While there was no suggestion that Dairygold is considering cutting returns to farmers, Mr Woulfe’s comments come as dairies around the country prepare to set their April milk price.

However, the ICMSA and IFA have reacted angrily, with both dismissing any justification for milk price cuts.

Most processors are currently quoting around 30.5-31.5c/l; apart from the West Cork co-ops that are paying over 34c/l. Last month Glanbia cut its milk price by 1c/l, with Lakelands dropping by 0.5c/l.

Gerald Quain of ICMSA said there was no reason for talk of “doom and gloom” in dairy markets.

Mr Quain pointed out that the GDT has seen 10 consecutive gains and is at its highest level since June 2017.

He added that Dutch spot market returns for butter and skim milk powder equated to an average price of 32.5c/l.

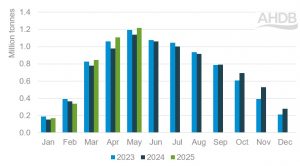

“The facts are that the global supply position is favourable, given that the EU and US are showing minimal growth year-on-year,” he said.

Static

While accepting that British and Polish supplies have grown strongly this year, Mr Quain said US supplies were relatively static, while New Zealand were at the end of their season.

“The next round of milk price announcements brings us into peak production and it’s not an exaggeration to say that this is the defining moment in the Irish dairy year,” he said.

“The prices we get for April/May/June are effectively what will decide whether this is a good year in terms of income.”

Meanwhile, the IFA’s Tom Phelan said spot and futures prices for most dairy commodities had strengthened on the back of slower global milk output growth and reasonable demand from China.

“Bearing in mind the continued pressure on farmers’ cashflow from input bills that are still outstanding from 2018, it is essential that they [milk suppliers] would be paid every possible cent per litre in the months when they normally rely on to clear bills,” Mr Phelan said.

Mr Woulfe also told the Dairygold AGM that the co-op had spent more than €1.5m purchasing carbon credits over the last year.

The co-op has bought 60,000t of carbon credits at a cost of €26/t to cover charges on emissions from its processing operations.

Indo Farming