Data is now available for U.S. consumption of dairy products through the full year of 2019. This post will cover dairy consumption exclusively. The trends are pretty well known. Beverage milk consumption is continuing down, yogurt consumption is continuing down, cheese consumption continues to grow, and butter consumption is also continuing to grow. Ice cream consumption is stable. All added together the data based on milk fat equivalent is around 1.5 percent increase per year. Read to the end of this post to see the summary chart and long-term trend of the combined product consumption summary.

Consumption data for 2020 has been very erratic. For instance, beverage milk that has been declining for 20 years took a big leap in March of 2020. That increase was erased in the following months and was probablybased on panic and hoarding at the start of the COVID-19 pandemic. The very rapid change from food service to retail buying has significantly skewed YTD dairy data for 2020. The emphasis in this post will therefore focus on firm data and trends through the end of 2019.

Most of the data presented below will follow per capita consumption. Total demand is based the size of the population and as well as per capita consumption. Chart I below shows the growth of the U.S. population. The rate of increase in the population of the U.S. is slowing. Over the last three years it has averages about .6 per cent annually. In 2000, the annual percent increase in population was nearly double that rate. The data in Chart I is based on the midyear population and should therefore be indicative of the average of the year.

If per capita consumption never changed, the demand for dairy products would be growing at .6 percent. However, as mentioned in the opening paragraph, the consumption of dairy products has been steadily changing.

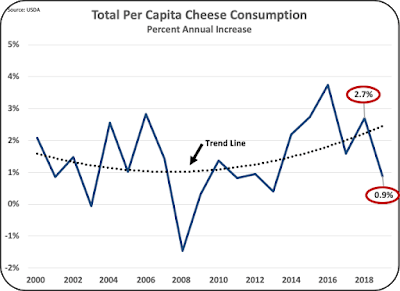

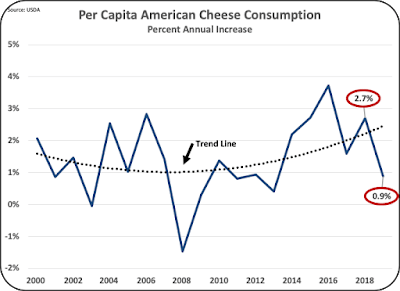

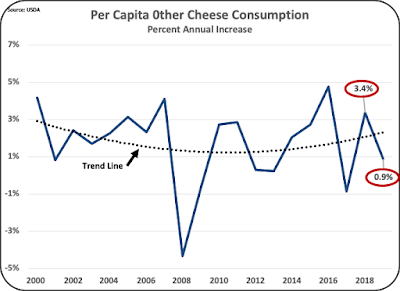

Cheese statistics are typically broken into two categories, American cheese which is primarily Cheddar and “Other” cheese which is primarily Mozzarella.

The growth of American cheese is shown in Chart III below. In 2019, the “average” American ate 15 pounds of American cheese. The growth of American cheese was relatively slow between 1980 and 2010, growing at just over one percent annually. Over the last five years American cheese has grown by 1.5 percent annually.

The growth of “Other” cheese is shown in Chart IV below. In 2019, the “average” American ate 23 pounds of “Other “cheese, primarily Mozzarella. The growth of “Other” cheese was relatively fast between 1980 and 2010, growing by three percent annually. Over the last five years it has grown by 2.2 percent annually.

The fast growth of the “Other” cheese category between 1980 and 2010 is often credited to the fast-growing pizza business. By 2019, both categories of cheese are growing at about the same rate, just under one percent annually.

In conclusion, the cheese business is growing very nicely. The per capita rate in 2019 was growing by .9 percent and the population is growing at .6 percent. Therefore, the total grow rate for cheese consumption grew by around 1.5 percent in 2019. Over the last five years, cheese per capita consumption has grown faster, averaging 2.3 percent annually which with the growth in population would amount to an annual increase of about three percent. Overall, based on trends, a growth rate of around 2.5 percent annually can be expected.

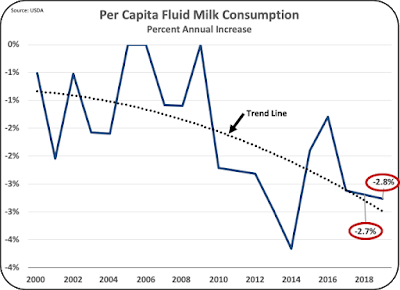

Beverage milk is a very different story. As shown in Chart V below, per capita consumption of milk is declining. It has been declining for a very long time, but for much of that time the increasing population kept total milk consumption steady. Milk for drinking is now declining at a rate of 2.2 percent over the last five years and 2.7 percent over the last three years. It appears that the rate of decrease is growing. The trend line in Chart V substantiates a growing rate of decrease in beverage milk consumption. In the near future, a decrease of around 3 percent annually can be expected. Beverage milk was the largest use of milk, but that time is long gone.

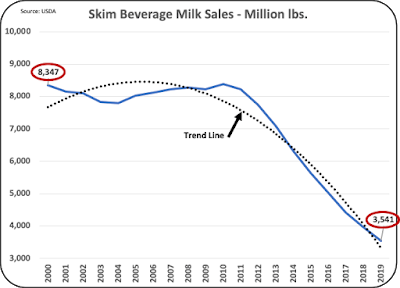

In addition, the type of milk is also changing. Skim or No Fat milk has dropped by nearly 5 billion pounds per year or 58 percent over 20 years. Most of the decline started in 2012 and volume fell quickly. The introduction of plant-based “milk” in the refrigerated section in grocery stores made No Fat milk an easy target. One of the strong points of the plant-based products was the minimal amount of fat, but decent flavor. Of course, the plant-based products have a much different nutritional profile.

