Cropp, professor emeritus of UW-Madison’s Department of Agricultural and Applied Economics, said cold storage reports bring both bad and good news to dairy farmers: American cheese stocks are slowly decreasing at 2% this month, but butter stocks have gone up 14% in the same timeframe. Stephenson, director of the Center for Dairy Profitability, said cheese stocks will continue to see rising price support.

“Cheese is probably supportive of the prices we’ve got or maybe even going to push up on them a little bit,” Stephenson said. “Butter might be a little bit of a different story, mildly bearish.”

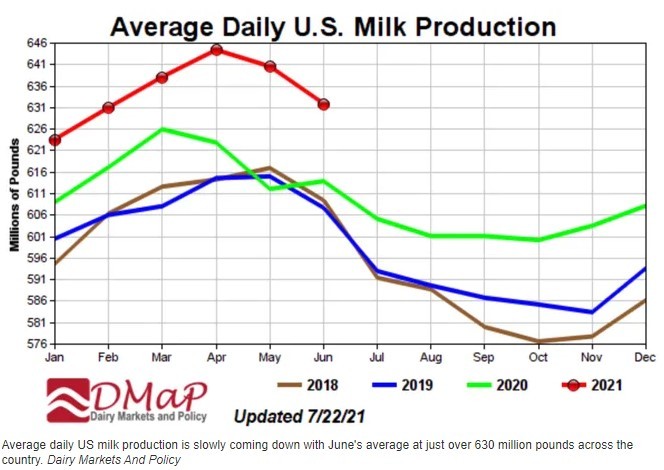

Production reports also reflect rising milk production, with May up 4.7% and June up 2.9%, as well as a total increase in the number of dairy cows across the country. Cropp said several states have seen double-digit increases in per-cow milk production, while a few have seen small decreases. North Dakota leads the pack with 14.7% increases per cow.

Cropp and Stephenson expressed concern with the dairy industry’s future in the western US with record heat waves, drought and wildfires leading to water rationing. While production numbers haven’t been significantly affected yet, an indefinite period of water rationing could put pressure on dairy production and crops like corn and alfalfa. Stephenson said dairy farms producing those silage crops will face some high expenses to get it to market.

“I’m a little concerned about margins on farms, particularly farms in the West. If they’re going to be able to water and harvest alfalfa, then purchasing it’s going to be expensive,” Stephenson said. “And the same thing with other crops – those margins are looking pretty tight.”

Milk prices are tentatively expected to increase in the coming months, Cropp said, depending on how milk production slows. He said all-milk prices could hit $17 in October with properly slowed production and expected demand increases, potentially even close to $18 late in the season. That’s following a small slump in milk prices over the summer as July hit $16 after $18 prices in May.

Cropp said 40-pound blocks of cheese are at about $1.50/lb now with barrels at $1.37/lb and butter at $1.75/lb. While he said USDA expects production to increase overall just 2.5%, going back to school, sporting events and holiday gatherings will put continued pressure on supply and prices. Plus, farmers shouldn’t be seeing negative PPDs anytime soon.

“The good news is the Class III and Class IV prices are only a dollar apart now, so those negative PPDs aren’t coming,” Cropp said. “I got to see if production slows a little bit more, but as I said, we’ll go through fall with schools opening, exports stay strong.”

Domestic dairy exports are also at a record high so far this year, even before the typical “seasonal boost” for butter and cheese during the fall and winter holidays.