U.S. dairy exports are particularly strong, with March exports reaching the second highest level ever as a percentage of monthly U.S. milk solids production. Meanwhile, domestic use of dairy products in the first quarter of 2021 rose 7 percent from a year earlier for both butter and American-type cheese. Still, despite the rosier outlook, immediate conditions remain challenging, with margins under the federal Dairy Margin Coverage program averaging almost $3.00/cwt below the maximum $9.50/cwt coverage level during the quarter, as rising feed costs combined with out-of-balance milk supplies kept returns over feed costs at depressed levels.

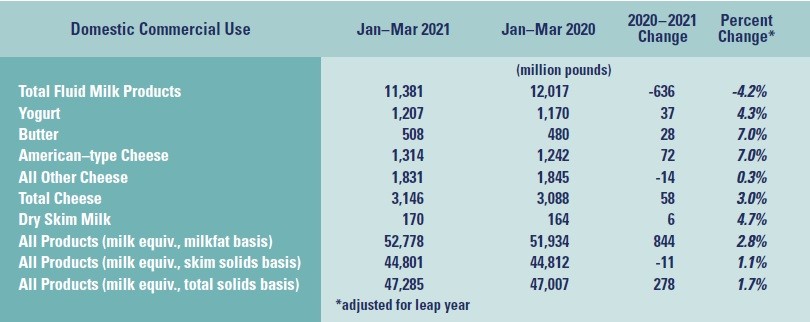

Commercial Use of Dairy Products

Total fluid milk sales dropped sharply in the first quarter of 2021, with March sales down by 7.5 percent from a year earlier. The fading of the COVID-19 pandemic is decreasing retail dairy product consumption even as food service and institutional purchasing rises, a transition that will take several months to complete. In contrast, overall domestic butter and American-type cheese consumption was up sharply during the quarter, while other than American-type cheese has yet to reflect food service growth. Domestic use of milk in all products increased by respectable amounts by all milk solids measures.

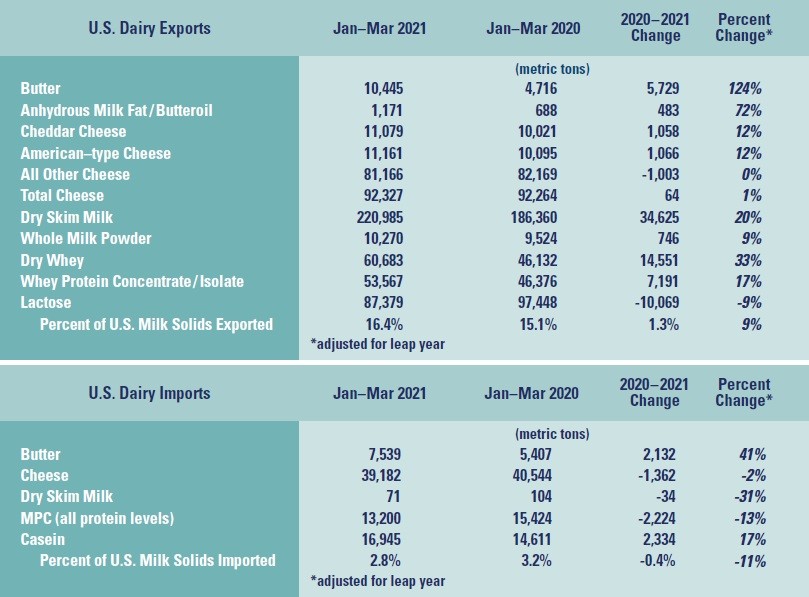

U.S. Dairy Trade

The first quarter of 2021 saw very strong growth in U.S. dairy exports almost across-the-board. Eased shipping delays that plagued U.S. ports during the last few months of 2020 partly explained the boom, but global demand for U.S. dairy products is genuinely increasing as well. Exports of almost all listed products were above their respective levels a year earlier during each month of the year’s first quarter, except for weakness in January for other than American type cheese and dry skim milk, as well as lactose, for which February exports were also lower. As a percentage of U.S. milk solids, March exports were the highest ever for that month and the second highest for any month. By the same measure, February exports were the second highest for that month and January’s exports were the ranked third highest for that month.

Meanwhile, first quarter U.S. dairy imports continued lower compared to year earlier for the major product categories except for butter, for which imports almost doubled in March. March imports were also higher for the major import categories of cheese, milk protein concentrate and casein.

