The traditional top three European supply nations are holding steady on production. High pricing and exotic supply origins may be causing multinationals to adjust their AMF supply strategies. Fonterra’s WMP-focused pricing model could give it an edge over competitors who are investing in non-WMP assets.

Larger “Shoulder” Period Seen in Europe

While this milk season has been very weak again in France this year, the “shoulder” period of collections has bounced up compared with expectations.

The German season continues strongly. Although milk collections began to drop sharply at the end of June, they stabilized in July at levels broadly similar to those collected in July 2023.

The net result across the “big three” of Germany, UK and France is still somewhat flat. Through week 30 the year-to-date cumulative milk production is now down about 0.2% and making slight gains compared with the prior season.

The sugar beet crops across Eastern European countries are strong this season. For the first time in recent memory, white sugar has been delivered from Polish ports against the August settlement. This aligns very well to the strong milk flows that have already been seen from Eastern European nations through June. I am taking it as a lead indicator for milk production numbers to continue at above 5% year over year growth from the likes of Poland.

We are hearing that is more profitable to sell Skimmed Milk Concentrate (SMC) in Europe at present rather than dry SMP. This poses an interesting dynamic as ordinarily we would watch for a “bigger EU shoulder” than expected to be dried into powders that compete with the start of the Oceania milking season.

China Begins AMF Exports

We are hearing that some large multinationals are seeking to flex down to the lowest permissible AMF offtake volumes under their supply agreements. At the same time, we have been hearing of Chinese AMF being exported to Southeast Asian destinations at pricing allegedly USD 500 USD/tonne below GDT pricing.

I have been familiar with China drying surplus milk into WMP in recent seasons, however Chinese AMF at scale for export is a new concept to me entirely. This implies that at least in some regions there is sufficient capacity to justify optimization of milk into the stream with the highest valorisation – which has been SMP and Cream/Fat products for some time.

If China is making AMF, then the logical next step is that processors there did not make WMP (or at least made less than expected). If true, this will be welcome news to NZ based processors. Less local WMP stock in China means that imports will need to be larger and start sooner. This could support WMP pricing.

The combination of these effects could start to weigh on AMF pricing and thus the SMP/Cream product stream relative to WMP in New Zealand.

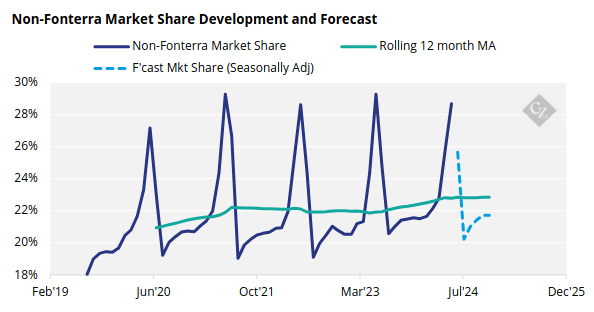

Non-Fonterra Collections Slip

June marks the start of the new milking season in New Zealand. Farmers have signed up to their processor of choice and will be looking forward to the season ahead. The latest milk collection figures for the month of June have now been reported by all dairy processors. However, numbers at this point of the season are close to meaningless, and a 2.17% drop in June this year versus 2023 is nothing to worry about.

The most interesting point to note is that after 19 straight year-over-year gains, the non-Fonterra group could not hang on to make it 20 gains on the trot. Collections for the group were down a surprise 4.11% as it reported its worst June in four years.

Fonterra reported relatively good production in the North Island in June so this may mean it has won some milk back from other processors. This would explain the 1% miss on market share by the non-Fonterra group in June. I will be watching closely as the milk flow begins to ramp up.

We are hearing that in general the key milking regions of the North Island have good grass covers, cows are in good condition and supplementary feed is available and affordable.

Total New Zealand milk production is still up just 0.2% through this Fonterra Financial Year. Given the immateriality of the remaining month to total collections, we expect to land somewhere around this mark for the 2023/24 Fonterra Financial Year.

