The Group’s turnover was down from £11.7 million to £10.7 million year-on-year for the first half, though it added that 59% of this change could be attributed to one-off seasonal activity in 2018.

The main change was in the company’s profits, which were down from £1.1 million to £0.4 million before tax, while its EBITDA also dropped from £1.3 million to £0.6 million.

Aside from dealing with the adverse effects of the hack, the company reported that its debts had widened from £2.1 million to £2.4 million. However, it added that its investment in tangible and intangible assets jumped from £0.3 million to £0.7 million on-year, while its net assets increased from £2.8 million to £4.1 million.

Responding to the attack and the first half results, Managing Director Andy Warne commented:

“We are pleased to report that despite an interruption to our services following the previously reported cyber-attack, NMR has emerged stronger having protected our revenue streams and substantially reinforced our cyber protection and restoration capability. We are particularly pleased to note that revenues from our Disease Testing services have grown by 4% year on year as we pursue our strategy of focusing on our core customers and greater penetration of our milk testing services. […]”

“The financial impact of the cyber-attack has been via additional credit to customers for interrupted services, the over-provision of testing in the labs to protect revenue streams, and additional costs for system protection and cyber-consultancy services. Whilst the quantum has been greater than previously envisaged, the direct financial impact is fully contained in the first half of the year. During the second half of FY20 we expect to trade broadly in line with our prevailing growth expectations for this period, albeit some initiatives having been delayed by the cyber-attack. Taken together, this updates our previous guidance. […]”

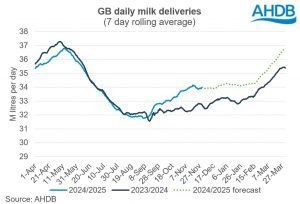

“With regards to the British Dairy industry, calendar year 2019 saw the highest level of milk produced in Great Britain for 27 years. There is some consequent downward pressure on milk prices which may reduce milk volumes to a small extent, however we remain positive that the UK dairy market offers strong opportunities and look forward to a successful second half of the year and beyond.”

Investor notes

The company’s shares aren’t currently trading; they currently stand at US $1.36 per share 10/02/20. National Milk Records has a market cap of $22.09 million, their dividend yield stands at 2.40%.