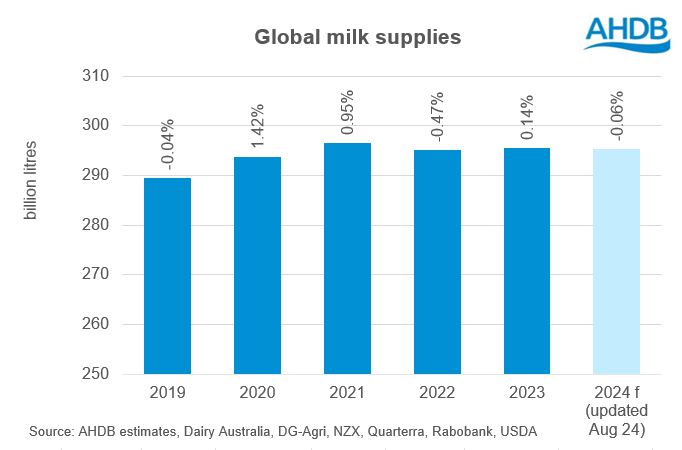

According to latest estimates, global milk production across the key producing regions is expected to remain stable with a small decline of 0.1% year-on-year. This is slightly lower than the 0.1% increase recorded in 2023 and a downgrade from the 0.25% growth predicted earlier this year. There is expected to be some variability across key regions.

Overall, dairy markets so far in 2024 have been tending towards slight undersupply due to weaker underlying market fundamentals. Disappointing Chinese import demand contributed to overall lack of movement on the demand side and lower prices than the previous year. Although prices have been rising again, producing some margin improvements, input costs remain at much higher levels than previously.

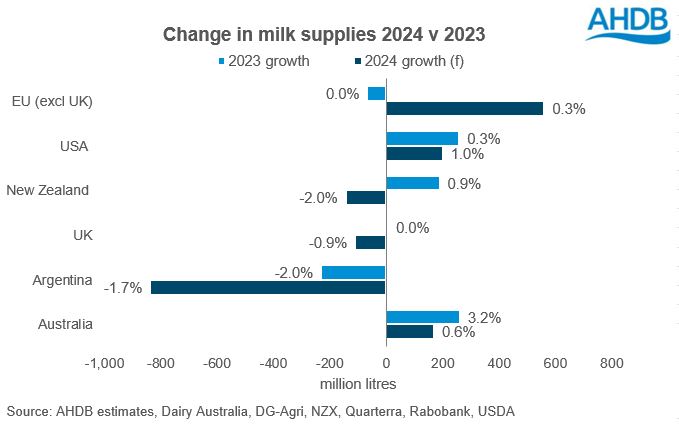

In the first half of 2024 (to June 2024) every region except for Australia and the EU have seen decline. Even the EU only grew by a modest 0.6%, whilst Australian milk supplies grew by 3.8%, annualising against a weaker 2023. However, total production for the year ahead is expecting to be overall more stable in the key exporting regions.

Australia (2.0%), US (0.2%) and EU (0.4%) are expecting to end the year with slight growth with the UK (-0.7%) and New Zealand (-0.7%) expecting to be in moderate decline. Argentina continues to expect more severe declines (-7.4%) in response to the challenging economic conditions seen in the country, although less severe than the declines we have been seeing.

The decline in herd size in the US is slowling down and cow numbers are expected to further stabilise in 2024. Despite the continuously decreasing dairy cow herd in Europe (-0.5%), EU milk supply is forecast to remain relatively stable also in 2024 (+0.4%). Stabilizing input and output prices could improve margins for dairy farmers in 2024, while EU dairy consumption could benefit from somewhat easing food inflation and remain stable overall.

Better weather, the stabilisation of input costs and improved farmer confidence is likely to boost Australian milk production.

In New Zealand, lack of rainfall due to El Nino has put pressure on feed availability and costs, particularly in the north island. Looking ahead, improved milk prices and better weather should boost production versus weaker comparables leaving expectations for 2024 in total moderately down.

According to Rabobank, the current recovery in market prices will be slower than they previously anticipated. This is because consumer demand is still lacking any sustained growth in most regions and with increased Chinese domestic production, Chinese demand for global product will also be disappointing. This perhaps leaves global markets nearer to a state of equilibrium for the year ahead.

You can now read the most important #news on #eDairyNews #Whatsapp channels!!!

🇺🇸 eDairy News INGLÊS: https://whatsapp.com/channel/0029VaKsjzGDTkJyIN6hcP1K