The Agriculture Department’s preliminary data show output hit a bearish 19.3 billion pounds, up 3.3% from April 2020. Output in the top 24 states, at 18.4 billion pounds, was up 3.5%.

Revisions added 30 million pounds to the March 50-State estimate, now put at 19.78 billion pounds, up 1.9% from a year ago.

April cow numbers were up for the 15th consecutive month, totaling 9.49 million head in the 50 states, up 16,000 head from the March count, which was revised up 6,000 head, and is up 113,000 head from April 2020.

April output per cow averaged 2,033 pounds, up 40 pounds or 2% from a year ago.

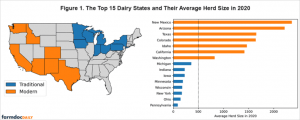

California milk was up a whopping 144 million pounds or 4.1% from a year ago, thanks to an 85-pound gain per cow, but 1,000 fewer cows. Wisconsin was up 117 million pounds, or 4.6%, on a 70-pound gain per cow and 14,000 more cows.

Idaho was up 1.0% on 5,000 more cows and 5 pounds more per cow. Michigan was up 4.5%, on 15,000 more cows and a 20-pound gain per cow. Minnesota was up 6.9%, on a 55-pound gain per cow and 17,000 more cows. New Mexico was up 2.9%, thanks to a 40-pound gain per cow and 3,000 more cows.

New York saw a 2.2% rise on a 45-pound gain per cow but cow numbers were unchanged. Oregon inched 0.9% higher on 1,000 more cows but output per cow was unchanged. Pennsylvania was down 1.0%, on a drop of 10,000 cows, though output per cow was up 20 pounds.

Texas output was up 7.7%, on 29,000 more cows and a 55-pound gain per cow.

Washington state was down 1.4% on 3,000 fewer cows, and a 10-pound drop per cow.

Culling drops

Rising milk prices spurred April milk output but also resulted in a drop in dairy cow culling from the previous month and year. The USDA’s latest Livestock Slaughter report shows an estimated 257,500 head were sent to slaughter under federal inspection, down 44,700 head from March and 21,900 or 7.8% below April 2020.

Culling in the first four months of 2021 totaled 1.1 million head, down 29,700 or 2.6% from the same period a year ago.

Butter aplenty

The fridge is far from empty but the Agriculture Department’s latest Cold Storage report shows inventories are not getting out of hand, at least on cheese.

American type cheese stocks fell to 830.8 million pounds, down 3.6 million pounds or 0.4% from March, which was revised up 2.6 million pounds, and they were 3.5 million pounds or 0.4% below those a year ago.

The “other” cheese category saw stocks dip to 601.2 million pounds, down 10.7 million pounds or 1.7% from March and 17.5 million or 2.8% below a year ago.

The total cheese inventory stood at 1.45 billion pounds on April 30, down 15.9 million pounds or 1.1% from March and 25.5 million pounds or 1.7% below a year ago, ending five consecutive months that total cheese stocks grew.

The decline in cheese stocks in April is a rare occurrence during the Spring Flush, says HighGround Dairy (HGD), “and especially notable following expanded cheese production capacity that has come online in recent months. It was the first April stocks decline since 1993 and signifies that cheese demand was extraordinary in the month, likely driven by both retail and foodservice channels as the economy quickly reopened.”

April butter stocks climbed to 385.3 million pounds, up a hefty 27.9 million pounds or 7.8% above the March inventory, which was revised up 2.8 million pounds. They were 12.7 million pounds or 3.4% above April 2020, making April the 22nd consecutive month that butter stocks topped those of a year ago.

Keep in mind, a year ago COVID lockdowns had restaurants closing their doors, thus butter stocks grew quickly. It will be interesting to see what April butter output looked like in the next Dairy Products report issued June 4.

HGD warns that “butter stocks are at multi-decade highs and will only climb further in second quarter before reaching the yearly peak. Heavy inventories prevent meaningful price appreciation throughout the remainder of 2021 with plenty of product available to meet demand.

But, StoneX says that overall, they are still bullish on butter with expectations of stocks falling back below year-ago levels by August.

Cheese falling

The bearish Milk Production data and plenty of product coming to the CME last week added downward pressure on cheese prices.

Block Cheddar closed Friday at $1.57 per pound, down 15.50 cents on the week, third week in a row of decline, and 36.75 cents below a year ago when it jumped almost 16 cents to $1.9375.

The barrels saw their Friday close at $1.6075, an inverted 3.75 cents above the blocks, but down 12.25 cents on the week and 28.25 cents below a year ago when they gained 17 cents; 33 sales of block were reported last week at the CME and 46 of barrel.

The blocks dropped 4 cents Monday on 10 trades, as traders still had last week’s bearish Milk Production report in their minds and awaited the afternoon’s April Cold Storage report. They lost a penny Tuesday on 5 trades, slipping to $1.52, lowest since Feb. 18, 2021.

The barrels were down 2.75 cents Monday but gained 3.50 cents Tuesday, with 9 carloads exchanging hands, climbing back to $1.6150, 9.50 cents above the blocks.

Friday’s Dairy Market News reported that milk remained available for Central cheese production last week but some contacts expect potential tightness as spring flush milk yields recede. Cheese producers are taking advantage of milk discounts, though they are smaller than a few weeks ago. Cheese demand varies, depending on the variety but pizza cheesemakers continue to report steady sales.

Retail cheese demand held steady in the West last week but food service demand slowed slightly. Cheese producers continue to run full schedules with the available milk in the region. While CME prices have weakened, some contacts are optimistic that recent changes to CDC recommendations regarding COVID-19 and vaccinated individuals may contribute to higher food service sales in the coming weeks as people resume pre-pandemic activities, says DMN.

Butter closed Friday at $1.87 per pound, down 0.50 cents on the week, after gaining 10.5 cents the previous week, but is 27.75 cents above a year ago. There were 15 sales reported last week.

Monday’s butter lost a nickel and stayed put Tuesday at $1.82.

Central butter producers say cream is available if they look West or South and churning for fall demand is ongoing. Food service demand reports are still improved from last year when markets were in a chaotic situation, but were fluctuating in the downward direction last week, according to some. Retail sales were meeting expectations, says DMN, “but the bar is set seasonally low.” Contacts say there is market uncertainty as to the potentiality of future governmental bids.

Cream is steady in the West with much of it going to ice cream and other Class II manufacturing, but butter makers are receiving adequate volumes. Butter inventories are stable. Retail orders were flat to lower. Depending on the locale, restaurant dine-in restrictions vary from unrestricted to full capacity, to a 25% cap.

Grade A nonfat dry milk marched to $1.3125 per pound last Tuesday but closed Friday at $1.2975, 0.25 cents lower on the week and the lowest since April 26, but was 28.50 cents above a year ago. 13 cars were sold last week.

The powder was unchanged Monday but gained 0.50 cents Tuesday, hitting $1.3025.

CME dry whey finished Friday at 64.50 cents per pound, up 0.50 cents on the week and 28.25 cents above a year ago, with 5 sales reported on the week.

Monday’s whey was up 0.25 cents and tacked on another 0.50 cents Tuesday, hitting 65.25 cents per pound, highest since May 3.