The Australian dairy industry has experienced significant change since the profitable 2023/24 season. According to the Dairy Australia December 2024 report, farm margins have been pressured by lower farmgate prices and higher operating costs.

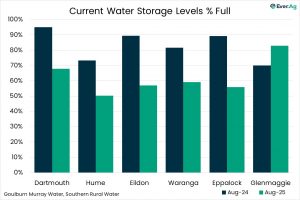

Milk production in Australia grew during the 2023/24 season, supported by strong farmgate prices. 2024/25 volumes saw some year-on-year growth in the first half, but as the season progresses, a slight drop is expected overall, as dry weather conditions and tighter margins challenge further growth.

Whilst some input prices have decreased, dry weather conditions during the 2024/25 milk season contributed to a rise in fodder and water prices pressuring margins.

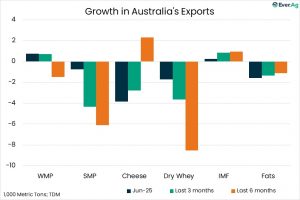

Australian dairy has been well placed to capitalise on trade opportunities so far this season and has become more price competitive. Shipping challenges along other trade routes has improved the market for Oceania dairy, coupled with tighter milk supplies in the northern hemisphere. However, economic restraints in key importing countries, namely China, have persisted.

The domestic market remains robust, though a rise in domestic retail prices may shift demand in the coming months.

You can now read the most important #news on #eDairyNews #Whatsapp channels!!!

🇺🇸 eDairy News INGLÊS: https://whatsapp.com/channel/0029VaKsjzGDTkJyIN6hcP1K