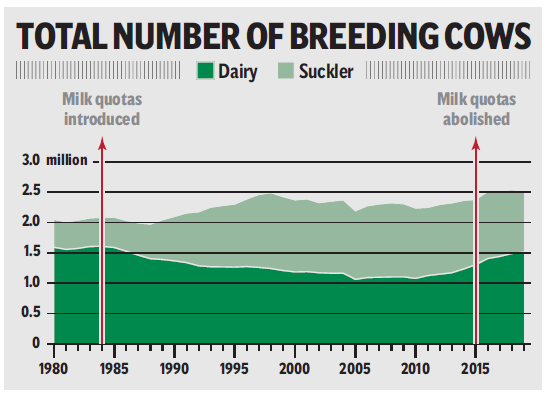

Dairy cow numbers are at their highest level in over three decades but the suckler cow herd has fallen below the one million mark for the first time in 26 years, according to new figures from the CSO.

The suckler herd now stands at 999,000, its lowest level since 1993, and the CSO’s June livestock survey shows that suckler cow numbers declined by almost 5pc (48,000hd) in the past 12 months.

In contrast, dairy cow numbers have increased by 1.6pc (23,000hd) to 1.5m – the highest figure since EU milk quotas were introduced back in the 1980s.

Suckler cow numbers have been in decline since 2008 on the back of falling margins for beef farmers.

The highest falls in suckler cow numbers were seen in Waterford (7pc), Leitrim (6pc), Sligo (5pc), Limerick (4pc) and Cavan (4pc).

Earlier this year, the Department of Agriculture published figures which showed that 51pc of dedicated suckler herds now have less than 10 animals.

A further contraction in the suckler herd can be expected next year as the impact of the BEAM scheme takes effect. Under the scheme, farmers must reduce bovine livestock manure nitrogen levels by 5pc.

Department of Agriculture figures show that 24,000 suckler cow farmers have joined the scheme.

Speaking to the Farming Independent, Minister for Agriculture Michael Creed said there had been a downward trend for some time, but described the decline in suckler numbers as “modest enough”.

Direct payments

However, IFA national livestock chairman Angus Woods said the continuing pressure on suckler cow numbers highlights the severe income issues in beef farming and the need for increased direct payments for the suckler cow herd.

He added that it is essential that Minister Creed secures additional funding for suckler farmers.

He called for a renewal of the €20m BEEP scheme this year and a simplified and better-funded BDGP scheme next year.

ICSA beef chair Edmund Graham said the ongoing growth in the dairy herd is having a substantial impact on the beef trade.

“ICSA is very concerned that unlimited dairy expansion hasn’t been thought through, especially when you consider the recent findings from Teagasc which show the futility of rearing dairy bred calves.

“Their analysis suggests that rearing a dairy calf to beef will lead to a loss of at least €150/head and over €200/head where there is Jersey cross breeding involved.

“There must be an urgent rethink when it comes to where we are going with the dairy expansion,” added Mr Graham. Dairy suppliers

Meanwhile, a number of industry sources have told the Farming Independent that dairy processors are now becoming more strategic and selective in accepting new milk suppliers.

It is understood concerns are increasing in relation to the cost of investments in additional processing capacity as well as the quality of prospective new entrants.

Further, increased demands for action on climate change and the planned reform of the CAP has concentrated minds in the dairy industry.

Glanbia said it is taking on 31 new suppliers for spring 2020, but said it is keeping its policy on new entrants under review.

A spokesperson for Dairy Industry Ireland said the Irish dairy industry has gone through phenomenal growth in recent times.

“To facilitate this growth, the industry has had to invest heavily, not only in state of the art factories to process this supply, but also in routes to market for the product.

“These new facilities are continuing to come on stream and the industry is busy matching supply to the processing capacity.

“While we are going through a period of huge political change with the likes of Brexit, CAP reform and Environmental obligations all to be clarified it, is right that the industry takes a strategic view on all decisions to ensure the maximum return is ensured to the farmer supplier as well as the processor.

“The industry is confident that this extra growth will be catered and planned for and companies are in constant contact with their boards and members to ensure that this is done in a sustainable manner for all parties,” the spokesperson said.