Overview

Overall U.S. dairy-product demand appears headed back to pre-pandemic levels, and U.S. dairy exports have achieved near-record highs as a percent of U.S. milk solids production during 2021 so far. Meanwhile, wholesale prices for butter, nonfat dry milk and dry whey in May were all higher than before the pandemic began, but cheese prices continue to struggle. However, capturing the state of dairy through data is unusually difficult at this moment, and will be for several months, as the industry is entering a series of months during which year-over-year comparisons are affected by the COVID-19 pandemic’s disruptions to dairy markets one year ago at this time. For example, U.S. milk production has been increasing, pressuring milk prices since early May, but year-over-year growth comparisons are somewhat misleading due to last year’s atypical seasonal production patterns. Similarly, year-over-year domestic fluid milk sales were down sharply this March and April, while commercial cheese use was up sharply in April.

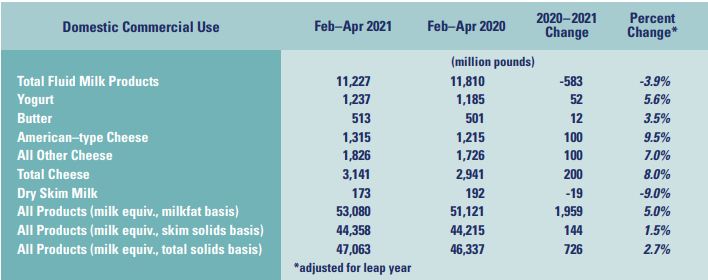

Commercial Use of Dairy Products

Larger than usual measured drops in domestic fluid milk sales during March and April brought year-over-year fluid sales down by almost 4 percent during February through April. The comparison, however, was against higher than usual fluid sales during the first months of the pandemic in March and April 2020, despite supply chain disruptions during those months. By contrast, domestic commercial use of both American-type and other cheese was considerably higher during February through April than during the same months in 2020, due in large part to year-over-year increases of more than 20 percent for both types of cheese in April. This was due, in turn, largely to a base effect, since domestic use of all cheese was significantly depressed in April 2020 as the pandemic registered its first full month of demand destruction in food service, and supply chains had not yet had time to redirect enough cheese to retail outlets. Allowing for this, the large April numbers for cheese indicate a recovery to close to normal consumption this year.

As a broader indicator of this recovery, commercial use of milk in all products, both domestic and total, was generally higher during 2021 than during comparable periods two years earlier, prior to the pandemic. Domestic use of dry skim dairy ingredients, including the whey complex, was largely down during the pandemic months, as strong export demand competed aggressively with domestic users for

the available supply.

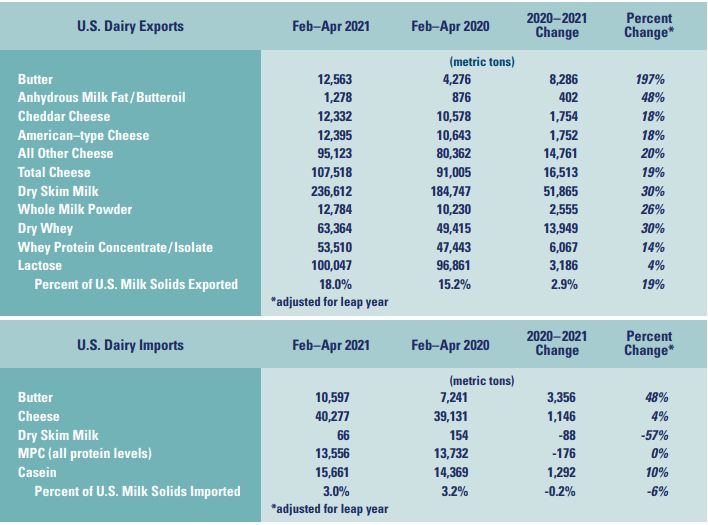

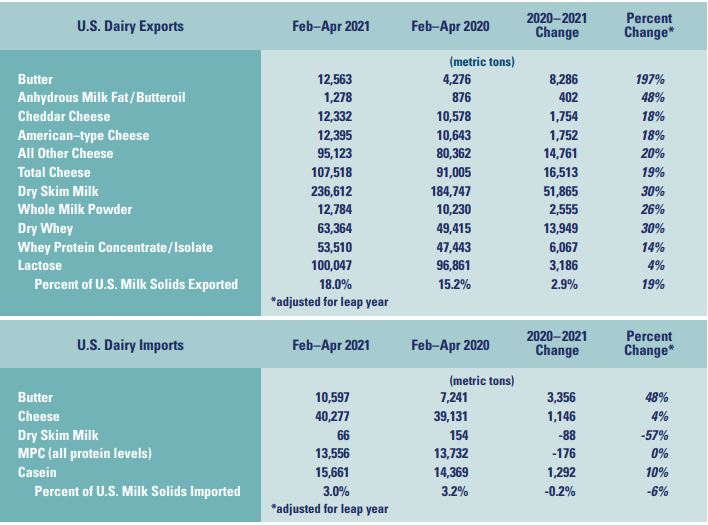

U.S. Dairy Trade

U.S. dairy exports surged during the first third of 2021, in spite of continued shipping difficulties. Exports of all major product categories during February through April were up over a year earlier by mostly double-digit percentages. Even more significantly, as a percentage of U.S. milk solids, April

exports were 18.7 percent, the second highest for any month, while March exports were 18.4 percent, the third highest.

January and February exports also reached high points for their particular months.