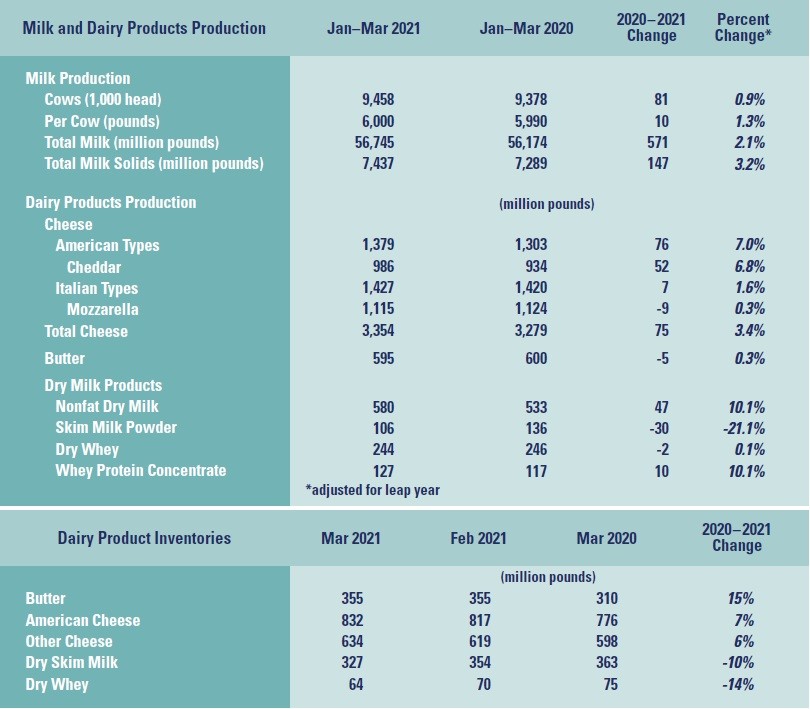

Milk Production

The year-over-year increase in the U.S. dairy herd reached a recent peak in December last year, when USDA reported 93,000 more cows on U.S. dairy farms than there were in December 2019. This rate of expansion as ebbed since then, with 77,000 more cows in the country than a year earlier in March. Year-over-year milk production growth reflects this. It’s been declining steadily since last November, when it peaked at 3.5 percent, but was half that, 1.8 percent, in March. This pattern of receding production growth has been mirrored in most states, with marked exceptions in Wisconsin, Minnesota and South Dakota. USDA data indicate that U.S. milk solids production increased by just over a full percentage point faster than liquid milk production during the first quarter.

Dairy Products

Dairy product production data strongly suggest that increased milk solids production during the first quarter largely went to increased production of American-type cheese. Total dry skim milk production on a leap-year-adjusted basis was 2.4 percent higher than a year earlier, and butter and dry whey were essentially flat, while other than American type cheese production was 1.1 percent higher.

Dairy Product Inventories

Month-ending stocks rose from February to March for cheese, were stable for butter and dropped for dry skim milk and dry whey. Measured as days of commercial use in stock,

end-of-month inventories were lower in March for butter and the dry products but relatively unchanged for other than American-type cheese. American cheese stocks were higher in March by all measures.

