The gradual relaxation of COVID-19 lockdowns aimed at limiting the virus spread will be staggered and uncoordinated. Governments face different timelines in reaching peak health risks and must juggle the political choices between managing health system overload and economic fallout. This will see varied rates of recovery in demand.

The ongoing impacts on demand from lower household incomes during recession and ongoing limits on business and tourism travel are expected to keep demand subdued.

The inevitable slowing in EU and US milk supply will be lagged and will not offset the slump in demand. Feed costs are low with an abundance of supply, but weather will continue to heavily influence margins and decisions made on farm as producers manage lower milk incomes.

Commercial actions announced to date to reduce surplus milk and product would appear to have limited effect. Government and industry measures announced to date to address surplus stocks will also not alleviate these pressures.

These impacts will continue to drive changes in product mix post-spring milk supply peaks in the US and Europe. Generally, shifts will avoid over-production of cheese and handle surplus cream where possible.

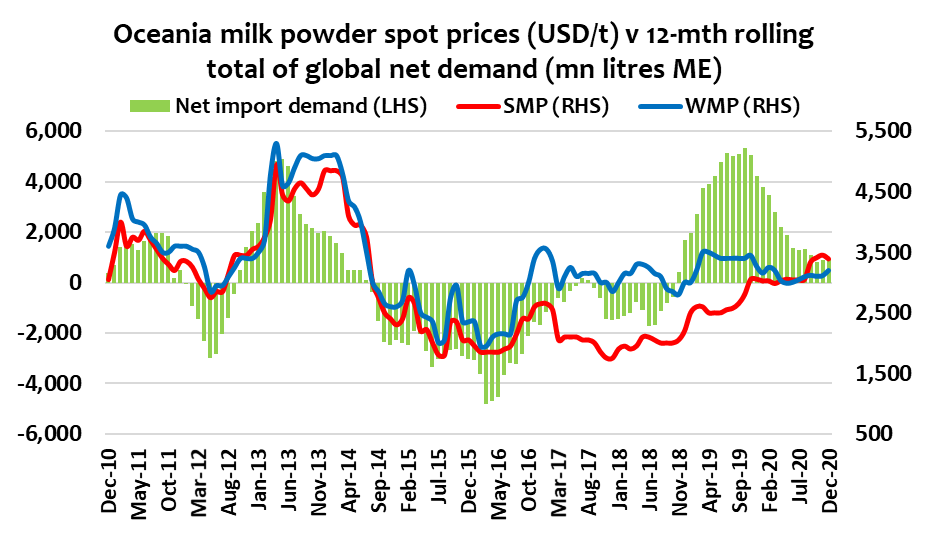

Commodity prices will remain heavily impacted by the likely stock-build in SMP, butter and cheese, until there are clear signals of a meaningful rebuilding in demand in Europe and the US. There will be a delayed impact in Oceania until product supplies build in spring.

The stimulation of stronger export demand from developing Asian and MENA markets for commodity ingredients at lower prices will be critical to the outlook as these regions experience their own lockdowns, the impacts of a global recession and travel restrictions.

Skim Milk Powder

Spot and futures weakened further in April as US values fell. NZ product trades at a premium compared to European product. Chinese buying has helped hold Oceanic prices firmer. Prices have shown some stability in recent weeks as demand signals improve.

Whole Milk Powder

Spot values continued to soften though April, impacted by the effects of demand destruction in EU and US on fat and protein prices. Demand from China and the oil producing nations has eased and fortunately volumes out of NZ are down due to the season being concluded heading into the Winter months.

Cheese

Cheese trade has increased against the prior year in all but one month since October 2018 and grew 4.3% in the 12 months to February.

US prices fell significantly through March and April with the closure of significant sales channels in particular the Foodservice channels. A slow recovery is underway as demand steadily improves. Declines in the EU market have been less severe with a much smaller foodservice exposure.

Butter

US spot prices have fallen, trading lower than at the start of March as milk production continues to improve while COVID-19 lockdowns weakened butter and cream demand. EU values also lost significantly but not as greatly as the US due to a smaller foodservice exposure, while NZ spot prices held firm – for now.

Whey

EU spot prices weakened though April now trading below US prices, which have steadied with better demand from China and a trimming of stocks.

Whey product trade improved in February – growing 5.4% YOY. This was the third consecutive monthly improvement in whey product shipments, and only the 4th month in 15 where trade grew year-on-year.

By Dustin Boughton, Procurement Director, Maxum Foods – Your partner in dairy

Graph Reference: Fresh Agenda