New Zealand had a relatively warm July. Temperatures were 0.9°C above average nationwide. While drier than normal, it is still winter in New Zealand and soil moisture across the country is approximately average.

Fonterra Ahead of Competition

We have talked much of the new factories in Waikato that are set to make products other than WMP. Thus, the non-Fonterra group has an increasingly smaller production weighting to WMP when compared with Fonterra.

This is a subtle point but remember that the Fonterra Milk Price is still largely dictated by WMP– and the non-Fonterra group attempts to beat the Fonterra Milk Price each year. Fonterra is still structurally “short” WMP due to the construct of its Milk Price, but its competition is now even shorter WMP.

What does this mean? If the price of WMP goes up, the Fonterra milk price should go up faster than its competitors and vice versa. Let’s also remember that as its milk price goes down, Fonterra also has an easier run on EBIT and should be able to generate a higher dividend.

In short: it might become harder to compete with Fonterra at a farmgate level as more non-WMP assets are built by competitors.

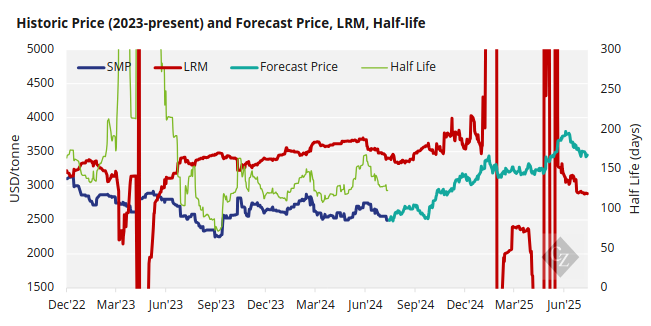

New LRM for SMP

Has mean reversion pulled WMP pricing upward? In the updated version of this article published by SGX at the start of August, our model had predicted that, in the absence of any other market shocks, we should see October SGX-NZX WMP trade at USD 3,335/tonne by September 29. At that time, it was at USD 3,105/tonne and as at time of writing this article it is back up to USD 3,250/tonne.

A look at NZ SMP from a mean reversion perspective shows that this has been trading below long-run mean since December 2022. If we zoom in more recently and include modelled values, the chart is quite ugly.

However, you can see an upward pull on the forecasted prices for SMP as well. No matter how many times I run the model, it seems that there will be a new long-run mean informed from January to July 2025 for SMP, with this eventually settling at around USD 2,900/tonne from July 2025.

It seems an unpopular and unlikely opinion, but if demand is strong and there is not a huge European SMP overhang expected, then perhaps we can start building a case for SMP pricing to find a bottom and start firming soon.

Asian GDT Demand Strong

Chinese and Southeast Asian demand in GDT event 361 was strong and the WMP index moving up was a surprise to many (but not to mean reversion!) Chinese WMP buying was the highest it has been since December 2023 and Southeast Asia was not far behind in terms of volume purchased.

Reuters reported a cutaneous anthrax outbreak on a Chinese beef cattle farm on August 6 (which was the date of the latest GDT event). This seems to be isolated, but I will include it in this section. Could the timing of this have sparked any early safety import buying?

The rumour mill is spinning, and I report this last Market Intel comment as a rumour only: apparently all Chinese GDT Resellers were offered a 30% freight discount for any GDT purchases made during the next three months.

If true, this could be a USD 15-25/tonne freight saving. While this is an immaterial amount relative to dairy product pricing, if GDT is the cheapest place to buy Oceania origin product and the freight for this just got cheaper than any other freight, would that encourage you to buy?

You can now read the most important #news on #eDairyNews #Whatsapp channels!!!

🇺🇸 eDairy News INGLÊS: https://whatsapp.com/channel/0029VaKsjzGDTkJyIN6hcP1K