The information coming out from Fonterra senior management is predictable given the straits they have got themselves into.

And, given the demise of the Westland Co-op it is even more important that Fonterra survives and provides a benchmark for producers to gauge their processors performance.

So, a back to basics approach and ring the wagons is understandable, however, the press release by Chairman Monaghan did bring back memories of the 1980’s when New Zealand started off its fire sales to balance the books. Is it naïve to expect farmers to gain a premium for “sustainability and provenance” when their product is increasingly going to be buried under a 3rd party brand.

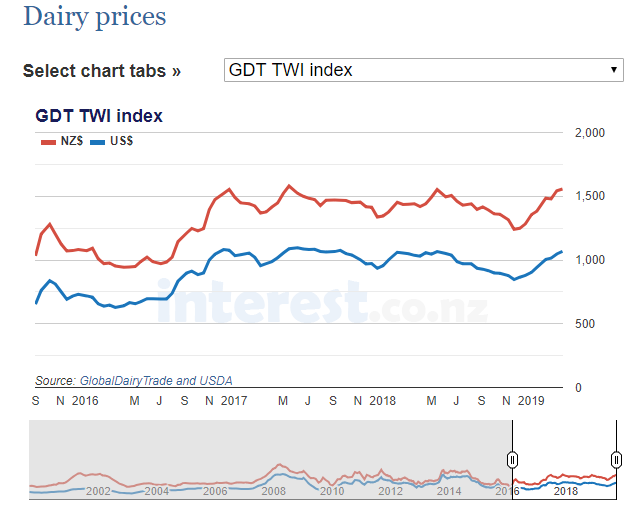

The auction system be it wool or the GDT is useful for disclosing a market price, but they do not necessarily do anything to help lift price, many would argue the reverse is true.

Fortunately, at the moment the GDT is continuing to move in the right direction with another lift. Over all products prices went up +1.9% and WMP +4%. So short term the concentration on meeting the commodities price seems to be a winner. However, I can’t help but feel this approach will leave Fonterra languishing in the dust as the other International companies continue to grow probably with the help of New Zealand raw products.

Harking back to the 80’s selling Inlaca for a $126 million loss if ever a company was going to be sold below its true value it would have to be selling now in Venezuela. History may prove it was the prudent thing to do but with the loss incurred does make one wonder at what the risk of holding on given that the market must at or close to the bottom of the cycle. Initially through the NZDB Fonterra has held a ’relationship’ with Inlaca since 1999 so it is a different fish to the Beingmate investment. Sold for a mere $16 mln provides the new owner with considerable potential upsides given that prior to the political unrest being experienced Inlaca had an annual revenue of around US$125 million. If concentrating on “core” business means giving away Fonterra’s international investment I have concerns at the sell at all costs strategy because to buy back into established markets is going to take considerably more than $16 m. As Keith Woodford has pointed out, the $80 mln half year profit does not include the $126 mln write down and the $16 mln is not going to make any sizeable inroads.

So, if this is the trend for future sales then shareholders shouldn’t be holding their breath for a major second half turn-around.

It seems Fonterra is developing a habit of compounding its mistakes with the fire sale approach being taken.

Tip Top which is next off the block, as far as we know, has apparently been suffering from underinvestment over the years and so it is unlikely any premium is going to be achieved there, especially as when ice cream prices at supermarkets are perused Tip Top sits near the bottom of the range with only the ‘house’ and budget brands lower. Let’s hope that Fonterra does not go the way of Polaroid, once a world leader in innovation because of its lack of ability to evolve it is now relegated to the shelves of memorabilia.

A comment made from some-one nearby;

“So, they (Fonterra) are abandoning any pretence of taking signals from customers/consumer, going back to the idea that people will want what they make. “Provenance”, “heritage”. This is very old-school. Customers-last strategy. Hard to see it working out for them.”

Synlait have released their half year 2019 result with Net Profit after tax down nearly -10% from the same time last year and now sitting at $37 mln ($41 mln HY-2018). The reduced margin is stated to be due to a result of the new pricing agreement entered into with The a2 Milk Company™ last July. Still at nearly 50% of the Fonterra return and with a value approaching $2 bln compared to Fonterra’s $13 bln or thereabouts, the result is largely due to the added value component and it is a stark difference.