During the first lockdown, the uplift in retail sales and an industry led marketing campaign, helped offset losses from out of home sales. That meant overall processing capability in GB settled at around 36.9m litres per day. By farmers curbing milk production by 75m litres, volumes stayed within this limit for most of the spring, saving the industry from widespread milk disposals.

What will happen if volumes rise as normal this year?

Based on our latest milk production forecast, volumes in the country would exceed the 36.9m litres limit at the end of the second week of April 2021. However, there are a number of factors affecting processing capability that could change the 36.9m litres per day average seen through the first lockdown.

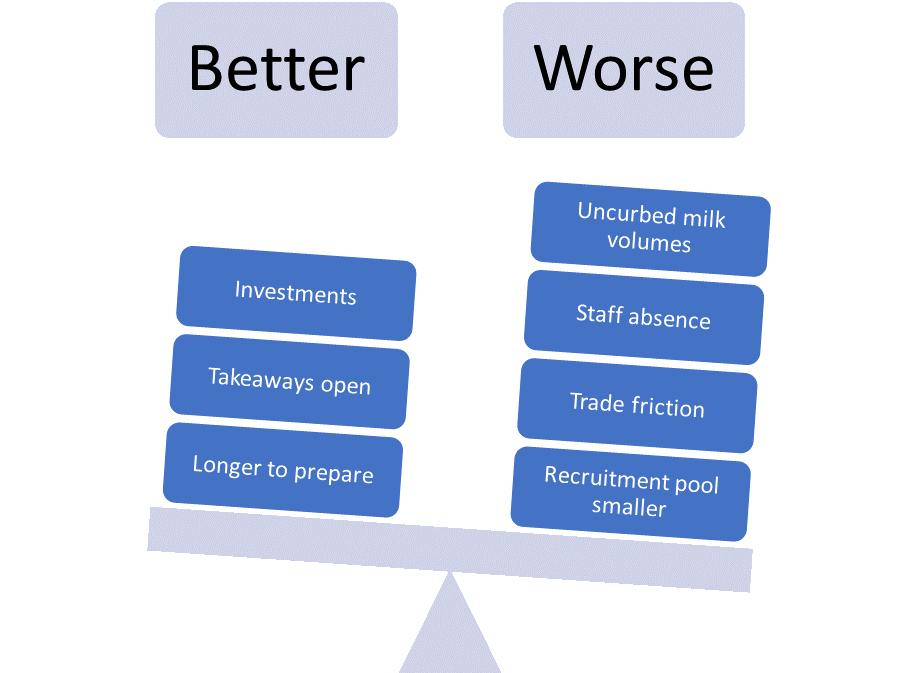

On the positive side:

-Takeaways were closed for much of the first lockdown, whereas takeaways are allowed to remain open at the moment.

-Companies have had more time to prepare for any issues this time round, and will have procedures in place to minimise disruption in the factories.

-Investments in processing over the last year will have lifted capability marginally.

On the negative side:

-Capacity was constrained by an estimated 2% during the worst affected weeks in April 2020 due to staff absence in processing sites. The latest outbreak is reportedly far worse in terms of the number of positive cases compared with the first lockdown. Therefore, we could expect the impact on staff levels to be more significant this time round, and to be a challenge across the whole supply chain.

-Based on our forecast, milk production is due to reach 38m litres per day by early May. If this remains uncurbed it would require an extra million litres capacity per day above the limit seen last year.

-Despite the last minute trade agreement with the EU, there are still challenges with exporting, compared with the frictionless trade of last spring. This, plus restrictions put on the UK because of the new coronavirus variant, mean processors have fewer options for handling surplus milk, cream or skim concentrate.

-EU exit has also made it more challenging for bringing in migrant workers, so the size of the recruitment pool throughout the supply chain has reduced.

At first look, it may seem that the industry can get through the third lockdown provided things are eased by the start of April. However, in reality, much is going to depend on the incidence of coronavirus cases over the coming weeks and its impact on staff levels throughout the supply chain. Getting through the spring unscathed will also depend on the Government meeting its target for vaccinations, thereby helping to keep staff absence at a manageable level.

Chris Gooderham

Head of Market Specialists – Dairy & Livestock