That purchase might not be huge but it did increase their holding by 23%.

The Last 12 Months Of Insider Transactions At Fonterra Co-operative Group

In fact, the recent purchase by Leonie Guiney was the biggest purchase of Fonterra Co-operative Group shares made by an insider individual in the last twelve months, according to our records. So it’s clear an insider wanted to buy, even at a higher price than the current share price (being NZ$3.57). Their view may have changed since then, but at least it shows they felt optimistic at the time. To us, it’s very important to consider the price insiders pay for shares is very important. As a general rule, we feel more positive about a stock if insiders have bought shares at above current prices, because that suggests they viewed the stock as good value, even at a higher price.

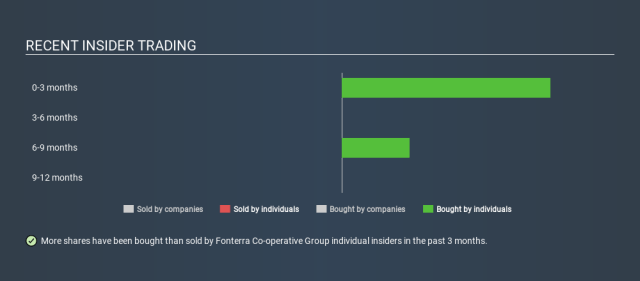

Fonterra Co-operative Group insiders may have bought shares in the last year, but they didn’t sell any. You can see the insider transactions (by individuals) over the last year depicted in the chart below. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

Fonterra Co-operative Group is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Insider Ownership

Another way to test the alignment between the leaders of a company and other shareholders is to look at how many shares they own. We usually like to see fairly high levels of insider ownership. From looking at our data, insiders own NZ$5.5m worth of Fonterra Co-operative Group stock, about 0.1% of the company. We consider this fairly low insider ownership.

So What Do The Fonterra Co-operative Group Insider Transactions Indicate?

It is good to see the recent insider purchase. And the longer term insider transactions also give us confidence. But on the other hand, the company made a loss during the last year, which makes us a little cautious. We would certainly prefer see higher levels of insider ownership but analysis of the insider transactions suggests that Fonterra Co-operative Group insiders are expecting a bright future. So these insider transactions can help us build a thesis about the stock, but it’s also worthwhile knowing the risks facing this company. While conducting our analysis, we found that Fonterra Co-operative Group has 2 warning signs and it would be unwise to ignore them.

But note: Fonterra Co-operative Group may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.