With Northern Hemisphere Dairy Supply Tight, All Eyes Are on New Zealand’s Spring Production to See What Impact It Will Have on Global Dairy Export Prices.

As the global dairy market enters the Southern Hemisphere’s peak production season, all attention is fixed on New Zealand’s spring output and its potential influence on export prices. While North American supply has tightened due to various challenges, a recovering global demand, particularly in Asia, has provided support for dairy prices. The interplay of these forces sets the stage for a critical period in global dairy economics.

Global supply signals have been mixed across major producing regions. In the United States, milk production is on the rebound, up 3.3% in June, thanks to rising cow numbers and improved yields following last year’s avian influenza outbreak. Conversely, Europe is facing more significant challenges from a bluetongue outbreak and drought conditions, which are weighing on milk volumes and raising long-term concerns about replacement heifers.

New Zealand, however, is bucking the trend. Favorable weather conditions, especially on the South Island, are supporting strong pasture growth, leading to a surge in milk volumes, up 14.6% year-on-year. This increase is a direct result of strong farmgate prices incentivizing supplementary feeding. While rising volumes on the GlobalDairyTrade (GDT) platform have put some pressure on prices, strong purchasing interest from key export markets is helping to limit a sharp decline.

While China has maintained stable import volumes, it has specifically increased its purchases from New Zealand by 6%, opting to import less from the Northern Hemisphere. Other Asian markets, like South-East Asia and Japan, have also shown robust demand, with import volumes increasing by 3.3% and 4.3% respectively. This strong demand for Oceania dairy is proving to be a critical factor in supporting export prices.

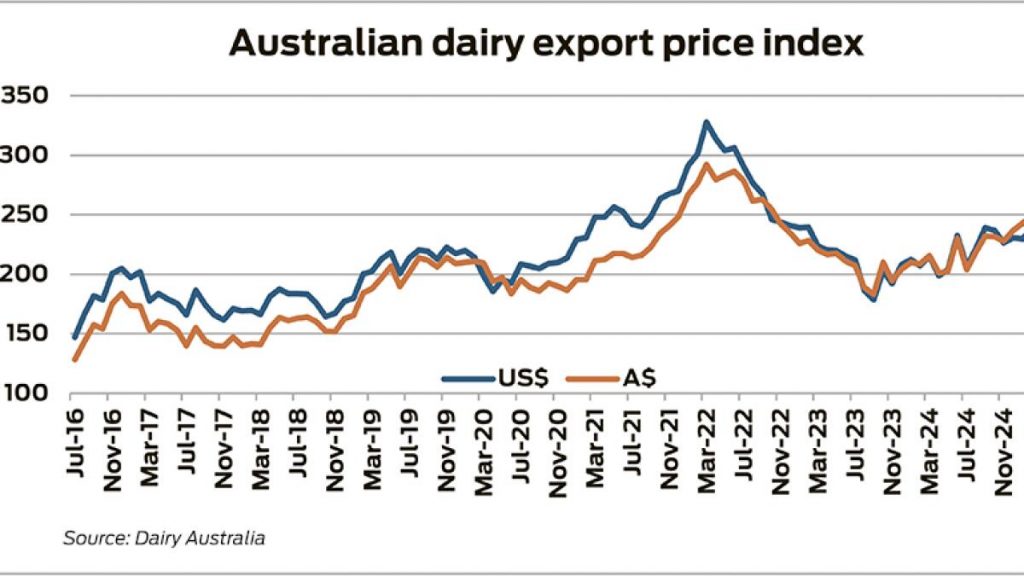

For Australia, the global market’s tightening supply and robust demand for Oceania product is providing welcome price support. However, local challenges, including high operating costs and a shrinking herd, are expected to weigh on spring volumes. Dairy Australia forecasts a 2% drop in national milk production in 2025-26. This dynamic underscores the complex and interlinked nature of global agribusiness, where regional challenges and opportunities impact the broader market.

Source: Dairy News Australia, “All eyes are on NZ as spring arrives”

You can now read the most important #news on #eDairyNews #Whatsapp channels!!!

🇺🇸 eDairy News INGLÊS: https://whatsapp.com/channel/0029VaKsjzGDTkJyIN6hcP1K