Dairy imports into the United States were higher during February through April than a year earlier for many of the major imported product category, although total imports as a percent of domestic milk solids production was down slightly during the period.

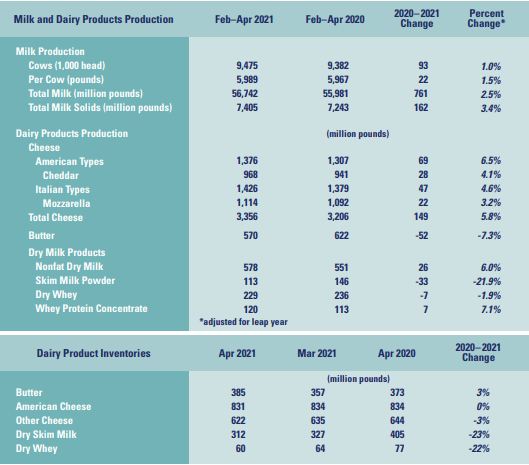

Milk Production

April milk production was 3.3 percent higher than it was during April 2020. This followed a string on months during which year-over-year production had been declining, from 3.5 percent in November 2020 to 1.9 percent in March. However, while milk production has indeed been increasing somewhat more rapidly than total consumption, comparisons to a year ago have become misleading because production during April though December 2020 was skewed by the pandemic. April and May production a year ago was sharply lower than usual, as cooperatives established base-excess plans in response to the sharp disruptions that supply chains experienced at the beginning of the pandemic. Production from July through December did not drop off as rapidly as had been typical going into the summer and fall. Had April 2020 production followed typical seasonal patterns production during April 2021 would have been up by about 2.2 percent year-over-year. Should 2021 production follow typical seasonal patterns, May production could show an increase above 5 percent over actual May 2020. Production will not likely fall below 1 percent over a year earlier until the last few months of the year.

Although also affected by the same base effect comparison, U.S. milk solids production growth over a year earlier exceeded growth of liquid milk production during February through April by almost a full percentage point, according to data from USDA’s Economic Research Service.

Dairy Products

Cheddar cheese production growth dropped off sharply in April, but Mozzarella and overall Italian cheese production growth jumped that month, presumably reflecting increased use in of food service. The net result is that total cheese production was up over a year earlier by almost 6 percent

during February through April. Butter production was down by over 7 percent during the period after being flat during the first quarter, while total production of dry skim milk and dry whey products was higher.

Dairy Product Inventories

Month-ending inventories did not increase from March to April for American-type cheese and dropped for other cheese. This was somewhat surprising given the strong production growth of American-type cheese in recent months and the weakness of cheddar cheese prices. Butter stocks have returned to the general levels of the first several months following the onset of the pandemic a year ago, while stocks

of dry skim milk and whey products were lower, reflecting strong export demand.

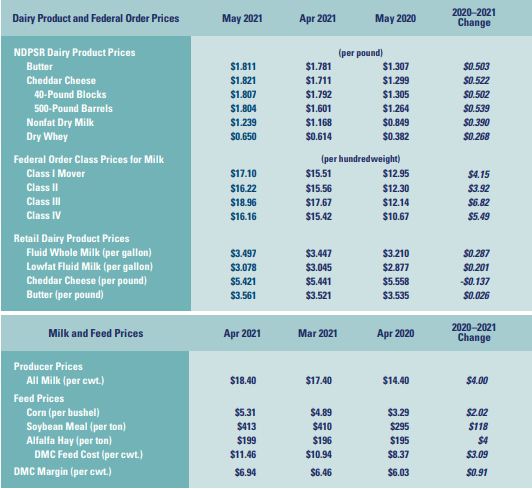

Dairy Product and Federal Order Class Prices

Monthly federal order prices for butter, nonfat dry milk, dry whey and Class IV milk reached their highest levels in May since before the pandemic began to affect the dairy industry in March 2020. By contrast, May federal order prices for cheese and Class I and Class III milk were significantly lower than at various times during the pandemic months. Retail prices for the major dairy products in May were all

down from various points during the pandemic, although retail prices for fluid milk have been rising during the past two months after dipping temporarily.

Milk and Feed Prices

The U.S. average all-milk price increased by a full dollar per hundredweight from a month earlier to $18.40/cwt in April. This had been anticipated by the strong increases in April Class III and Class IV prices announced several weeks earlier, together with smaller increases in April Class I and Class II

prices. The Dairy Margin Coverage feed cost calculation increased by $0.52/cwt, mostly from a higher corn price, producing a monthy net increase of $0.48/cwt in the April DMC margin, and an April payment of $2.56/cwt for coverage at $9.50/cwt. USDA estimated that 2021 DMC payments for disbursment reached $446 million as of June 7. Half of these estimated payments were to enrolled

producers in the four states of Wisconsin, California, New York and Minnesota.

Looking Ahead

USDA’s monthly World Agricultural Supply and Demand Estimates (WASDE) forecast released in early June projects annual U.S. milk production will expand by 2.7 percent year-over-year in 2021 and by a further 1.1 percent in 2022. The Department forecasts the all-milk price to average $18.85/cwt in calendar year 2021 and $18.75/cwt in 2022. At the same time, the dairy futures were indicating the

2021 and 2022 all-milk prices would average $19.20/cwt and $20.50/cwt, respectively. The dairy and grain futures continued to indicate that the DMC margins would remain below $9.50/cwt for the second and third quarters of 2021 but might rise modestly above this level during the fourth quarter.