World milk production in 2018 expanded a bit slower than it did in 2017, rising by 2.2 percent (compared to 2.4 percent in 2017). The year-on-year increase was largely due to higher dairy herd numbers as well as continued improvements in milk yield and collection processes.

Meanwhile, world trade in dairy products rose by 2.9 percent in 2018, with Skim Milk Powder registering the biggest expansion, followed by butter, Whole Milk Powder and cheese. International dairy prices, measured by the FAO Dairy Price Index, fell by 4.6 percent in 2018, as large export availabilities exerted downward pressure on prices during the second half of the year.

Overview of global dairy market developments in 2018

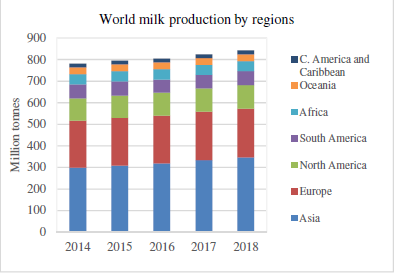

Global milk output in 2018 is estimated at 842 million tonnes, an increase of 2.2 percent from 2017, driven by production expansions in India, Turkey, the European Union, Pakistan, the United States of America and Argentina, but partially offset by declines in China and Ukraine, among few others.

This increase has come about as a result of higher dairy herd numbers along with improvements to milk collection processes (India and Pakistan), efficiency improvements in integrated dairy production systems (Turkey), increased yield per cow (the European Union and the United States of America) and enhanced utilization of idle capacity and higher demand from the processing sector and imports (Argentina). Milk output declines largely stemmed from industrial restructuring processes and downscaling of small-scale farms (China) and reduced producer margins and farmgate prices (Ukraine).

Across the regions, Asia registered the highest milk output expansion by volume in 2018, followed Europe, North America. Milk output expanded in all other regions too, but by smaller volumes.

World exports of dairy products1 expanded to 75 million tonnes (in milk equivalents), an increase of 2.1 million tonnes, or 2.9 percent from 2017, principally coming from the United States of America and Argentina, but also India, Uruguay, and Mexico. By contrast, exports declined in a number of countries, in particular in the IslamicRepublicofIran.

Across the main dairy products, in 2018, SMP registered the highest export expansion (+8.6 percent), followed by butter (+7.5 percent), WMP (+1.7 percent) and cheese (+0.8 percent). As for milk powders, consisting of SMP and WMP, export availabilities were abundant from almost all major international suppliers. Large stocks of SMP, held by the European Union, the United States of America and India, also contributed to elevate global supply availabilities. SMP stocks of the European Union, given their age, were mostly considered less suitable for human consumption. In addition to immediate human consumption in the form of milk, powders were also in high demand from food processors and manufacturers,boosting import demand from some countries such as Mexico.

The complet Report here: ca3879en