The Australian dairy industry is in many ways sitting in a vastly different position compared to last season.

The December 2024 Situation and Outlook report highlights that on-farm profitability remained strong in the 2023-24 season.

Since then, farm gate milk prices have lowered, while increasing margin pressure for dairy farming businesses, the price competitiveness of Australian dairy products has improved.

This has coincided with export conditions strengthening, domestic retail sales recovering, and increased milk production finding homes in both markets.

Data from the Dairy Farm Monitor Project (DFMP) indicates that operating costs were high during the 2023-24 season, while farm gate milk prices were slightly lower than the previous season in most regions.

Weather played a significant role, benefiting some farmers while impacting others.

Drier regions saw feed inventories heavily utilised, contributing to rising fodder prices.

With the 2024-25 season under way, many farming businesses are expecting lower returns due to lower farm gate milk prices and rising interest and lease costs.

Cost pressures have eased for some farm inputs, although higher prices persist for others, particularly due to weather-related impacts in Australia.

Milk production in Australia has grown compared to last season, although ongoing dry conditions in several regions may limit further growth, in addition to existing challenges.

National milk production increased by 1.3 per cent year-on-year in October.

Considering the mounting weather and financial constraints this season, longer-term challenges around labour and farm exits, and modest milk production recovery during the 2023-24 season, further growth may be muted this season.

As such, Dairy Australia continues to forecast a slight drop in the national milk pool (relative to the previous season, to 8.3 billion litres) in 2024-25, with potential to steady on account of better-than-expected rainfall.

The price competitiveness of Australian dairy products has improved, coinciding with more favourable export opportunities.

The availability of Australian exportable product tightened this season, as uncertainty around dairy export returns and past seasons of import pressure readjusted the focus of many Australian manufacturers towards higher specification product, and the domestic market.

However, shipping challenges along key trade routes have steadily increased demand towards Oceania dairy, in addition to tighter milk supplies and elevated export prices in the Northern Hemisphere.

Additional inquiries have been surfacing from buyers across South-East Asia and the Middle East, and purchasing activity from Chinese importers has increased over recent months as local milk production slows and product stockpiles lessen.

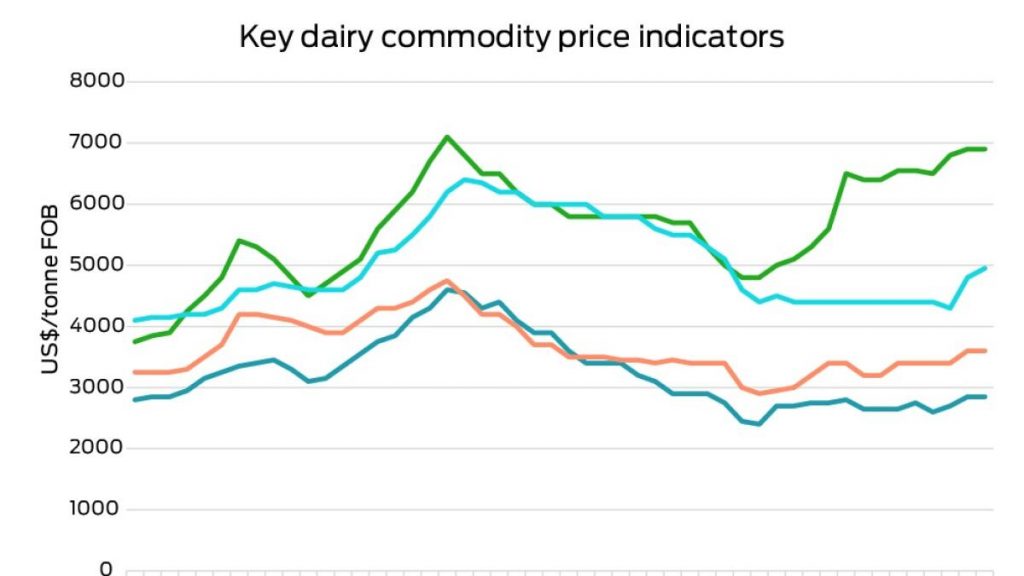

Accordingly, prices of product sold on the GlobalDairyTrade platform and in Australia have risen, particularly for butter, where indicative prices are sitting just shy of 2022 peaks.

Nonetheless, the export market maintains its underlying challenges; buyers in most key importing countries remain price sensitive and economic constraints in China are persistent.

Furthermore, developing geopolitical conflicts and trade dynamics (such as those proposed by the incoming US administration) will continue to influence global markets.

Local market conditions have improved for Australian dairy products as well, with the volume sold of cheese, dairy spreads and yoghurt in retail all increasing, while milk holds steady.

However, value growth in key dairy categories is under pressure from renewed discounting of retail prices for private label dairy.

The comparatively high international prices are considered likely to deter Australian-based importers, suggesting Australian dairy should remain competitive in domestic markets.

The Australian dairy industry has been well placed to capitalise on export opportunities thus far this season, while focusing on regaining domestic market share.

However, challenges remain; geopolitical and trade flow uncertainty looms overhead, while pressure on retail prices signal a potential shift in domestic market conditions.

Although aiding Australia’s realignment to global markets, lower farm gate prices will create financial pressure for some farming businesses this season.

Eliza Redfern is Dairy Australia’s analysis and insights manager.

You can now read the most important #news on #eDairyNews #Whatsapp channels!!!

🇺🇸 eDairy News INGLÊS: https://whatsapp.com/channel/0029VaKsjzGDTkJyIN6hcP1K