RaboResearch’s annual Global Dairy Top 20 report reveals a year of modest gains and strategic shifts within the dairy sector.

The report, which analyzes the financial performance of the world’s leading dairy companies, indicates a slight 0.3% increase in combined turnover in US dollar terms, a stark contrast to the previous year’s 8.1% growth.

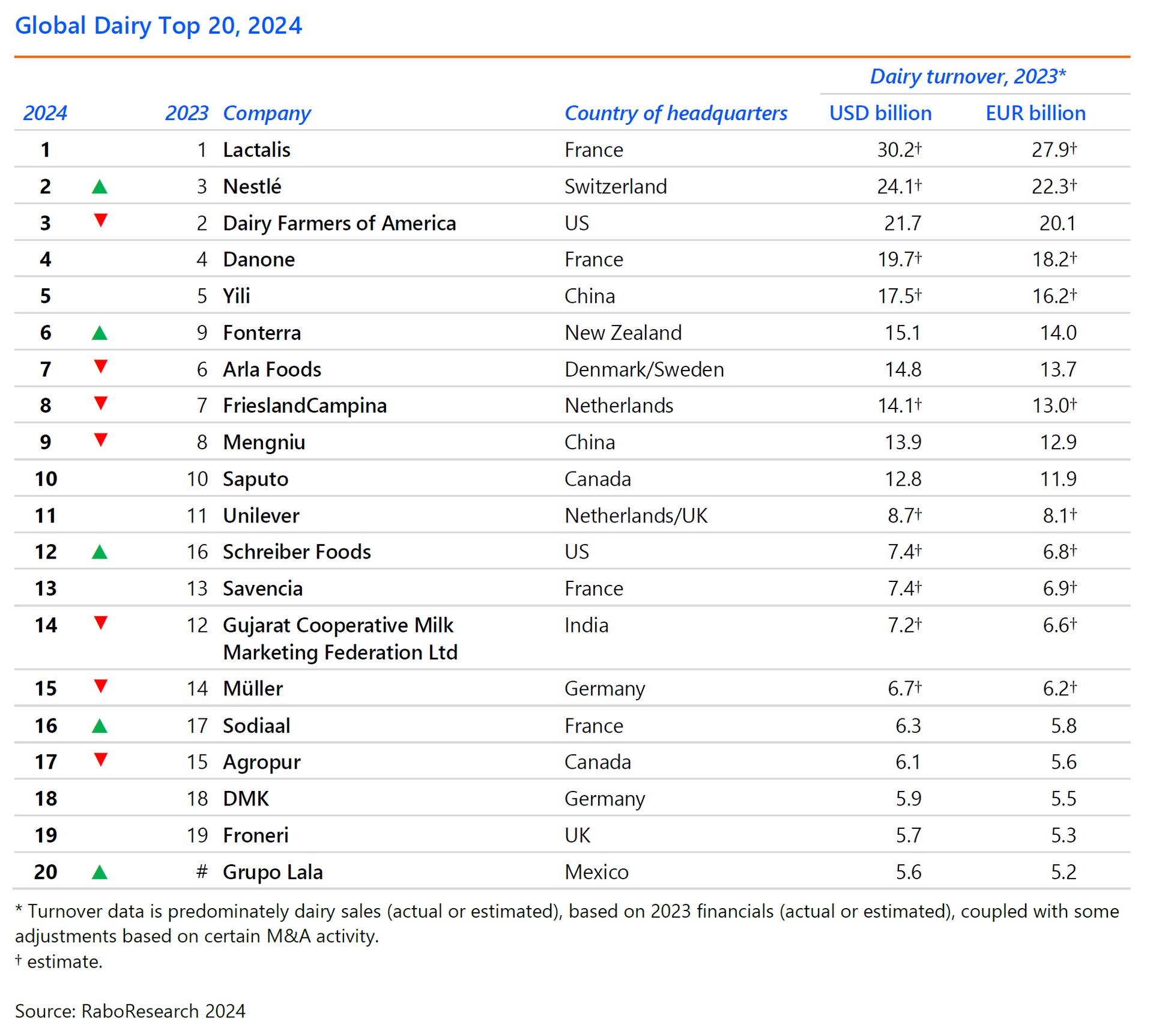

Lactalis remains No. 1, followed by Nestlé and Dairy Farmers of America. Fewer than half the companies listed maintained the same position as last year. FX developments continue to impact the overall rankings, and limited M&A activity was again a key theme this year.

Lower commodity prices dampen revenue growth

The report attributes the deceleration in revenue growth to lower milk prices in 2023 compared to the robust values seen in 2022. This trend particularly affected European cooperatives, and seven companies worldwide reported lower revenues in their local currencies. Despite this, many companies have managed to report stronger profits and margins than in the previous year.

Lactalis keeps No. 1 spot, achieving record revenue

France’s Lactalis kept its top spot in the ranking for the third year. It became the first company ever to exceed USD 30bn in annual dairy-related revenue, an accomplishment that follows several years of significant revenue expansion through organic growth and acquisitions. Nestlé came in second on the list, swapping spots with Dairy Farmers of America, largely due to weaker milk prices.

Grupo Lala makes Top 20 debut

In a notable development, Mexico’s Grupo Lala secured a position in the Global Dairy Top 20 for the first time, thanks to favorable foreign exchange (FX) developments and 6% organic revenue growth in Mexican peso terms. The strengthening of the Mexican peso against the US dollar by 11.8% played a significant role in Grupo Lala’s ascent, displacing Ireland’s Glanbia from the list.

M&A activity remains subdued

The dairy industry continues to experience limited merger and acquisition (M&A) activity, with Danone’s divestment of its Russian business and the shedding of its Horizon Organic and Wallaby brands being notable exceptions. These strategic moves reflect a broader industry trend of companies refocusing on their core businesses.

Upcoming deals signal a changing landscape

The report highlights a potential shift in the industry’s dynamics, with at least two significant deals on the horizon that could reshape the Global Dairy Top 20 rankings.

Unilever’s planned divestment of its ice cream business and Fonterra’s decision to shed its consumer business are indicative of a strategic pivot toward core operations, with sustainability considerations playing an increasingly important role.

US dairy companies focus on internal growth

In the US, companies are focusing on internal growth rather than acquisitions, with over USD 7bn planned for new plant construction and expansions from 2023 to 2026, mainly in cheese production. Milk production is expected to grow again in 2025 after three years of stagnation.

This trend contrasts with other regions where plant closures are more common due to limited milk production growth. Significant investments by US dairy companies and foreign firms with US facilities could lead to revenue growth and changes in the Top 20 rankings.

You can now read the most important #news on #eDairyNews #Whatsapp channels!!!

🇺🇸 eDairy News INGLÊS: https://whatsapp.com/channel/0029VaKsjzGDTkJyIN6hcP1K