“We were briefed [weeks ago] as part of our NASDA meeting that international trade trips are suspended for at least 90 days,” says Randy Romanski, the secretary-designee, Wisconsin Dept. of Agriculture. “[It’s] a rolling 90 days.”

Romanski says it’s extremely important to make new connections in person.

“Once we get people in the state and they see the infrastructure and they see the dairy and cheese we produce and quality, the sales just flow from that,” says Chad Vincent, the CEO of Dairy Farmers of Wisconsin.

The pandemic put a stop to those in person meetings. There was also a drop in price.

“We had cheese at the Chicago Mercantile Exchange hit $1 per pound,” says Mark Stephenson, the director of dairy markets and policy at UW-Madison. “We haven’t seen that since 2007.”

Stephenson says the cheaper price got some countries to buy cheese. Industry leaders say dairy exports are doing well overall.

“When cheese prices crashed and other dairy products sold off, everyone looked to Asia to try to soak up this affordable dairy product,”says Alyssa Badger, director of operations at HighGround Dairy. “We saw massive exports to southeast Asia.”

China has also been a big buyer, especially for whey products for hog feed.

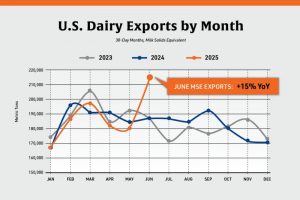

“China, obviously, a bright spot in terms of whey as [China] rebuilds their hog industry adding 14,000 new farms just this year,” says Tom Vilsack, the President and CEO of the U.S. Dairy Export Council. “It creates a good opportunity for us in terms of the whey complex. The combination of those two things, combined with strong sales in Korea and Japan, allowed us to have a pretty good 7 months.”

The USMCA between Canada and Mexico is also now enforced. Industry leaders watch now Canada handles “Class 7.”

“Canadians didn’t really get rid of Class 7,” says Andrew Novakovic, who is with the department of agricultural economics at Cornell University. “They agreed to a different way of pricing that would be more like what we do but actually, not as much as we thought it was going to be. This pricing arrangement isn’t completely eradicated.”

Novakovic says Mexico is diversifying its portfolio but buying from New Zealand and Europe as well despite the agreement.

“I don’t think we’re going to get that toothpaste all back in the tube,” says Novakovic. “I think there’s a new reality there.”

Mulhern says there is More competition in Mexico now because they just negotiated an agreement with the E.U.

“[The agreement] is going to give them equal access from a tariff standpoint, eliminating tariffs on dairy imports,” says Jim Mulhern, the president and chief executive officer of the National Milk Producers Federation. “We’re going to be competing with the E-U and Mexico, which means we’re going to look more to Central and South America for opportunity.”

“I’ll tell you what, New Zealand and the European Union are way ahead of us,” says Stephenson. “They’re negotiating some bilateral [deals] and even multi-lateral agreements much more quickly than we are.”

The industry is also looking building stronger relationships with customers.

“The real growth and population is in Asia and middle-east North Africa,” says Mulhern. “Not only is the population growing but the middle class is growing.”

It’s about every sale across the globe as it helps to support the work happening at home.

The E.U. and the U.S. are also dealing with some issues pertaining to dairy trade and common food names.

During late July, a group of senators sent a letter to USTR and USDA to urge stronger safeguards to protect U.S. exporters using common food and wine terms.

NASDA, the U.S. Dairy Export Council, the National Milk Producers Federation, the American Farm Bureau Federation, the North American Meat Institute and the Wine Institute sent out this press release:

The letter requests that the U.S. government enhance their common food name protections as a core policy objective in all trade-related discussions. It’s a direct challenge to the European Union’s misuse of protections meant for valid geographical indications to instead block American exports of common or generic food and wine terms, such as parmesan, feta, bologna or chateau.