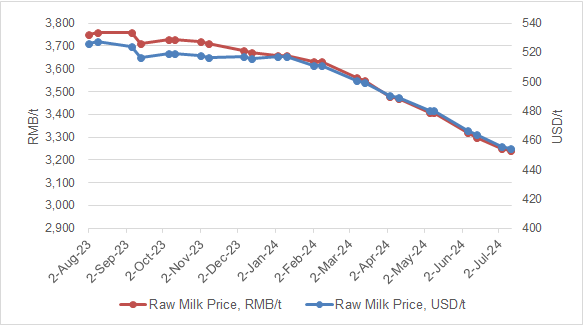

In the week ended 11 July, China’s raw milk price averaged USD454.6/t (RMB3,240/t), down 0.3% from the first week of the month and down 13.8% YoY.

-

- The national price of corn averaged USD363.4/t (RMB2,590/t), up 0.4% from the first week of the month but down 12.8% YoY; the average price in major production regions (Heilongjiang, Jilin and Liaoning) was up 0.4% to USD336.8/t (RMB2,400/t); and the price in the main demand area, Guangdong, up by 0.8% to USD376.1/t (RMB2,680/t) from the first week.

- The national price of soybean meal averaged USD508/t (RMB3,620/t), down 0.8% from the first week of the month and down 17.5% YoY

The problem of milk surpluses has become more acute in China. According to the National Bureau of Statistics (NBS), the national raw milk production in H1 2024 was 18.56 million tonnes, up by 3.4% YoY. A survey from the National Dairy Industry and Technology System has estimated that from April to May, the average spraying of raw milk by dairy firms reached 20,000 tonnes per day, accounting for 25% of the volume of raw milk traded, though the number dropped to 8,000 t/d in late June, representing 11% of the total raw milk traded in the month. By the end of June, total sprayed milk stocks held by large dairy manufacturers had reached more than 300,000 tonnes.

In May, for the first time since records began, the national average price of raw milk fell below the average production cost, with 80%+ of dairy farms reporting a loss. AustAsia Group Ltd. (Stock Code: 02425.HK), one of the dairying leaders, predicted a net loss of -USD84.2 million (-RMB600 million) to –USD98.2 million (-RMB700 million) in H1 2024, following the loss of –USD43.5 million (-RMB310 million) in H1 2023, mainly due to the decreases in its selling price of raw milk and dairy cows by 16% and 17% YoY, respectively.

Reference trading prices for raw milk in major regions in Q3/H2 2024:

- Shandong: USD421.0/t–USD519.2/t (RMB3,000/t-RMB3,700/t) in Q3

- Hebei: USD456.0/t (RMB3,250/t) in Q3

- Shanghai: USD575.3/t (RMB4,100/t) in H2 2024

- Sichuan: USD631.4/t (RMB4,500/t), with a minimum price of USD606.2/t (RMB4,320/t) in H2

Figure Trends in China’s Raw Milk Price, August 2023–July 2024

Source: Ministry of Agriculture and Rural Affairs of China (MARA)

Source:CCM

More information can be found at CCM Dairy Products China Monthly Report.

About CCM:

CCM is the leading market intelligence provider for China’s agriculture, chemicals, food & feed and life science markets. Founded in 2001, CCM offers a range of content solutions, from price and trade analysis to industry newsletters and customized market research reports. CCM is a brand of Kcomber Inc.

You can now read the most important #news on #eDairyNews #Whatsapp channels!!!

🇺🇸 eDairy News INGLÊS: https://whatsapp.com/channel/0029VaKsjzGDTkJyIN6hcP1K