

Kellie and her sister milk a herd bred for production, containing one-third Jersey cows, one-third Friesian cows and one-third mixed.

To offset the lower price, Kellie has recently been buying extra cows to increase volume, both in total production and of milk solids.

She purchased in-calf Jersey and Holstein cows at a recent dispersal sale at Koonwarra VLE.

Shaun and Sharna Cope recently purchased a dairy farm at Meeniyan, and have been milking for Lactalis for the past few weeks.

They haven’t decided which milk processor to sign with.

The couple were sharefarming with his parents for many years, but after the farm was sold a couple of years ago, they took some time off, raising and selling heifers.

They are now new entries to the dairy industry and started milking on June 7, after buying 22 Holsteins in-milk that day.

They purchased another 20 cows in-milk on June 8. All are in-calf to sexed semen and due to dry off at the end of June, to begin calving in late July.

Shaun and Sharna have also been buying springing heifers in-calf to sexed semen, including 19 Holsteins in May from a combined sale of cattle from Rowan Foote at Fish Creek and the Lancey family from Poowong.

“We had already bought enough heifers, so we were looking for cows to buy,” Shaun said.

“The heifers have just started calving, so we’ll carry milking through after we dry off the cows.

“We’ll push these heifers back next year to calve in July, so everything will be in sync.”

Shaun said a lot of their decision about which milk processor to supply in the 2024-25 season depended on what bonuses were on offer.

“We’re supplying milk to Lactalis in June and weighing up our options,” he said.

“We want to know the price, but also what bonuses and incentives are on offer.”

In particular, Shaun and Sharna are looking for incentives from milk processors that demonstrate support for young farmers and new entries to the dairy industry.

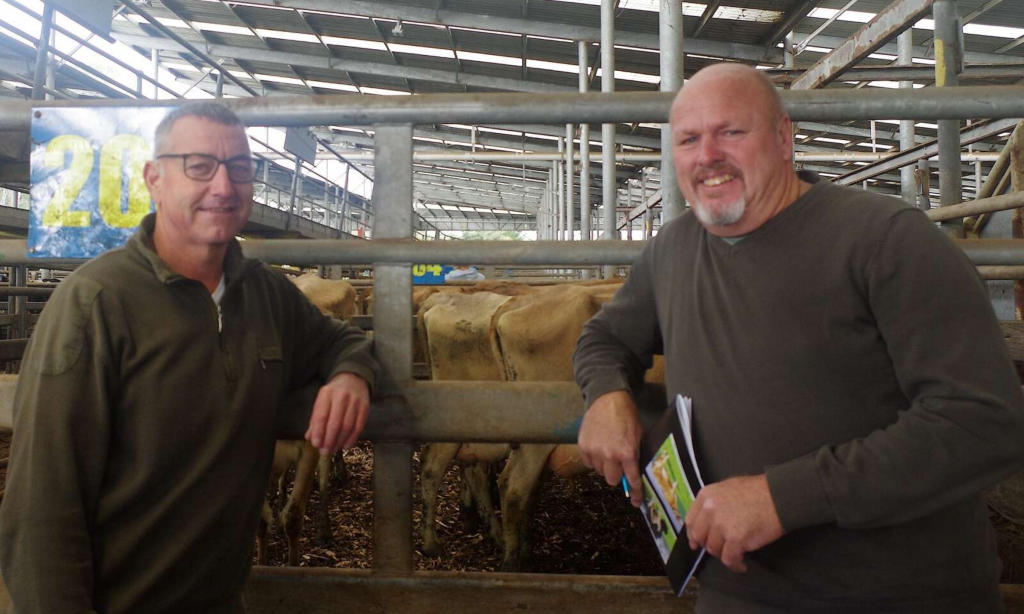

Established dairy farmers Danny Salter and Robert Griffiths are looking to increase their milk solids to offset a price drop.

They own Barringa Jersey stud at Kerang and supply Australian Consolidated Milk.

“ACM has offered $8/kg MS and then a bonus if we sign with them for two years,” Robert said.

“We’ve committed to two years.”

ACM, based at Girgarre in northern Victoria, announced a price range of $7.80 to $8.20/kg MS.

“To offset the drop in price, we’re improving production in the herd, and increasing the quantity of milk solids,” Robert said.

Danny and Robert recently purchased 10 Jersey cows in-calf to add to their existing genetics, and increase their quantity of milk solids.

“These new cows duplicate some of the proven genetics we already own,” Robert said.

“We hope ACM will step up their offer through the year to at least $8.50/kg MS.”

Robert and Danny also use irrigation to grow sorghum and millet crops to graze for milk production and harvest.

Pressure along the supply chain is affecting everyone in the Australian milk industry.

This includes growing imports of dairy products, available at lower prices to consumers at the retail level.

ACM executive chairman Michael Auld said increased imports and volatile markets were affecting the returns to processors.

He is one of many making the same claim.

SDA milk supply and planning director Kate Ryan said Saputo’s opening milk price was contingent on global market volatility and subdued demand for locally grown and manufactured food products.

Bulla Dairy Foods chief executive officer Allan Hood spent several weeks meeting suppliers on their farms before announcing the company’s price for the next season.

He said there was a gap between what farmers expected and what the company was able to pay. Both parties were affected by input costs.

Consumer choice, increased imports of dairy products and supermarket margins all added pressure to dairy processors, which they carried through to farmers.

Allan said this year had seen an unprecedented increase in input costs, shifts in consumer behaviour towards buying more imported products and increased competition from imported dairy foods.

“We can’t influence the global price of dairy products, and in the categories Bulla is in, retailers import cheaper products,” he said.

“Bulla — like other local processors — can continue to promote our products and our brands, telling our story.

“But the industry needs to work together to raise awareness about the increasing quantities of imported products on the market, being sold at lower prices, and how that affects locally made dairy products.”

Allan said unregulated imports had a detrimental effect on Australia’s food security.

Gippsland Jersey co-founder Steve Ronalds said Coles Group had recently advised the company it would no longer stock its milk, unless a larger margin was available from the boutique milk processor before the end of June.

“This decision by Coles overlooks the broader impact on family farms and rural communities, which depend on the viability of local dairy businesses to provide jobs and give consumers choice,” Steve said.

“Australia is home to around 26 independent milk brands.

“Many brands [on the supermarket shelf] are owned by multi-national companies.

“Brands like Great Ocean Road, Devondale and Sungold are owned by Canadian company Saputo. Pauls’ brands are under French multinational Parmalat.”

In recent years, Coles has pivoted its company from being retail-centric to deal directly with dairy farmers at the farm gate.

The Coles company also owns its own milk processing factories, and has a cooperative agreement with Saputo for its milk processing.

Gippsland Jersey supplies milk to Coles supermarkets.

“Coles is a very big business, and in reality, their systems and processes don’t really support small brands like ours, despite our best efforts to fit in and meet their targets,” Gippsland Jersey co-founder Sallie Jones.

“We can’t give them the margin they need for their spreadsheet.

“Our milk and other dairy products cost more because we pay our farmers a fair price.”