Ag Land Values Remain Surprisingly Resilient, Fueled by Low Supply, Strong Investor Demand, and High-Value Sales in Key Regions.

Despite a significant tumble in commodity prices, farmland values across key regions of the United States are holding firm, a trend that is challenging conventional dairy economics. According to Jay VanGorden of Farmers National Co., this resilience is due to a combination of factors, including a sharp 25% reduction in the supply of land on the market since 2023 and strong demand from both farmers and investors. This data points to a market that is fundamentally different from a few years ago, with buyers valuing land as a stable, long-term asset.

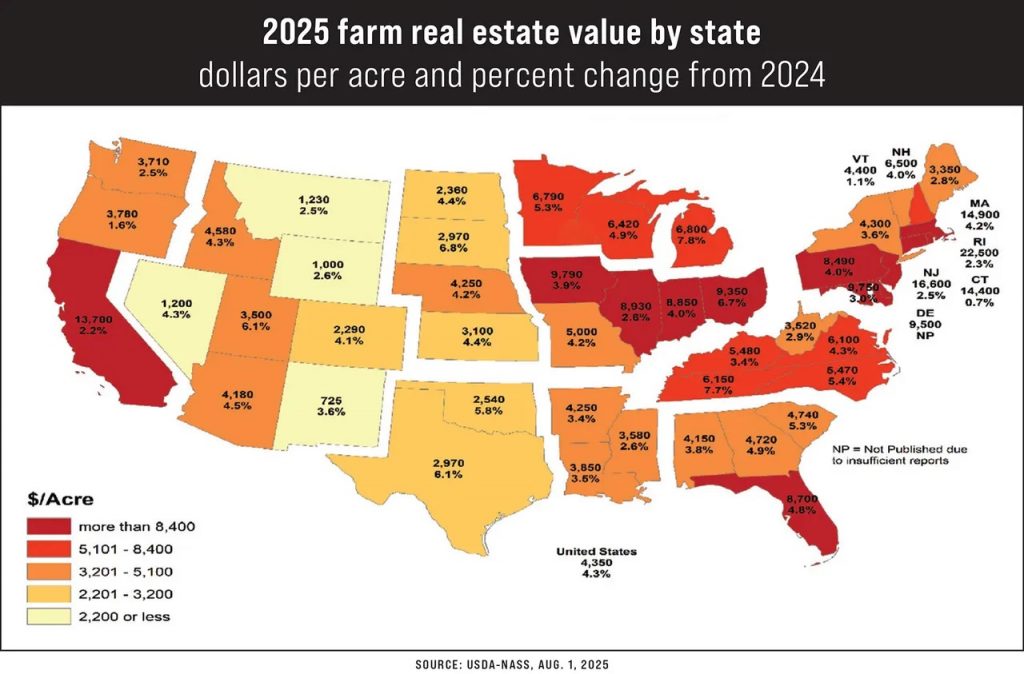

Recent sales and official reports underscore this surprising trend. The USDA Land Values Report indicates that Michigan farm real estate, which includes both land and buildings, saw a 7.8% increase to $6,800 per acre—the highest percentage increase in the nation. Ohio followed closely with a 6.7% jump to $9,350 per acre. Individual sales in top-tier areas were even more impressive, with a farm in Madison County, Ohio, fetching a staggering $19,200 an acre, highlighting the premium placed on highly productive and tillable land.

Farther east, in states like Pennsylvania, a different but equally robust trend is emerging. Dustin Prievo of Whitetail Properties notes that smaller farm parcels, specifically those between 10 and 30 acres, are in exceptionally high demand. These parcels are selling quickly and often for over their listing price, driven by both farmers and non-farmers who find these sizes more affordable. The value of land in prime locations like Lancaster County is so high, ranging from $18,000 to $35,000 an acre, that it is compelling some landowners to sell and relocate to more affordable areas.

The continued strength in land values is heavily influenced by investor interest. The article highlights that many investors are seeking to diversify their portfolios by owning land, which is seen as a more tangible and stable asset compared to the stock market. With an annual cash return of 2% to 3.5% and long-term appreciation, farmland has a track record of performing comparably to the Dow over a 50-year period, but with less volatility. This strategic insight is a crucial piece of data journalism for the entire agribusiness sector.

Ultimately, the market is becoming highly segmented. While top-quality farms with a high percentage of tillable land and productive soil types are selling for near-market highs, farms with fewer tillable acres or lower-quality soils are being priced 10% to 20% below their peak values. The demand for smaller, more affordable parcels also suggests a new dynamic is at play, as the market adapts to evolving buyer preferences and financial realities, making it a truly “interesting market,” as one expert described it.

Source: Farm Progress: Farmland values hold steady despite commodity price drop

You can now read the most important #news on #eDairyNews #Whatsapp channels!!!

🇺🇸 eDairy News INGLÊS: https://whatsapp.com/channel/0029VaKsjzGDTkJyIN6hcP1K