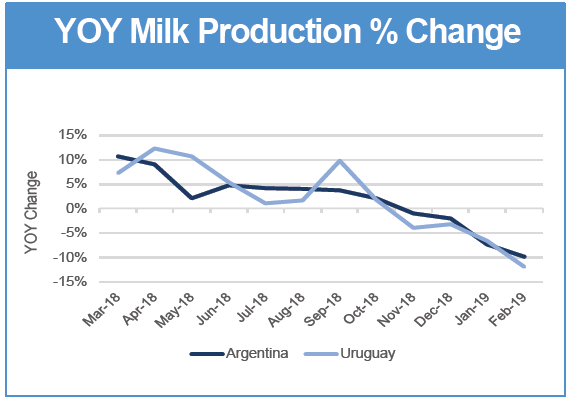

Although the challenges these nations faced in early 2019 were well known, their impact was more severe than originally expected, causing a larger-than-anticipated milk production contraction in both Argentina and Uruguay.

In Argentina, year-to date milk production was running 8.5% behind the prior year at the end of February. Most of the decline can be blamed on prevailing weak economic conditions in the broader economy. High inflation and an important currency devaluation in late 2018 created issues for dairy farmer profitability, even as milk prices steadily climbed in local currency terms. In an effort to compensate for tough farm economics, many farmers reduced feeding of supplementary concentrates, which further reduced output.

Across the river in Uruguay, performance has been similar, with cumulative production for 2019 trailing the prior year by 9%. While Uruguay’s economy is more robust than Argentina’s, due to the strong commercial relationship between the two countries, the crisis in Argentina has affected Uruguay as well. Strong slaughter data from Uruguay suggests that more farmers are choosing to reduce their herds, which will likely lead to a slower recovery when the tides shift.

These production declines will leave both Argentina and Uruguay with less product available for export, especially milk powder. Although export numbers have stayed surprisingly strong this far, mostly due to continued demand from Brazil, powder inventories have taken a hit. A lack of product will also leave the two exporters without much room to participate in international tenders. Even as weak currencies provide a price advantage for South American product, these countries will simply not have the supply to capitalize on the opportunity. Other global suppliers could step in to fill these gaps. However, overall tighter global supply will likely place upward pressure on dairy commodity prices.