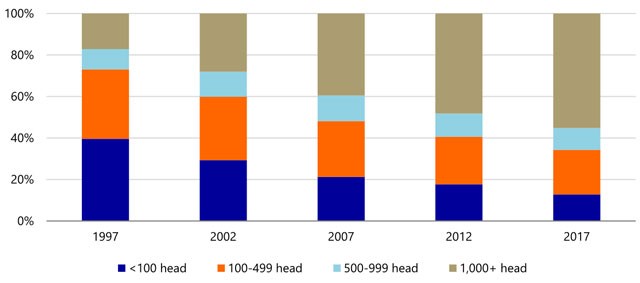

Fifty-five percent of milk cows in the U.S. reside on dairies with more than 1,000 cows, according to USDA data. Just 12 years ago these operations accounted for less than 20% of the U.S. dairy herd, says Ben Laine, dairy analyst for Rabobank.

“With limited opportunity to improve milk revenues during extended periods of subdued milk prices, farms have looked for opportunities to better their cost management to improve margins,” Laine says. “Expanding to a larger scale has been one of the ways that farms have attempted to do that.”

Several factors impact the drive to larger dairies, Laine says. The first is production costs. Herds with 2,000 or more cows have lower costs per cwt than dairies with 100 to 200 cows, he says. “On a per hundredweight basis, large farms face 12% lower feed costs, 20% lower operating costs, and 45% lower allocated overhead than smaller operations,” Laine says, citing USDA cost of production estimates.

While hired labor costs are 36% higher on large dairies, these costs generally bring in higher returns as the labor can be applied to more specialized activities.

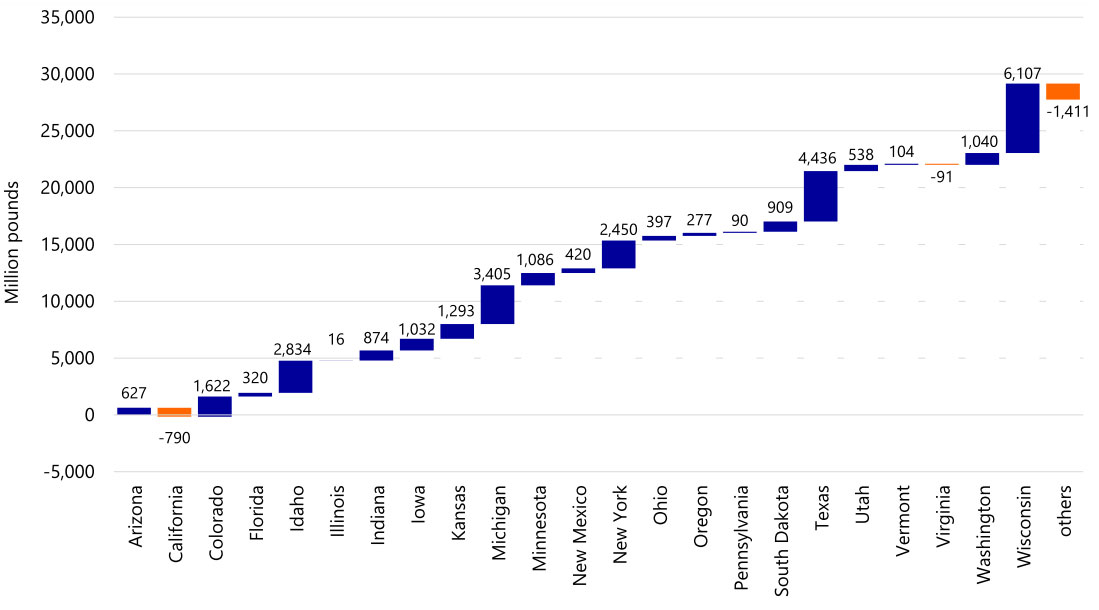

As the scale of dairies continues to increase, the locations of these dairies has shifted away from what were traditional dairy centers. The Census showed 189 farms with more than 5,000 cows. Those farms have an average herd size of 7,400 cows. The largest concentration of these dairies is out west, with California and Idaho home to 35 each. There are 25 in Texas.

“Idaho and Texas both experienced substantial growth in milk production between 2008 and 2018, due in part to the expansion of large farms,” Laine says. “California, meanwhile, experienced significant growth in the decade prior (1998 to 2008) but saw a decline over the most recent ten years as a result of a combination of water availability concerns and heightened labor regulations.”

Growth is not without risk, Laine says. Recent actions by animal activists show the vulnerability of large scale operations and the pressure it puts on the supply chain.

“If there is consumer backlash against large-scale production in general, entire supply chains would face pressure to adjust,” Laine says. “This could raise opportunities for smaller-scale specialty products to differentiate and obtain premium pricing, but such premiums would be at risk during a downturn in the domestic economy.”