But earnings fell short of expectations, hurt by higher costs, and its shares fell more than 6% in morning trading. The stock, which has a market value of $15.8 billion, has risen 36% so far this year.

But earnings fell short of expectations, hurt by higher costs, and its shares fell more than 6% in morning trading. The stock, which has a market value of $15.8 billion, has risen 36% so far this year.

Here’s what the company reported compared with what Wall Street was expecting, based on a survey of analysts by Refinitiv:

The pizza chain reported fiscal third-quarter net income of $99.1 million, or $2.49 per share, up from $86.4 million, or $2.05 per share, a year earlier. Analysts surveyed by Refinitiv were expecting earnings of $2.79 per share.

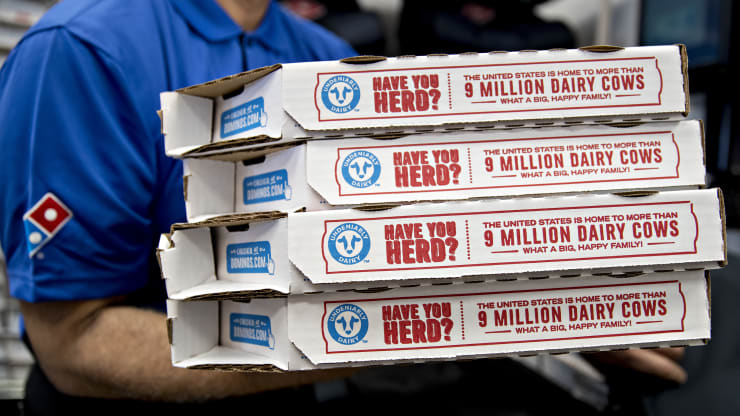

While the pandemic lifted sales, it also boosted costs for the company. Higher wages for front-line workers, personal protective equipment and enhanced sick pay cost the company an estimated $11 million. And increased sales also resulted in higher compensation based on performance. Volatility in the commodity markets caused by the crisis pushed ingredient prices, including cheese, 3.8% higher.

Net sales rose 17.9% to $968 million, topping expectations of $953 million. U.S. same-store sales rose 17.5%.

The company said that sales in its home market were “positively impacted” by changes to customer behavior as a result of the pandemic. Customers were choosing delivery over carryout, which tends to carry a higher ticket. Loyalty memberships have also accelerated during the pandemic, and more customers have stuck around.

Domino’s also released new and improved chicken wings during the quarter. Executives said that they haven’t run any promotions on the new menu item because they’re already flying off shelves.

Its international business reported same-store sales growth of 6.2%.

As of Oct. 5, fewer than 300 of Domino’s international locations are temporarily shuttered. During the quarter, the company permanently closed 126 restaurants, primarily in India. Domino’s added 83 net new locations. In early September, Domino’s had 17,256 locations worldwide.

CEO Ritch Allison said that the company is reassessing whether it will be able to reach 25,000 stores globally by 2025. According to him, unit growth remains a challenge because of the pandemic and related construction and permitting delays. But he said it was more of a question of timing than if demand really requires so many locations.

In the second quarter, due to the uncertainty caused by the crisis, Domino’s borrowed $158 million under its variable funding notes. It has since repaid that debt.

Domino’s will hold a virtual investor event on Nov. 12.

Legal notice about Intellectual Property in digital contents. All information contained in these pages that is NOT owned by eDairy News and is NOT considered “public domain” by legal regulations, are registered trademarks of their respective owners and recognized by our company as such. The publication on the eDairy News website is made for the purpose of gathering information, respecting the rules contained in the Berne Convention for the Protection of Literary and Artistic Works; in Law 11.723 and other applicable rules. Any claim arising from the information contained in the eDairy News website shall be subject to the jurisdiction of the Ordinary Courts of the First Judicial District of the Province of Córdoba, Argentina, with seat in the City of Córdoba, excluding any other jurisdiction, including the Federal.

1.

2.

3.

4.

5.

eDairy News Spanish

eDairy News PORTUGUESE