Dairy Outlook: Mexico purchases more than 25% of all U.S. dairy exports.

With feed margins improving for U.S. dairy farmers and the potential to see solid returns for producing milk, many in dairy circles are asking, “What does 2025 hold for U.S. dairy?”

“U.S. dairy has certainly entered a unique moment in time,” says Corey Geiger, lead dairy economist for CoBank. “On one hand, there’s strong belief that U.S. dairy will be a growth industry globally, as nearly $8 billion in new dairy processing assets will be coming on line by 2026. This fall, the first of three large cheese plants has already started to make cheese.”

More cheese production

By the middle of 2025, Geiger says there could be nearly 20 million pounds of new milk flowing to those new plants located in the southern Central Plains and Southwest. That means there also will be a lot more cheese seeking a new consumer home, and exports will be a major destination for those dairy products.

“But, on the other hand, the U.S. election took place, and a new administration will be in the White House in January,” Geiger says. Topics such as tariffs, immigration and deportation came up frequently on the campaign trail, and action on these topics could impact future trade opportunities, he notes.

“How this situation unfolds in the new year is anyone’s guess,” he says.

“We know for certainty that dairy exports definitely matter to U.S. dairy farmers and processors. These days, 16%, or 1 in 7 tankers, of milk gets turned into dairy products destined for customers around the globe,” Geiger explains.

While China was the top purchaser of U.S. agricultural products at $34 billion in 2023, Mexico and Canada tied for second place in a near photo finish at $28 billion each in 2023, according to USDA trade data.

“Mexico is by far America’s top dairy product customer, and that relationship has grown considerably since the signing of the U.S.-Mexico-Canada Agreement that replaced the long-standing North American Free Trade Agreement,” Geiger says.

In 2023, Mexico purchased $2.32 billion in U.S. dairy products. That represented one-fourth of all U.S. dairy exports, according to data from USDA’s Foreign Agricultural Service. By contrast, China, a top three U.S. dairy customer, purchased $607 million of U.S. dairy products. For the U.S., the China dairy export market was just 26% of the size of Mexico in 2023.

Even though China is the world’s largest dairy product importer, New Zealand is its largest supplier. The U.S. is Mexico’s largest supplier, and that relationship has grown considerably in 2024. By September, Mexico’s purchases grew to 29% of all U.S. dairy product exports, according to data from USDA-FAS. Overall, the U.S. supplied Mexico with over 80% of its imported dairy products.

What’s happening near term?

This September, U.S. dairy exports increased 8.5% on a milk solids basis compared to other countries across the globe, Geiger says. Mexico’s stepped-up purchases have been important in this growth, as exports to the country were up an impressive 23% on a year-over-year basis in September.

