Why are Milk Prices Low When Butter and Butterfat are at Record Highs?

|

| Chart I – Butter Price |

|

| Chart II – Class III Milk Price |

This blog deals primarily with factual analytical data about the dairy industry. However, there are few posts about the formulas that play an important part in the analytics. The reason is simple, most readers do not want to read about formulas. While low readership is expected for this post, it will review some of the formulas not covered in detail in prior posts to this blog.

The first formula to be reviewed is the butterfat pricing formula. As shown below, it is strictly based on the the price of butter. The butter price is reduced by $.1715, the cost of churning butterfat into butter, and multiplied by 1.211 to adjust for the yield of butter from butterfat as water and other items are added to the butterfat.

Butterfat Price = (Butter Price – $.1715) x 1.211

|

| Chart III – Butterfat rises in value as Butter Increases in Value |

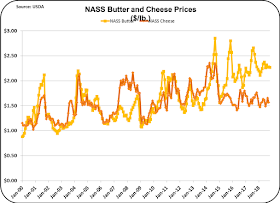

However, at today’s butter and cheese prices shown in Chart IV, butterfat is more valuable when it is used in butter than in cheese.

|

| Chart IV – Butter and Cheese Prices Since 2000 |

If the formula presented above for protein pricing was collapsed to its simplest terms, it would look like this:

|

| Chart V – When Butter Prices Increase, Butterfat goes up and Protein Goes Down |

So, as long as cheese prices stay low, producer milk prices will remain low.

A producer can make more money if he increases the amount of butterfat or milk protein, but if the only thing changing is the butter price, revenue will be shifted more toward butterfat than protein, but the overall milk price will not be significantly changed.

The U.S. dairy industry is in an unusual period where cheese inventories are high, causing low cheese prices, while butter inventories are low, causing high butter prices. As we enter into 2019, there are no apparent trends to change this. Unless there are some changes in inventory levels, low milk pricing will continue while butter and butterfat remain high priced.