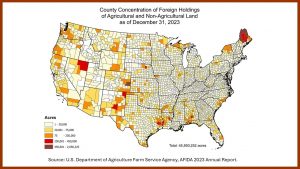

Environmental temperature and humidity levels used to indicate likely heat stress.

LANSING, Mich. — Economic losses due to heat-stressed dairy herds are estimated to exceed $1.5 billion a year, “in large part because of the Holstein’s intolerance for heat,” according to Cornell University researchers. That research found heat stress impacts milk quality and production, with losses beginning to occur at 75 degrees Fahrenheit, ranging from 30% to 70% in extreme weather scenarios.

Similarly, a 2023 University of Minnesota study found a loss of milk production ranging from 2.5 pounds to more than 10 pounds per head per day in extreme heat stress events.

Fortunately, Michigan dairy producers now have an option, beyond sprinklers and fans, to manage the financial risk of lost milk production due to higher average temperatures and more intense, longer lasting heat waves during the summer months.

Farm Bureau Insurance has partnered with AIR Parametric, Inc. to offer Michigan dairy producers access to “Milkshake” — a heat stress insurance product for 2025, according to Kevin Robson, sales director for Farm Bureau Insurance of Michigan.

Following a successful launch in 2024, the innovative solution will now be available to Michigan dairy producers to minimize the significant financial impact.

Originally designed to protect farmers from prolonged seven-day heat stress events, enhancements for 2025 include options for shorter, more frequent three-day and five-day events, based on elevated “Temperature-Humidity Index” or THI levels.

THI is a well-studied weather metric that combines environmental temperature and humidity levels to provide an indication of the likelihood of heat stress among dairy cattle.

“The crop insurance team is always looking for more avenues to help farmers mitigate risks,” Robson said. “Farm Bureau is excited to be the only insurance provider in Michigan to offer this innovative risk protection tool.”

AIR Parametric is a specialty insurance provider delivering parametric insurance solutions for businesses affected by lost revenue due to extreme weather events, according to AIR Parametric, Inc. CEO and Co-Founder Jamie Luce.

Milkshake provides dairy farmers compensation for lost production and higher expenses during elevated THI periods using farm-specific dairy production data mapped against over 50 years of weather experience to ensure it provides coverage for economic losses from extreme heat events.

Utilizing AIR Parametric’s leading weather data, geospatial and AI technologies, and 24/7 weather monitoring, Milkshake ensures transparency and immediacy while dramatically simplifying the insurance process for customers, according to Luce.

“Listening to farmers and their insurance advisors is a key part of our product development,” said Luce. “This broader coverage addresses more extreme heat events, further enhancing Milkshake’s value to dairy producers.”

“Parametric” insurance, also known as index-based coverage, is based on predetermined weather-triggers, in this case THI levels, which are established in advance, as reported and verified by an independent third-party.

When a triggering event occurs, policyholders receive a predefined payout.

According to AIR Parametric head of product development Ed Yorty, Milkshake relies on weather data provided by the European Centre for Medium-Range Weather Forecasts (ECMWF), an international weather monitoring body as “an independent third-party record of the weather.”

Leveraging AIR Parametric’s advanced weather data, engineering expertise, and machine learning capabilities, Yorty said Milkshake tailors coverage to a customer’s location by identifying unique weather triggers.

“Parametric insurance remains an underutilized tool for businesses looking to mitigate the growing risks of extreme temperatures and weather events,” Yorty said. “This approach enables us to focus our technical expertise on creating solutions that truly address customer needs.”

For dairy producers with existing sprinkler and fan cooling systems, which only restore about 60% of lost milk production, Farm Bureau Insurance of Michigan Crop Insurance Specialist Matt Thelen says the protection offered though Milkshake is still a great fit.

Noting electricity, fuel and water aren’t getting cheaper, Thelen said Milkshake insurance coverage can compensate for higher-than-normal operating costs during a THI triggering event, since payments are triggered due to actual production loss or increased operating expenses.

“For dairy farmers considering protection from heat stress, we are able to provide historical data specific to their farm location, indicating the number of weather events that would have triggered a loss in years past,” Thelen said.

“Access to this data will help dairy producers to see the value of the product and determine if the additional coverage makes sense for their operation.”

For additional information, producers should contact their crop insurance agent, including one of the following Farm Bureau Crop Insurance Specialists or multi-line agents for assistance before the early binding window ends April 30, 2025, for coverage beginning on May 1, 2025. After this date, coverage will be dependent on the near-term weather outlook.

Farm Bureau crop insurance specialists

- Ryan Fox, West, 269-313-5566

- Marc Erffmeyer, Southwest, 269-569-1039

- Marc Reinhardt, Bay-Thumb, 989-450-4851

- Adam Reinhardt, Bay-Thumb Specialist, 989-553-2026

- Nate Gust, Southeast, 517-605-1076

- Brenda Szach, Northern, 989-329-7290

- Matt Thelen, Central, 989-640-0570

Multi-line Agents

- Brent Leininger, Hillsdale, 517-437-7619

- Marty Rudlaff, Berrien Springs, 269-473-4791

- Duane Simpkins, Gladwin, 989-426-8131

- Jack McPhail, Croswell 810-679-9801

— Dennis Rudat, Michigan Farm Bureau

You can now read the most important #news on #eDairyNews #Whatsapp channels!!!

🇺🇸 eDairy News INGLÊS: https://whatsapp.com/channel/0029VaKsjzGDTkJyIN6hcP1K