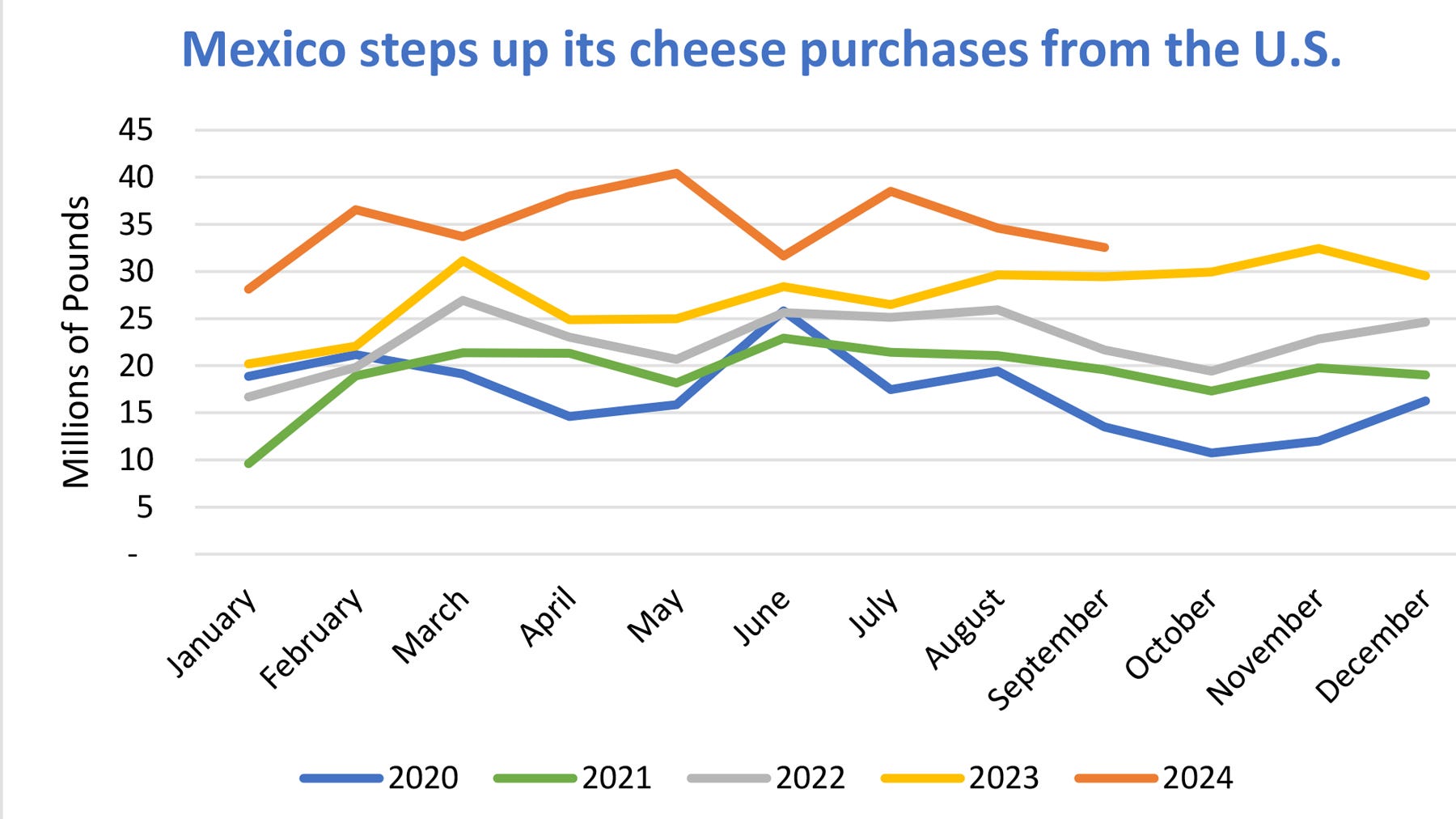

“One big growth area has been cheese,” Geiger says. “Overall, U.S. cheese exports have climbed by 19% to 853 million pounds globally from January to September 2024 when compared to the previous year. However, Mexico has exceeded that growth in a major way. Through September, U.S. cheese exports to Mexico have totaled 314 million pounds, for a 32.4% growth rate through the first nine months of 2024.”

Overall, Mexico has purchased 37% of all U.S. cheese sold to international customers so far this year. The cheese story isn’t a flash in the pan either, Geiger points out, as cheese exports to Mexico grew 17.9% in 2022 and 15.4% in 2023 when comparing the first nine months of those years.

“While cheese has been an impressive story that continues to unfold, nonfat dry milk and skim milk powder was the largest category at 793 million pounds exported in 2022, and moved to 919 million pounds last year, according to U.S. trade data,” Geiger says. “Mexico purchased 51.5% of all U.S. nonfat dry milk and skim milk powder exports.”

What to expect in the future

Looking to the future, Mexico has a strong demand for dairy because it faces a dairy product deficit ranging between 25% and 30%. From 2011 to 2023, per-capita dairy product consumption grew by 50 pounds of milk equivalent in Mexico, moving from 244 pounds to 293 pounds.

By way of comparison, the U.S. market growth mirrored Mexico by improving 50 pounds per capita, growing from 603 pounds to 653 pounds from 2011 to 2023. On a percentage basis, Mexico’s per-capita consumption grew 20% during that 12-year window while the U.S. consumer market moved 8.3% higher.

“Dairy product sales have upside potential as more Mexican consumers enter the middle class and seek higher-quality proteins and fats,” Geiger explains. “To that end, Mexico’s average citizen consumes just 45% of the dairy products of the average American. It’s important to note the comparisons in these examples are on a fluid basis. That liquid milk then is sold as beverage milk or is manufactured into cheese, nonfat dry milk or other dairy products.”

You can now read the most important #news on #eDairyNews #Whatsapp channels!!!

🇺🇸 eDairy News INGLÊS: https://whatsapp.com/channel/0029VaKsjzGDTkJyIN6hcP1K