“But quenching that thirst will be problematic, not least because finding the millions more cows needed for planned new and expanded farms will be challenging.

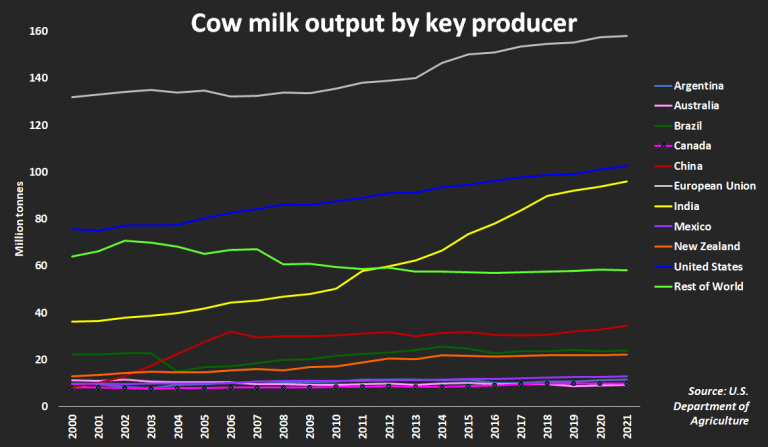

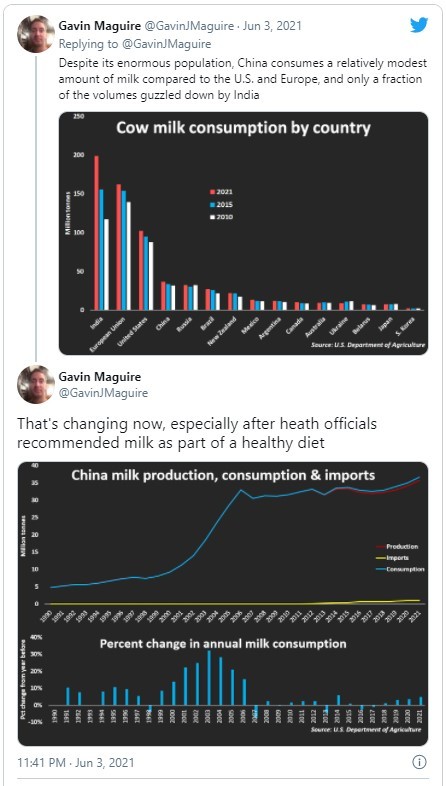

“China is the world’s third-largest milk producer, but last year’s 34 million tonnes of output only met about 70% of domestic needs. Complicating matters are feed costs at multi-year highs, while land and water are also in short supply, making the country a costly place to produce milk.”

Ms. Patton explained that, “Spurred on by near record highs for raw milk prices and government subsidies, just over 200 new Chinese dairy farm projects were announced last year, according to consultancy Beijing Orient Dairy.

“Its analysis shows that 60% of the new projects have set their sights on 10,000-plus cows and in total the plans call for some 2.5 million cows – roughly half of China’s current milking herd – to be added in the coming years.”

The Reuters article noted that, “Feed costs, however, present another impediment, analysts and industry sources say, as imported heifers take time before they become milkable cows.”

Also last week, Reuters writer Karl Plume reported that,

“China’s feed grain industry is unlikely to become self-sufficient despite the country’s efforts to ramp up domestic production, David MacLennan, chief executive of Cargill Inc said on Friday.”

“Tightening domestic supplies of feed grains and soaring demand from China’s pork producers has triggered record feed grain import purchases this year.”

The Reuters article indicated that, “‘I think they realize comparative advantage … Grow and produce what fits your climate, your natural resources, your soil, your water supply. They don’t have it the way we, Brazil, Australia do,’ MacLennan said at the National Grain and Feed Association annual convention on Friday.

“‘They need to depend on trade,’ he added.”

Meanwhile, Reuters News reported last week that, “China hailed on Thursday the resumption of ‘normal discussions’ with the United States on the trade and economic fronts, apparently keen to move beyond a trade war as it said both sides aimed to resolve issues pragmatically.

“China’s Vice Premier Liu He, who has led trade negotiations with the United States, has held two video calls with U.S. Trade Representative Katherine Tai and Treasury Secretary Janet Yellen in a week, marking the first formal engagement between the two sides on trade and economic issues under the Biden administration.”

The Reuters article pointed out that, “Chinese state media also focused on the positive tone of the economic talks following frosty exchanges between top Chinese and U.S. foreign policy officials at a meeting in Alaska in March.

“The exchanges over the past week were ‘sparking optimism over enhanced communication between the world’s two biggest economies,’ the Chinese state-run Global Times tabloid reported.”

And Bloomberg News reported on Wednesday that, “President Xi Jinping urged Chinese officials to create a ‘trustworthy, lovable and respectable’ image for the country, in a sign that Beijing may be looking to smooth its hard-edged diplomatic approach.

“Xi told senior Communist Party leaders Monday that the country must ‘make friends extensively, unite the majority and continuously expand its circle of friends with those who understand and are friendly to China,’ according to the official Xinhua News Agency. Beijing needed ‘a grip on tone’ in its communication with the world, and should ‘be open and confident, but also modest and humble.’”

“It remains to be seen whether the push would have any impact on China’s policies in disputes with countries such as the U.S., Australia or the European Union, all of which have seen ties deteriorate further in recent months,” the Bloomberg article said.