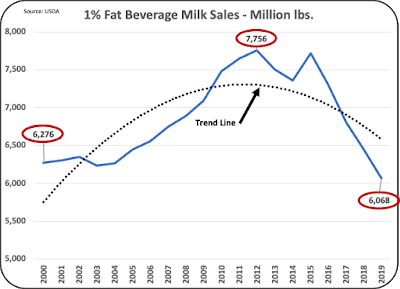

One percent fat milk fell into the same trap, declining by nearly 2 billion pounds annually since 2012.

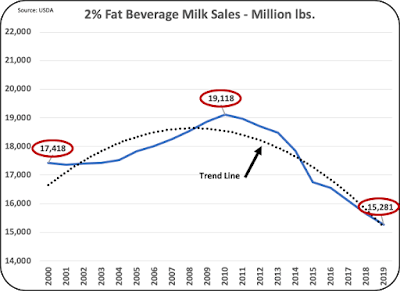

Two percent fat milk (Chart VIII) was recently the leading beverage product. It became the best-selling milk product in 2004 and held that title until 2018. Volume has fallen by nearly 4 billion pounds since 2010. One of the reasons behind this is the publication of studies touting the nutritional value of butterfat, especially for children.

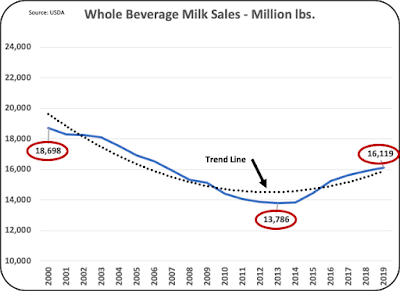

As a result, Whole milk (Chart IX) made a major comeback. Whole milk had fallen out of favor as there were concerns about the calories in butterfat. However, in 2013, the trends reversed and whole milk consumption began to grow. The growth was a positive note for the dairy industry, but it was not strong enough to overcome the overall beverage milk decline.

The decline of beverage milk has multiple impacts on the dairy industry. The decline has a major impact on producer prices as Class I milk for drinking is the highest priced milk. The decline has lowered the average or uniform price of producer milk as the highest priced category shrinks.

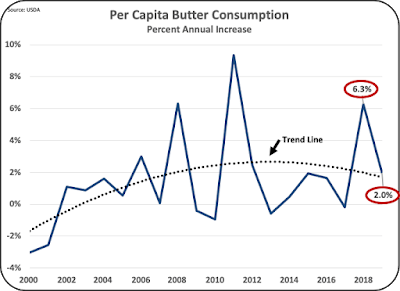

Because less butterfat is being removed from milk, there is less of this butterfat available for churning. This has put pressure on the butterfat supply for manufacturing butter. As shown below in Chart X, butter consumption is growing.

Butter consumption is a positive note. Per capita consumption of butter is growing at a three percent rate over the last five years. While plant based similar products have taken a lot of market share, concerns about saturated fats and a desire for more natural products has helped butter consumption grow. In the last two years. the growth rate has varied from 6.3 percent to 2.0 percent. The trend line would indicate an annual growth rate around of two percent.

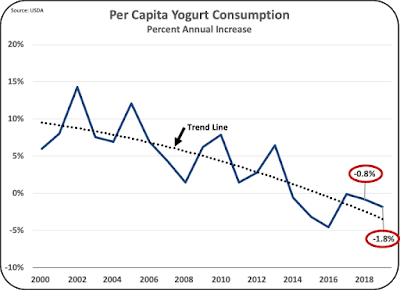

The growth rate of yogurt per capita consumption has been on a downhill slide for 20 years. Beginning in 2014, the growth rate changed from positive to negative. Yogurt is a small piece of the domestic use of milk. However, regionally it can be important. For the last five years yogurt has averaged a 1.4 percent annual decline. Because the rate of decline is growing, an annual decline of two percent annually can be expected for the near future.

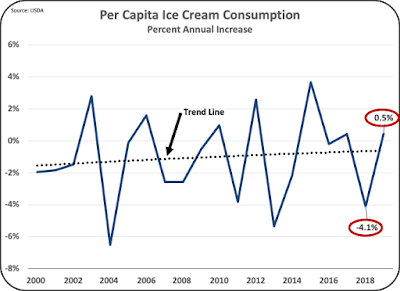

To end this post with a sweet point, ICE CREAM consumption is growing. This writer can take credit for contributing to this success. Everyone should do the same. The category and the growth rate are small, but it is nice to see some growth.

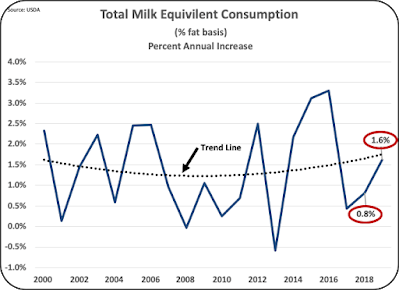

The USDA provides a summary for this set of consumption data. They use a butterfat based equivalent to summarize the data from the different dairy products. The most recent five year average is a 1.9 percent increase in butterfat needed to meet demand. This is within the normal increases in milk volume per cow and the increases in component development. Overall, the U.S. cow population should not grow.

All of the data above is based U.S. domestic consumption of dairy products. Exports and imports have not shown much new demand, but any added exports and lower imports would increase demand further. Hopefully the COVID-19 aberrations will abate and allow a more normal and predictable need for milk.

The data does show that the future of milk production is centered around components, not pounds of milk. More protein is needed for efficient cheese production and more butterfat is needed to supply the butter demand.

Future posts will continue to follow the dynamics of the rapidly changing dairy industry.