November’s exports posted the first year-over-year decline in 2020. Despite a 27% increase in whey shipments, total volumes were down 0.2%. Shipments were down 8% for nonfat and skim milk powders, 16% for cheese and 14% for lactose.

As a higher value product, lower cheese exports contributed most to the decline in total value for the month, USDEC reported.

The decline in cheese exports was caused in part by high U.S. domestic prices in the summer and fall, which caused international buyers to delay purchases.

U.S. exports of cheese to Mexico in November declined 38% year over year. Reduced consumer demand due to the COVID-19 pandemic and Mexico’s severe economic consequences likely contributed to the decline, USDEC analysts said.

However, U.S. cheese volumes to Mexico January through November were down just 1% despite the pandemic, they said.

Mexico had also been buying less nonfat and skim milk powder from the U.S. for most of the year. That trend abated in November, with shipments up 16% year over year, and it appears Mexico’s powder demand may be on the road to recovery, the analysts said.

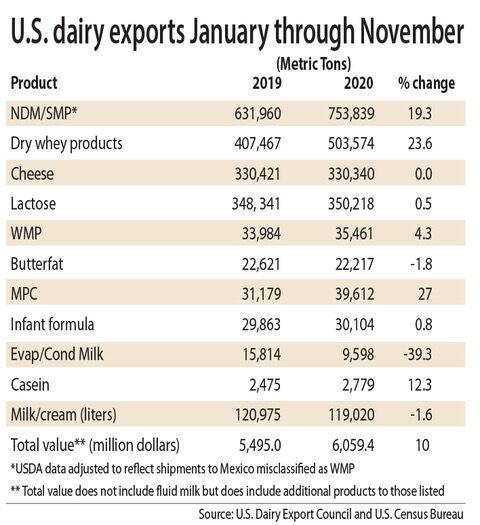

Total U.S. whey shipments were up 24% January through November, continuing to be driven by China as the country rebuilds its pig herd. China reported its pig herd had reached about 90% of normal levels at the end of November.

“But given that pork output is still far short of demand and dry whey pricing levels suggest strong Chinese buying activity, we expect whey import gains to persist into the new year,” the analysts said.

Whey volumes to China demonstrate the market has moved from recovery to demand expansion, they said.

U.S. whey shipments to China more than doubled in November and were up 111% January through November. That growth is due in large part to the retaliatory tariff exemption secured in 2019 and renewed for 2020, they said.

The U.S. also saw strong powder sales to Southeast Asia in 2020, with shipments up 50% year over year January through November. That acceleration was due primarily from U.S. market share growing from 31% of the market to 46% on an annualized basis.

But U.S. powder exports to the region slowed in November, despite a 22% increase in exports to Indonesia. Total exports to the region dropped 27%, likely due to multiple factors, the analysts said.

“A 46% share of trade for any suppliers is well above the norm in such a highly competitive region … thus, some regression in market share or volume was to be expected,” they said.

In addition, November was the strongest month of growth to the region in 2019. So if volumes were to fall in 2020, November would be the most likely month. Some of the decline could also be a function of shipping dates, they said.

USDEC will be monitoring overall powder demand in the region but expects U.S. exports there to remain closer to the record-breaking levels in 2020 than to the preceding era.