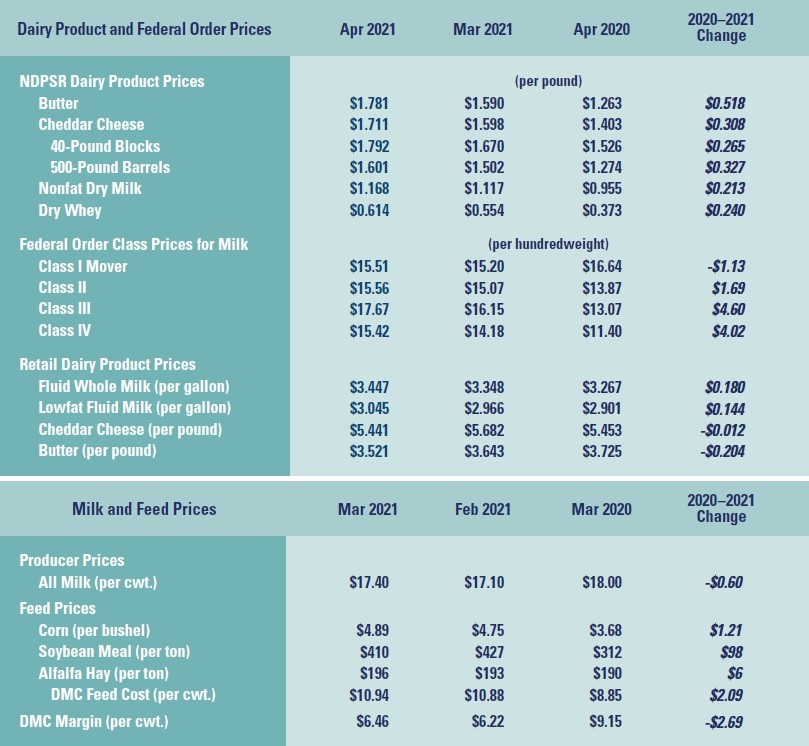

Dairy Product and Federal Order Class Prices

Monthly survey prices of all the dairy products that establish federal order class prices were higher in April than in March, especially for butter and cheese. The same was true for all four federal order class prices themselves. U.S. average retail prices for fluid milk products rose significantly in April from a month earlier, while retail cheese and butter prices were significantly lower. This may reflect recent drops in retail sales for manufactured dairy products as those products were restocked by food service operations.

After rising by 1.9 percent from a year earlier during the first quarter, the Consumer Price Index (CPI) for all items rose by 4.2 percent in April from April 2020, unleashing much media discussion about possible reignition of inflation.

Bucking this trend, the CPI for food and beverages was up by 3.5 percent in the first quarter but 2.3 percent in April, and the CPI for dairy and related products even more so, with annual growth of 2.7 percent in the first quarter and just 0.6 percent in April.

Milk and Feed Prices

February’s Dairy Margin Coverage program margin showed further signs of being the year’s bottom, as March’s margin rose $0.24/cwt to $6.46/cwt. The March U.S. average all-milk

price was $17.40/cwt, $0.30/cwt higher than in February, while the DMC March calculated feed cost was just $0.06/cwt higher than February’s. On a per hundredweight of milk basis, a higher corn price was almost entirely offset by a lower cost of soybean meal in March. The March payment for $9.50/cwt DMC program coverage is $3.04/cwt. On an annual basis, the DMC program will have already paid the equivalent of $2.17/cwt for coverage at $9.50/cwt during the first quarter of 2021 alone. USDA reported that 164.7 billion pounds of production history, or 79.2 percent of the total, was enrolled in the 2021 DMC program, with an estimated $344 million in payments for disbursement as of May 3.

Looking Ahead

Current futures prices indicate that DMC margins going forward should rise above $9.50/cwt by late summer this year. The March margin was more than $3.00/cwt below this level, and the futures currently foresee a rise in the U.S. milk price of over $4.00 from March to a peak in October, while the feed cost outlook shows a peak for the year during the next few months but recession from there through the fall.

Recent changes in U.S. dairy cow numbers strongly suggest that they are resembling a cycle typical for at least the last quarter-century. In a typical expansion cycle, U.S. cow numbers begin to rise above their level of a year earlier, following which monthly cow numbers will exceed year earlier levels by steadily increasing amounts for about the next year, reach a peak and then recede until the monthly growth ends and turns negative. This point often then marks the beginning of a cycle of cow number decline, or a herd contraction cycle, with similar characteristics except that the monthly cow numbers are below a year earlier.

Prior to the current period of cow number growth, there was a dairy cow herd expansion cycle that began in June 2016, reached a peak 11 months later of 86,000 more cows than a year earlier and lasted a total of 24 months. Prior to that, there was a somewhat shorter and more intense herd expansion cycle, powered by the record-high milk prices of that time, that began in June 2014, reached a peak of 103,000 more cows 8 months later and lasted 19 months.

The U.S. dairy cow herd began growing in January 2020 and now appears to be on the downward slope of a typical expansion cycle.

Accordingly, dairy cow numbers might be expected to stop growing by the end of this year. However, this decline may be somewhat uneven since the current expansion cycle had an uneven start when the pandemic first hit a year ago.

But this still augurs that national milk supply and demand will increasingly come into balance, and perhaps a tight balance, later this year, as demand recovers from the pandemic and cow numbers level off. The dairy futures are increasingly, but not yet fully, reflecting this dairy market scenario.