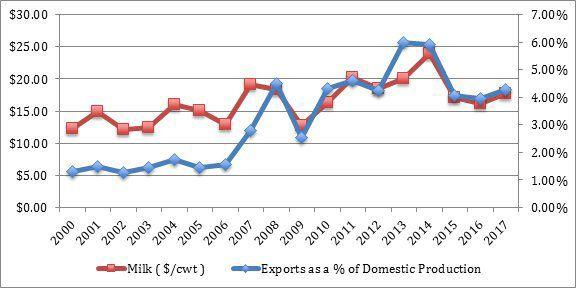

On a milk fat equivalent basis, exports have increasingly played a role in absorbing U.S. dairy production to make up the difference between the growth in production and consumption.

Let’s look at the last two historically high milk price years: 2007 and 2014.

During these years, exports rose dramatically higher than in previous history.

Traders in Chicago see that more people want U.S. dairy products. They are willing to pay more for the existing supply, pushing prices up domestically.

U.S. dairy farmers, receiving a higher price for milk, act accordingly to increase production and capture that higher price.

The production increase then balances out the supply with the demand. All this takes place over a time lag since, unlike most production systems like cars or electronics, farmers cannot simply add additional machines or workers.

They must wait for the cows to be born and enter the biological production cycle.

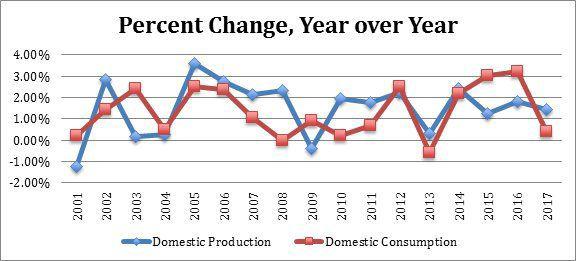

U.S. year-over-year production has continued to grow an average of 1.5% since 2000. At the same time, domestic consumption has only grown at an average rate of 1.36% annually.

The U.S. Dairy Export Council published its mostly optimistic market outlook for 2019 in January. Improved demand with our largest trading partners (Mexico, China and Southeast Asia) is the leading cause for optimism.

Additionally, Europe had been holding stocks (aka supply) of milk powder. These stocks helped keep global market watchers wondering what might happen if that supply ended up in the market.

That supply is now all but gone, working its way through the system.

The combination of lower stocks and weather factors, which are never easy to predict, make balancing supply and demand much closer than it has been in recent years.

However, one looming unknown is how trade agreements will progress and open (or close) large partners like China to U.S. dairy products.

In the U.S., the “spring flush” is on its way, with the western U.S. unlikely to slow its growth over the last year.

U.S. prices may see more stabilization in 2019 due to global supply balancing. Still, the question at home remains: how to make milk profitably?

The graph below illustrates how markets have become more volatile since 2000. On the supply side, the only way to manage the demand volatility is to consistently achieve a low cost of production, and manage for the risk.

Risk management options include holding enough capital or cash reserves for a temporary price drop, marketing options, such as contracting or futures, crop insurance products like Dairy Revenue Protection or a combination of all the above.

Farmers have many options when it comes to their methods of production, markets and business structures.

For everyone though, global markets can and will affect farm profitability.