This analysis aims first to contrast CEO compensation with other large companies. Next, we’ll consider growth that the business demonstrates. And finally – as a second measure of performance – we will look at the returns shareholders have received over the last few years. This method should give us information to assess how appropriately the company pays the CEO.

How Does Jeffrey Lu’s Compensation Compare With Similar Sized Companies?

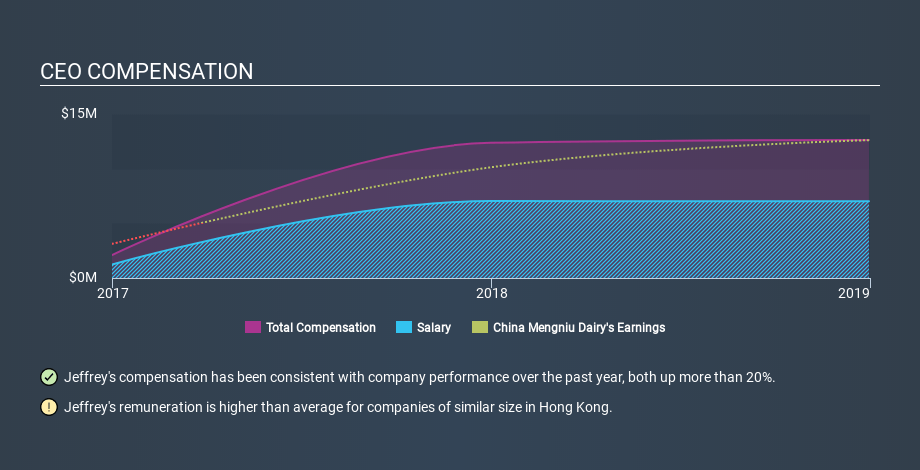

According to our data, China Mengniu Dairy Company Limited has a market capitalization of HK$122b, and paid its CEO total annual compensation worth CN¥13m over the year to December 2018. We think total compensation is more important but we note that the CEO salary is lower, at CN¥7.0m. When we examined a group of companies with market caps over CN¥55b, we found that their median CEO total compensation was CN¥6.5m. (We took a wide range because the CEOs of massive companies tend to be paid similar amounts – even though some are quite a bit bigger than others).

As you can see, Jeffrey Lu is paid more than the median CEO pay at large companies, in the same market. However, this does not necessarily mean China Mengniu Dairy Company Limited is paying too much. We can better assess whether the pay is overly generous by looking into the underlying business performance.

You can see a visual representation of the CEO compensation at China Mengniu Dairy, below.

Is China Mengniu Dairy Company Limited Growing?

On average over the last three years, China Mengniu Dairy Company Limited has grown earnings per share (EPS) by 63% each year (using a line of best fit). Its revenue is up 14% over last year.

This demonstrates that the company has been improving recently. A good result. It’s also good to see decent revenue growth in the last year, suggesting the business is healthy and growing. It could be important to check this free visual depiction of what analysts expect for the future.

Has China Mengniu Dairy Company Limited Been A Good Investment?

I think that the total shareholder return of 101%, over three years, would leave most China Mengniu Dairy Company Limited shareholders smiling. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary…

We compared total CEO remuneration at China Mengniu Dairy Company Limited with the amount paid at other large companies. Our data suggests that it pays above the median CEO pay within that group.

However, the earnings per share growth over three years is certainly impressive. On top of that, in the same period, returns to shareholders have been great. So, considering this good performance, the CEO compensation may be quite appropriate. So you may want to check if insiders are buying China Mengniu Dairy shares with their own money (free access).

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies, that have HIGH return on equity and low debt.