The cuts were not across the board however, and primarily affected farmers supplying processors with a high concentration of customers in the foodservice sector.

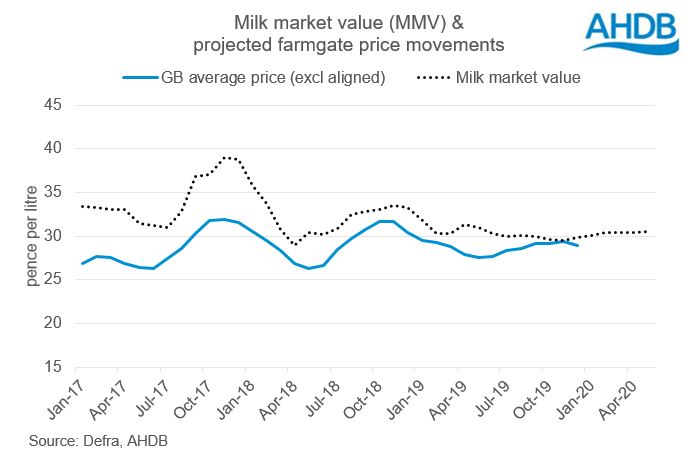

A key concern facing all farmers will be how farmgate prices could move in the next quarter, as global dairy markets continue to deal with an imbalance in supply and demand.

Typically, movements in the value of milk returned from the market (MMV) provide a good view to how farmgate prices are likely to move in 3-4 months’ time. However, MMV only measures market related impacts on farmgate prices. It does not cover adjustments resulting from cashflow or capacity issues, contract negotiations or the degree of competition for milk in the market. So we wouldn’t have expected the MMV indicator to reflect the recent price drops resulting from the immediate disappearance of foodservice demand.

The latest data however shows little change in MMV, suggesting minor drops in farmgate prices through the summer. With dairy product markets showing sharp drops in value recently, why is the MMV not reflecting these?

The main reason the MMV is not showing a similar decline is the relatively high influence of cheese returns on the indicator. The MMV is a weighted average of AMPE and MCVE on a 20:80 basis, which was found to be the best predictor of movements in the GB average farmgate price based on historical data.

In early April, the value of AMPE dropped considerably as much of the surplus fresh milk made its way into powder and butter, and trade was absent given the uncertainty of future demand. Mild cheddar returns remained stable however, with the value of MCVE falling only due to whey powder returns. The cheese market also lost demand from the out of home market, and our estimates suggest the uplift from retail sales has not been enough to completely offset these losses. However, we are not seeing this imbalance flow into prices at this stage. That will be partly because of the maturation period for a number of cheeses, and that current sales will be for cheese produced a number of weeks ago. That will be why, historically, mild cheddar prices have tended to follow powder and butter with a few months delay.

With high seasonal production, and a drop in global demand, stock build-up is likely to put pressure on cheese prices. The extent of this is, as yet, uncertain, and highly dependent on how quickly markets reopen and consumers return to pubs, restaurants and cafes.