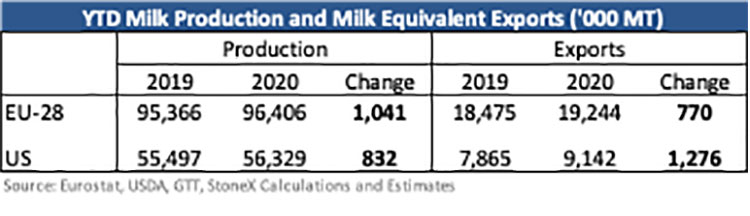

The shipments have been so strong that they have absorbed nearly all of the milk production growth in the European Union (EU), and U.S. exports have outpaced the growth in production this year. This has a number of important implications.

First, it means that domestic demand isn’t great. It does depend on the product that you look at, but broadly, it appears that EU domestic sales are running about flat against last year and U.S. domestic sales are running below last year. The second implication is that stocks haven’t grown by much. Even with weak domestic demand, exports have cleared the growing production in both regions.

The third implication is that we’re probably dependent on the export market to continue to clear the growing production through the end of the year. Will the demand be there to absorb it all?

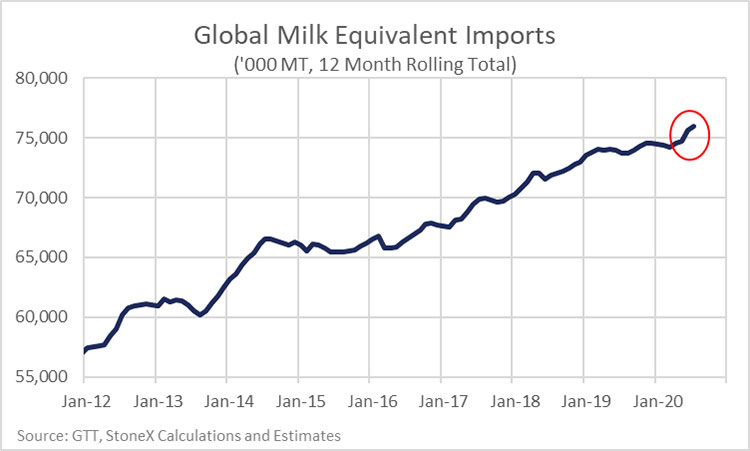

The recent import pace has been very strong, but it has only been happening for the past four months’ worth of data (April to July). We saw imports grow at this pace for 12 months from mid-2013 to mid-2014, so it is possible the pace could continue.

Where is the product going? China, Japan, South Korea, and Indonesia are all running strong, but the Middle East/North Africa are the strongest relative to the model. Given where oil prices are and the outlook for economic growth in the oil exporting countries, demand should be down significantly, but import volume is up. This is strange.

It’s tempting to argue that the strong imports in the second quarter were buyers loading up on product to take advantage of the dip in prices as well as get more physical product into their countries in case there were logistical disruptions due to COVID. I think that was part of the recent strong import pace, but the fact that global dairy prices have stayed relatively firm into September suggests that the demand side is still holding together okay. It still seems like the most likely direction for demand (and prices) is down, but the strong exports have limited inventory build-up in the U.S. and EU, and maybe this strong global demand will continue a lot longer than anyone thinks.